Last Friday, the Malaysian Communications and Multimedia Commission (MCMC) announced that U Mobile had been chosen to develop the country’s second 5G network. Following this announcement, the orange telco stated that it will be cutting its foreign majority shareholding to 20% in order to align with the “national agenda”.

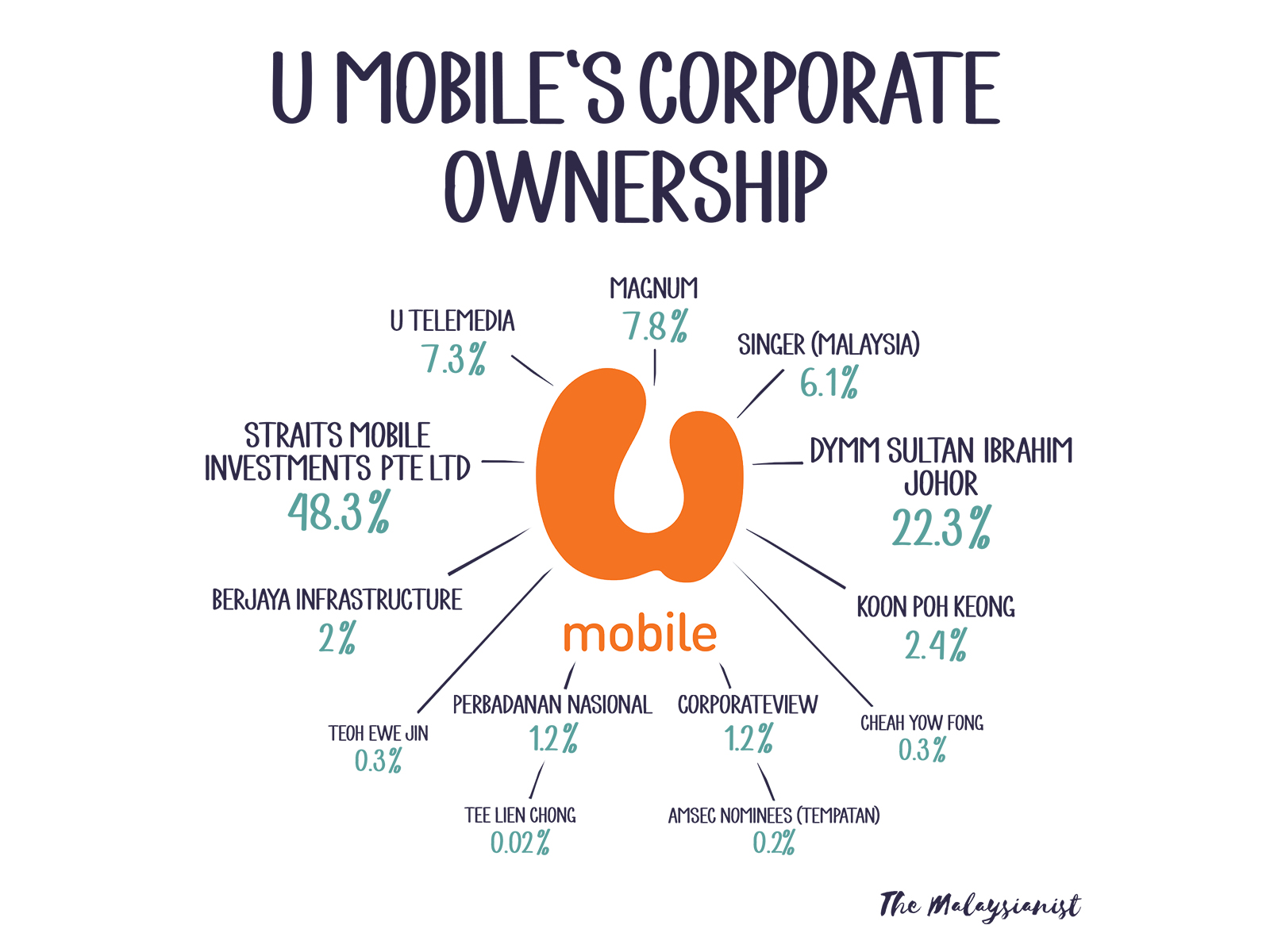

The network operator’s biggest shareholder is currently Straits Mobile Investments Pte Ltd, which is a subsidiary of Singaporean investment firm ST Telemedia Pte Ltd. Backed by the Singapore government’s investment vehicle Temasek Holdings, it holds a stake of 49% in the telco company. Other major shareholders include Malaysian tycoon Vincent Tan and the current Agong of Malaysia, Sultan Ibrahim Iskandar.

In its statement, U Mobile mentioned that it will be working together with CelcomDigi and Telekom Malaysia to deliver 5G-Advanced services. The operator also claimed that its subscribers consumed the most 5G capacity compared to other telcos.

Regarding MCMC’s selection, Maxis, which was also vying to develop the second 5G network, said that it will be engaging with the commission to understand the rationale behind its decision to appoint U Mobile, given that 77% of Maxis shares are owned by Malaysians. Both Maxis and CelcomDigi have stated that they will consider their options with 5G after discussions with their respective stakeholders.

Notably, deputy communications minister Teo Nie Ching said earlier this year that telcos will not be allowed to hold equity in both entities under the 5G dual wholesale network model in order to foster competition. With the exception of TM, all the major network operators hold a collective 65% stake in Digital Nasional Berhad (DNB), which runs the country’s sole 5G network.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.