GXBank today celebrated its first anniversary as a digital bank in Malaysia. As revealed by its CEO Pei-Si Lai during an event that was held earlier, it now has almost one million customers, with more than 24 million transactions and more than 900,000 Savings Pockets set up. In conjunction with its anniversary celebration, dubbed “GX 2.0”, the digital bank also unveiled its latest financial products, with the earliest rolling out progressively this month.

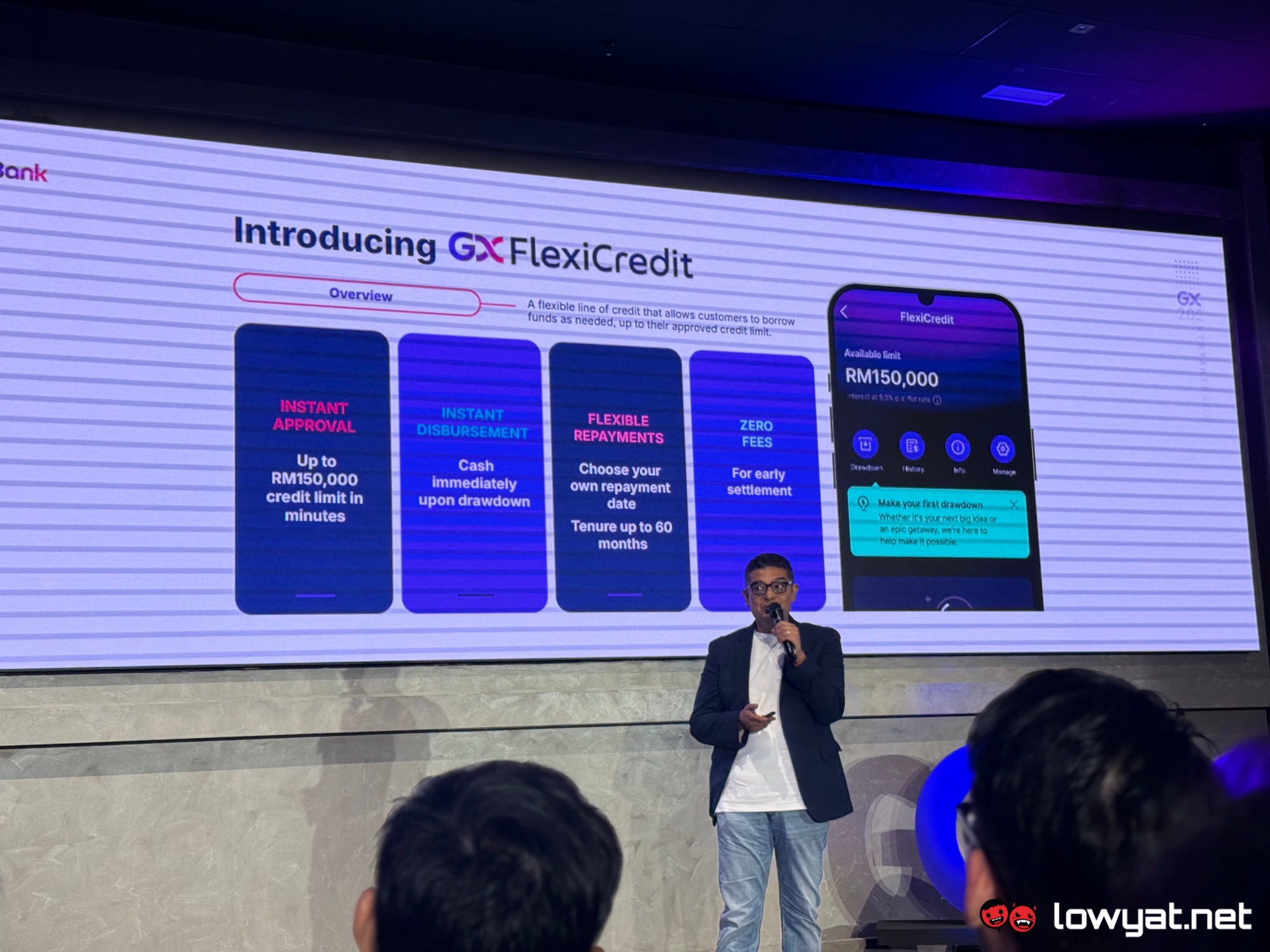

Speaking of which, the earliest to be reaching customers is the recently teased GX FlexiCredit offering, where eligible customers are able to get instant approval of up to RM15,0,00 credit limit within minutes and disbursement. GXBank adds that this provides users with the flexibility of getting immediate cash drawdown (with interest only on the drawdown amount) with zero fees if they choose to settle repayment early. As mentioned earlier, GX FlexiCredit is gradually rolling out to the bank’s customers starting November 2024.

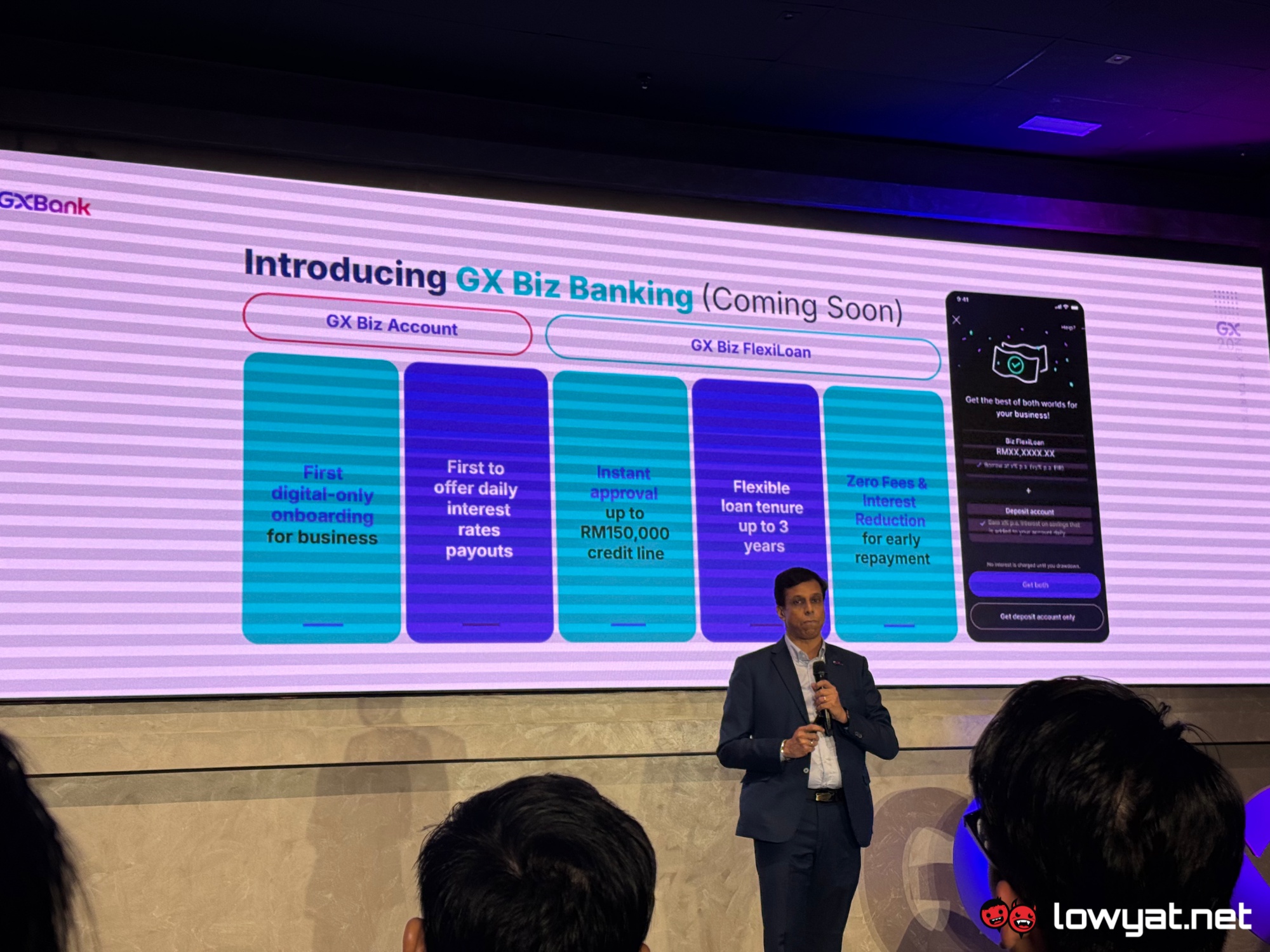

Next up is GX Biz Banking, which aims to serve as a comprehensive digital solution for small businesses in Malaysia. In line with the government’s Belanjawan Madani 2025 initiative, this addresses the challenges MSMEs face in accessing finance by providing a fully digital onboarding process and daily interest payouts, streamlining account setup and access to funds.

Micro-entrepreneurs using the GX Biz Account can apply for the GX Biz FlexiLoan directly through the app, with eligible applicants potentially receiving instant approval for credit lines up to RM150,000. GX Bank says flexible loan terms of up to three years and the option for early repayments without fees or extra interest add to its appeal for small business owners. GX Biz Banking will roll out to merchants in the Grab Malaysia ecosystem before expanding access to small businesses nationwide by early 2025.

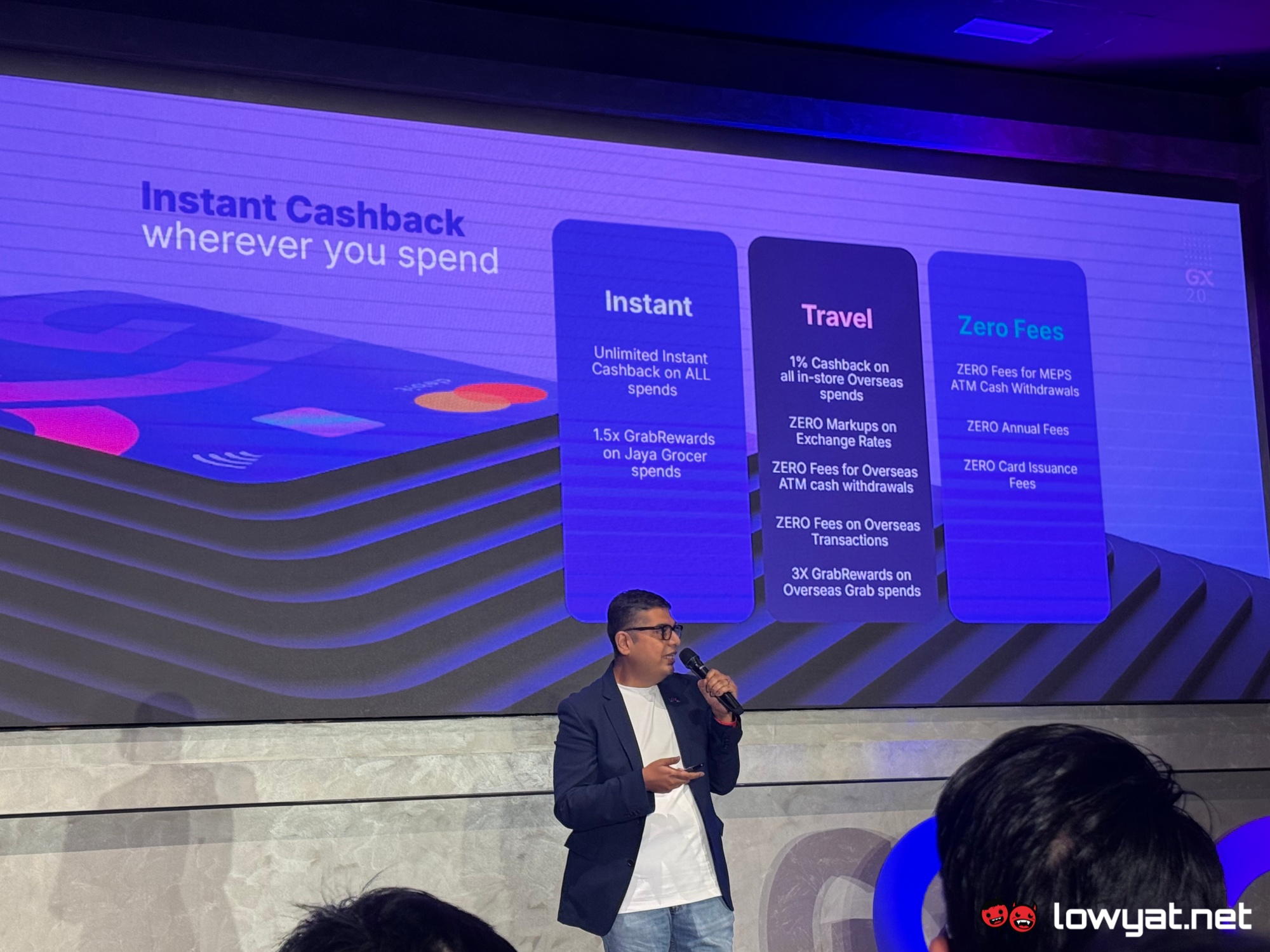

Additionally, it announced a refresh to its debit card that’ll come into effect starting tomorrow. Users can enjoy 0.1% unlimited instant cashback on all spending, 1% cashback on all in-store overseas spends, 1.5x GrabRewards points on Jaya Grocer spending, 3x GrabRewards on overseas Grab spends, zero markups on exchange rates, as well as zero fees for overseas ATM cash withdrawals and transactions. GXBank further assured that there will be zero annual and card issuance fees, and zero fees for MEPS ATM cash withdrawals.

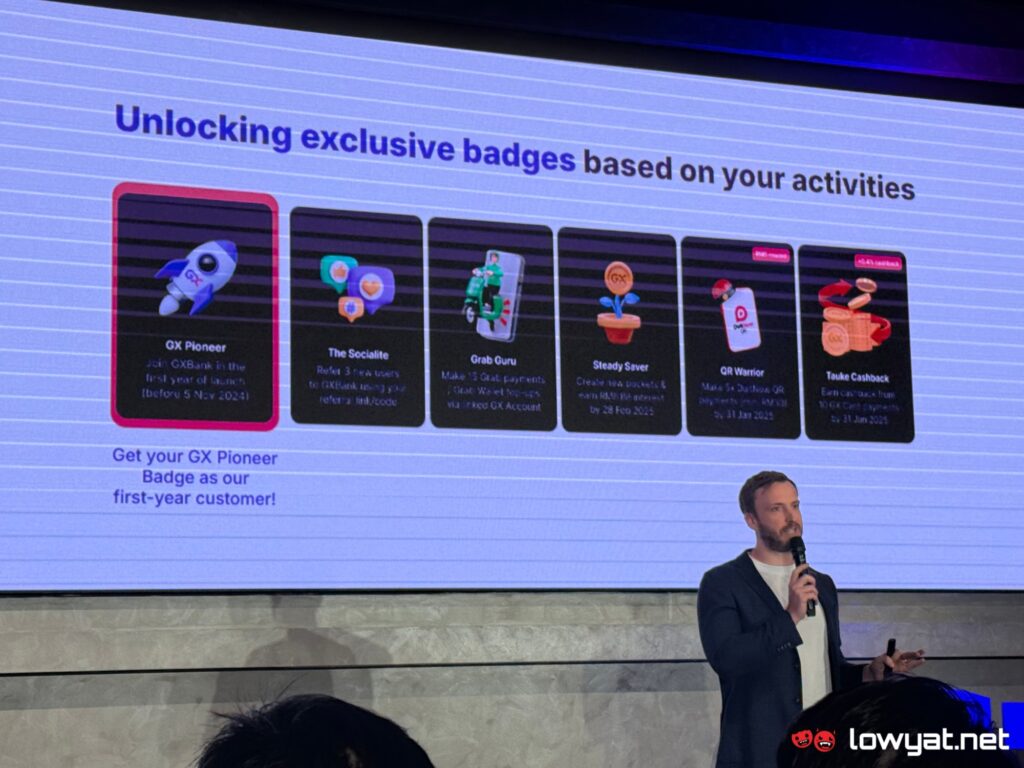

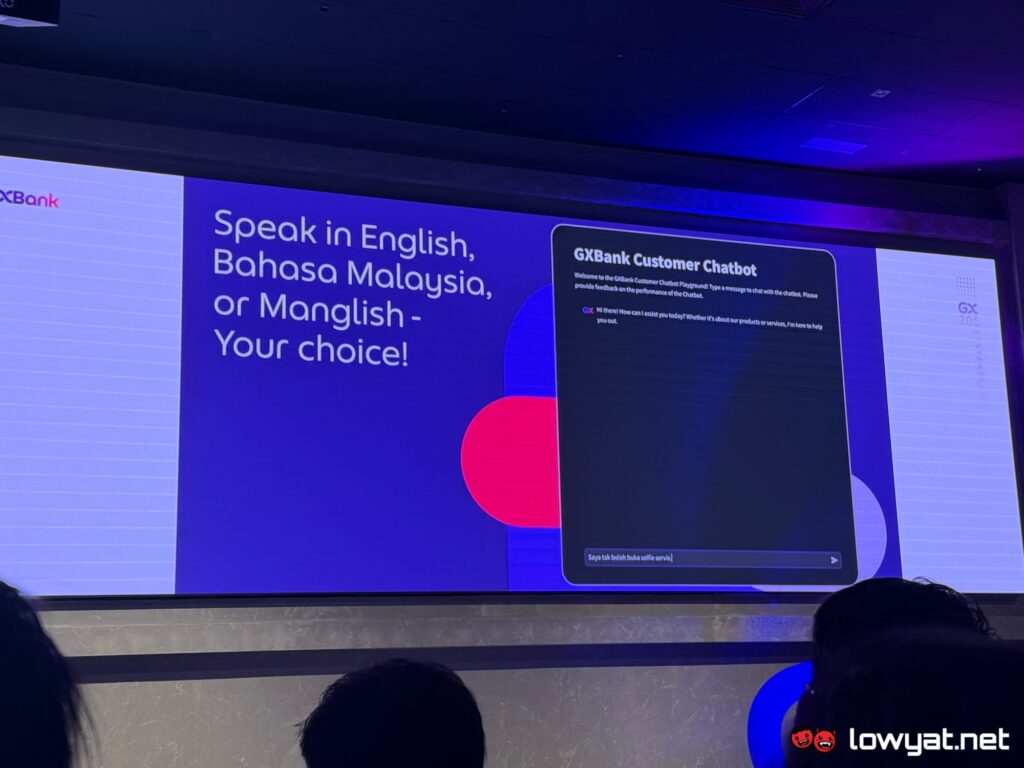

Lastly, the digital bank also announced future additions to its mobile app, including an AI-powered chatbot called AIni that can understand English, Bahasa Malaysia and even Manglish, badge rewards, and an all-new GXWrapped feature that will allow users to view a compilation of data about their activity on the platform. However, GXBank did not specify when these updates will be implemented just yet.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.