GXBank has announced that its personal loan service, GX FlexiCredit, is now available for all its users. The digital bank introduced the feature a few months ago in the form of a pilot programme, offering users an open line of credit that can be used and repaid in instalments.

Your credit limit, once activated, can go up to RM150,000 based on an assessment of your financial profile and no fee or interest will be charged unless you actually use it. The loan tenure can range from six months up to 60 months, with a flat interest rate starting from 3.88% p.a. However, the effective interest rate, which takes into account compounding interest for tenures over a year, actually starts from a hefty 6.62% p.a.

There are no fees for early settlements if you wish to fully settle the drawdown outstanding balance before the end of the tenure. For overdue payments, however, there will be a late charge of 1% p.a.

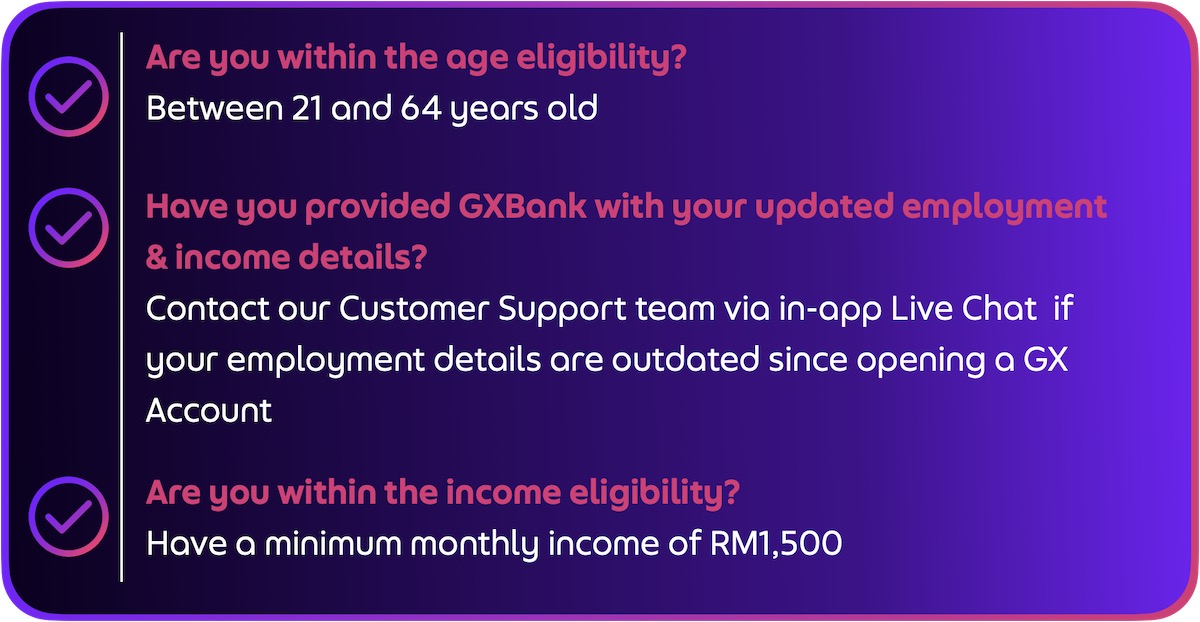

To be eligible for GX FlexiCredit, you must have an account and be aged between 21 and 64. Moreover, you must have a minimum annual income of RM18,000 or RM1,500/month. To apply, salaried individuals need to provide two years of EPF statements showing consecutive contributions for the last six months, while self-employed individuals need to provide six months’ business bank statements.

(Source: GXBank Press Release)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.