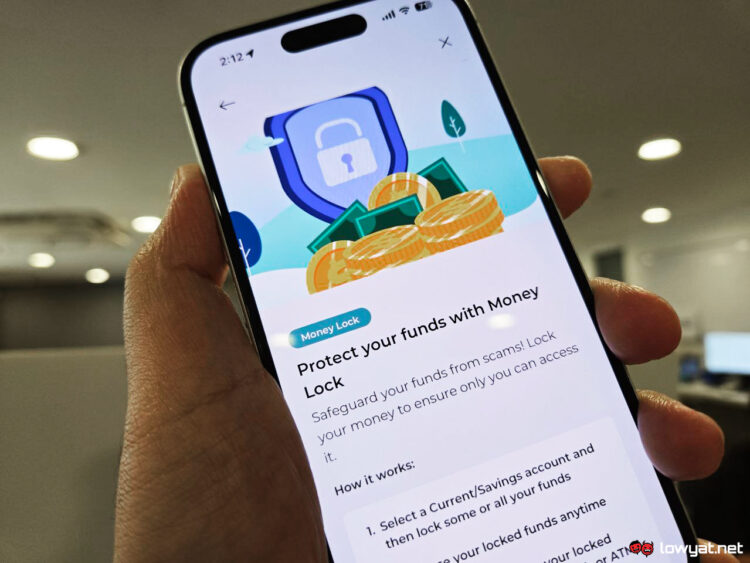

Maybank has launched a new security feature called Money Lock, which locks up your money and protects it from scammers and hackers. Added as an extra anti-fraud measure for peace of mind, the feature allows users to make any amount of their funds inaccessible.

Users can lock away as little as RM10 but they can increase the locked amount any time, with no limit to how many times the feature can be used and with no fees. Funds under Money Lock cannot be used for online transactions, ATM withdrawals, over-the-counter withdrawals, debit card usage, auto-debit, bill payments, credit card payments, loan payments, fixed deposit placements, or standing instructions.

In order to unlock the funds or decrease the amount of locked money, you will need to visit any Maybank ATM or branch in order to verify your identity. Once verified, the funds can be instantly unlocked or decreased.

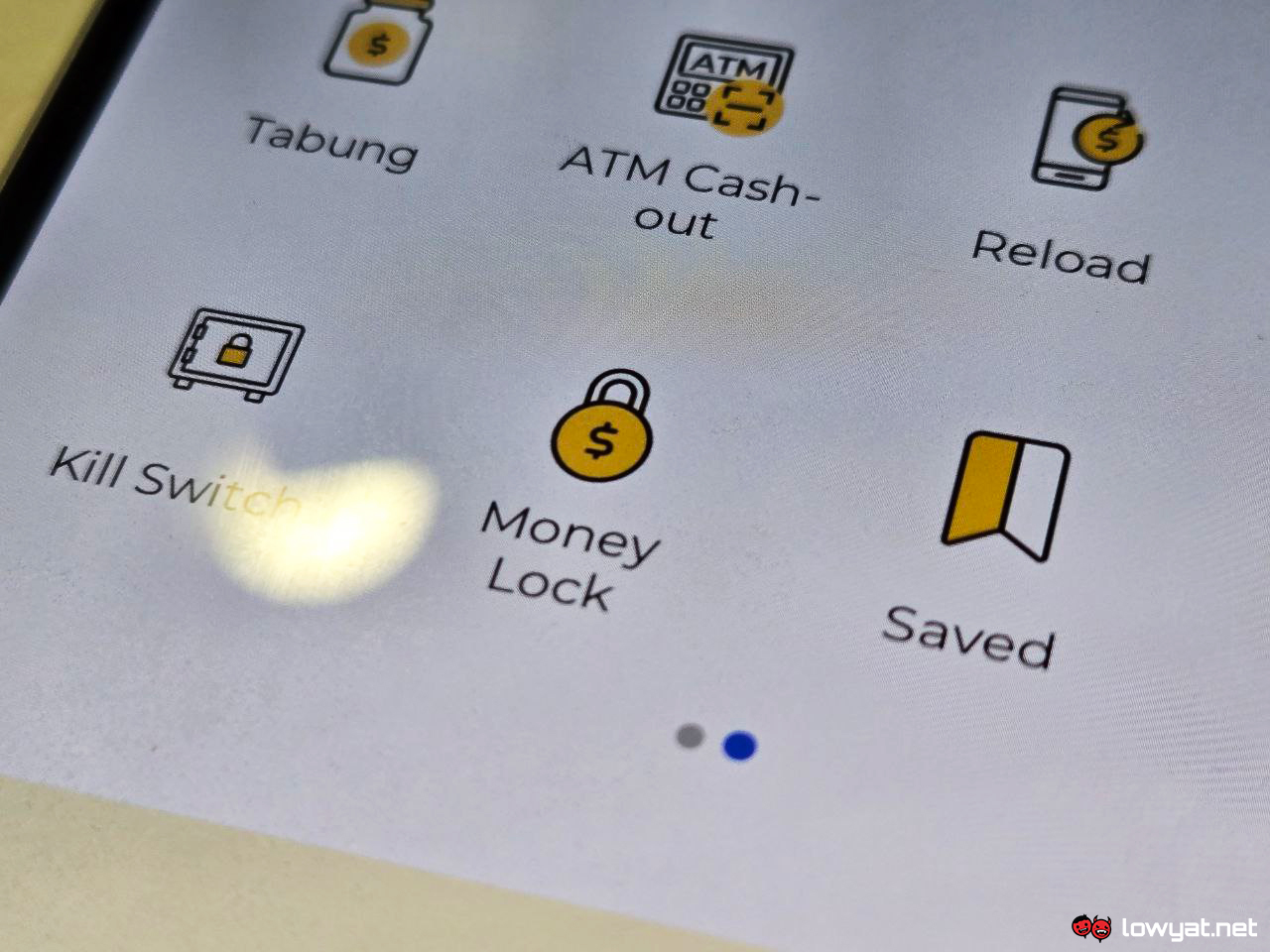

To use the feature, go to the Money Lock icon on the MAE app, select the account you want to lock funds for, input your preferred amount, and approve it via Secure2u. You can follow similar steps to increase the amount of locked funds.

(Source: Maybank Press Release)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.