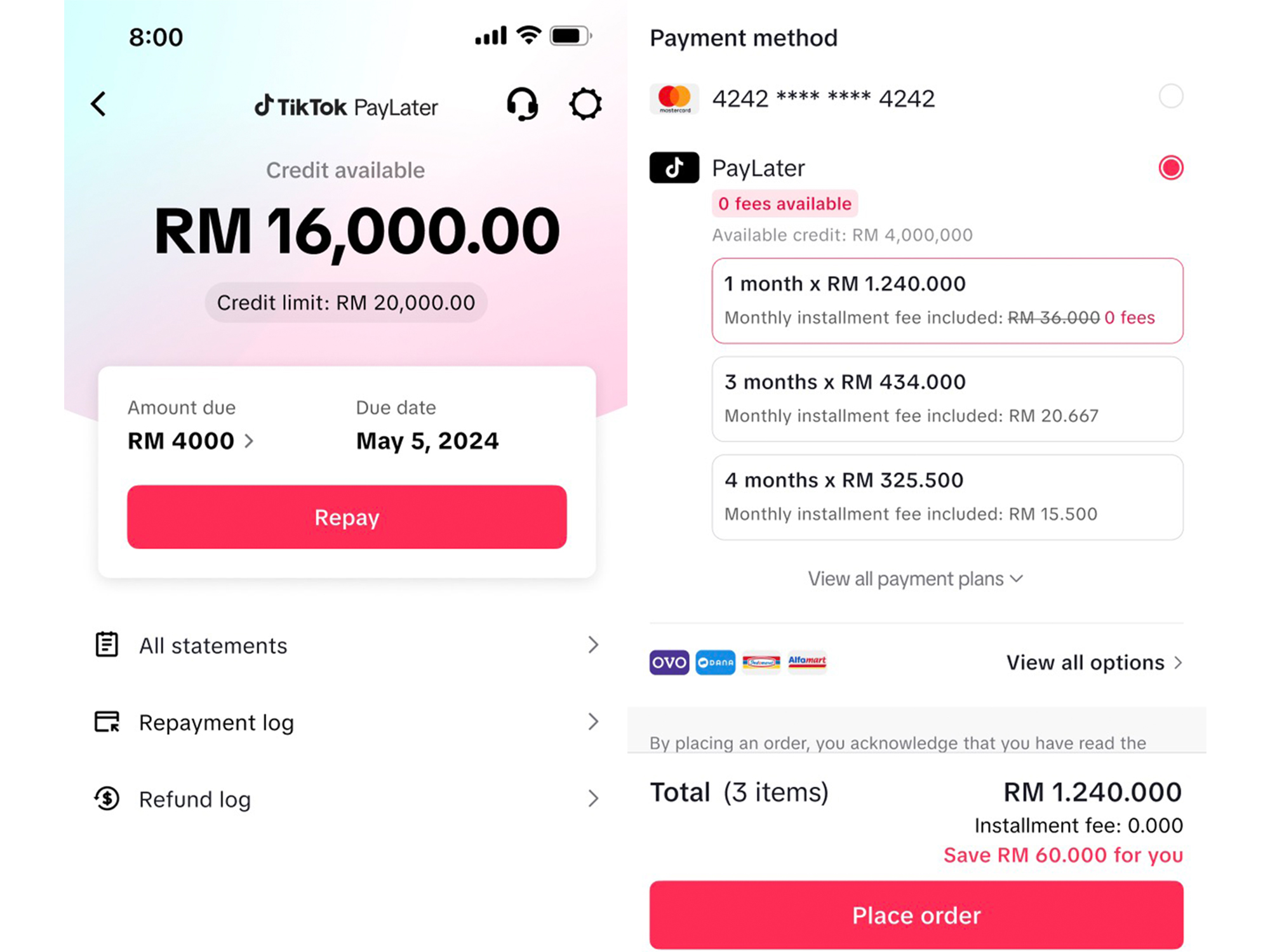

TikTok seems to have quietly introduced its own Buy Now Pay Later (BNPL) scheme called TikTok PayLater. Separate from its Atome integration that was implemented last year, its own BNPL system offers longer instalment options and was released here on 28 October 2024.

It seems that the feature is still being rolled out in stages as some have reportedly received an offer to use it, but it is still not widely available for all users in Malaysia. The feature can only be used by verified users and their credit limit will depend on their occupation and income, but it can offer up to RM10,000 in credits.

Unlike Atome, which is limited to a six-month instalment, TikTok PayLater can enable users to break down a purchase into 12 months. It seems there is no instalment fee for the one-month payment plan, allowing users to wait up until the 41st day after ordering to make the payment.

The company has not yet published an FAQ detailing TikTok PayLater’s interest rates and fees. We reached out to TikTok for more information on the payment plan, but the social media giant declined to give out any details at this time.

As of 2023, Malaysia has 3.7 million active BNPL users, with the majority being in the 21 to 45 age range. With the growing use of the scheme, the government is set to table a Consumer Credits Act that will regulate non-bank consumer credit providers, including BNPL companies.

(Source: TikTok)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.