We commonly hear of financial scams and the way it affects victims. Less commonly is hearing of the way it affects banks, even if it sort of goes without saying. But it looks like it’s affecting Public Bank enough that it is implementing what is named Caller Authentication. This will see customers calling its customer support and case management help desks having to verify their identity before getting help they were looking for.

The Star reports that Public Bank sent out an email to that effect, to prevent scammers from impersonating customers. This will only be available to users who have activated PB SecureSign, which allows for transactions to be authenticated using biometrics or PIN.

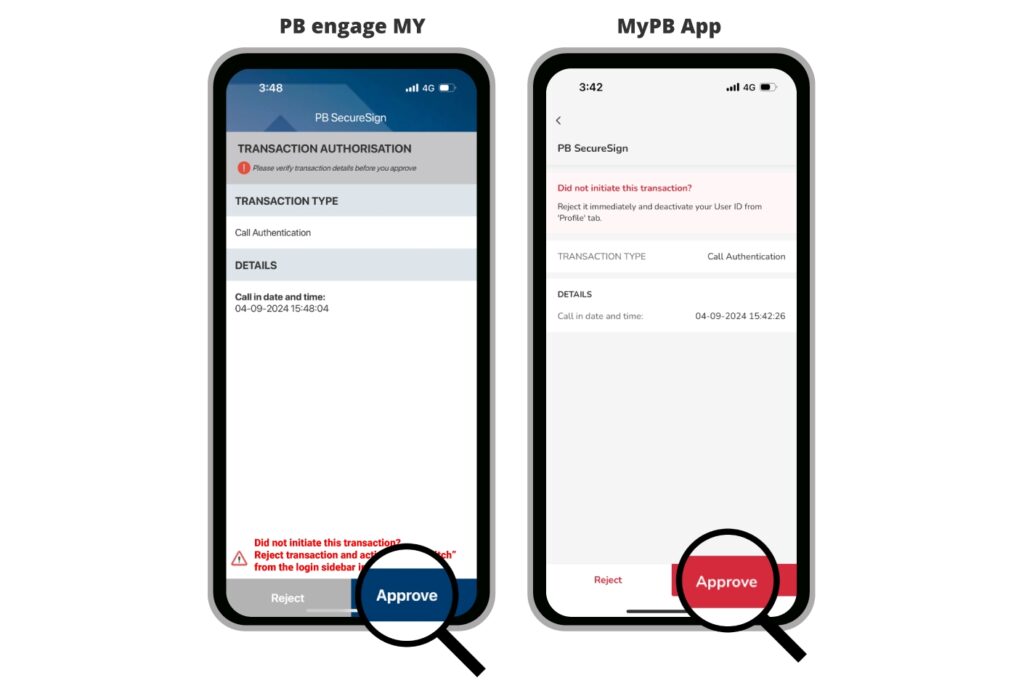

As for the process of this Caller Authentication, customers calling the aforementioned Public Bank help desks will be asked to provide their MyKad number. Following that, a notification will be sent to their phone via the PB engage MY or MyPB apps, displaying a transaction authorisation page with Call Authorisation being the transaction type. Users can then approve or reject the request, and following that, they will be provided assistance by the Public Bank help desk operator.

The report notes that this Caller Authentication feature will take effect starting 4 December. That being said, the report does not mention in what way the rollout will affect Public Bank customers who have not yet activated PB SecureSign.

(Source: The Star)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.