Touch ‘n Go eWallet recently unveiled its new SOS Balance feature, which aims to reduce disruptions at toll plazas. It works by essentially fronting users the credit needed to pay the toll fare when their card has an insufficient balance.

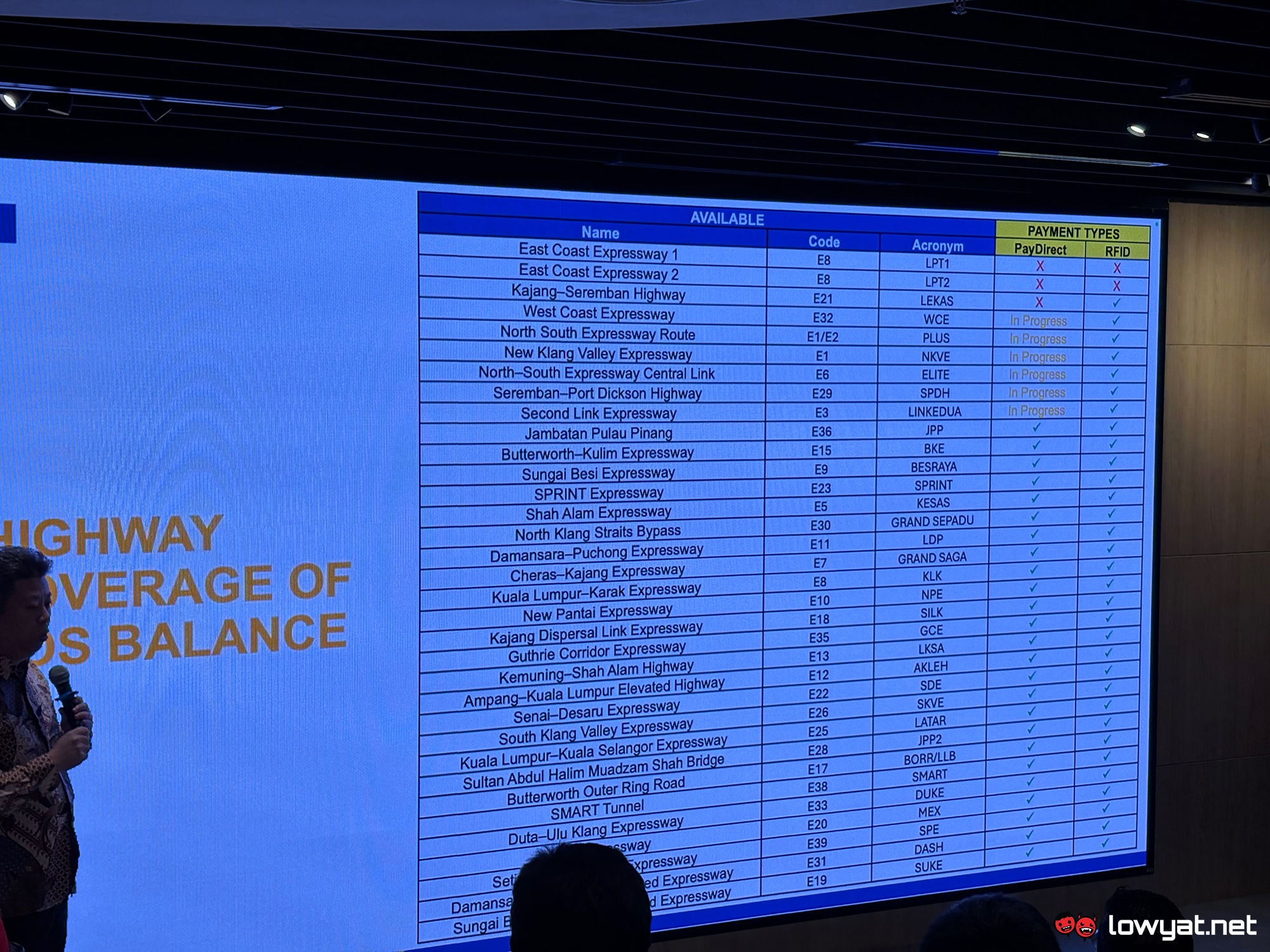

At its official launch event today, TNG Digital CEO Alan Ni revealed that while the feature is currently limited to fare payments at toll plazas that support RFID or PayDirect payments, it could be extended to also cover parking payments in the future. However, there is no timeline expansion just yet, as the feature is still in its early days and the company will have to see its performance amongst users.

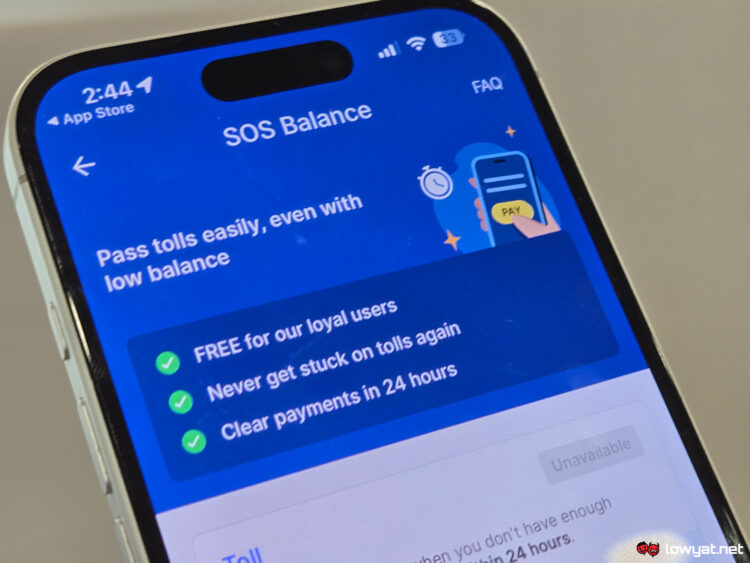

To recap, SOS Balance will be activated when you try and pay a toll fare with card that has an insufficient balance, with a structure similar to Buy Now Pay Later schemes except it is completely free. When the feature is used, users have 24 hours to settle their outstanding balance; failure to do so will result in many of the TnG eWallet app’s features to be restricted for your account.

While its FAQ does not state a specific limit to which SOS Balance can be used within a 24-hour period, works minister Alexander Nanta Linggi mentioned that there is a daily limit of RM80 per user. However, a representative clarified to us that this limit is dynamic and can vary with each user depending on their spending habits.