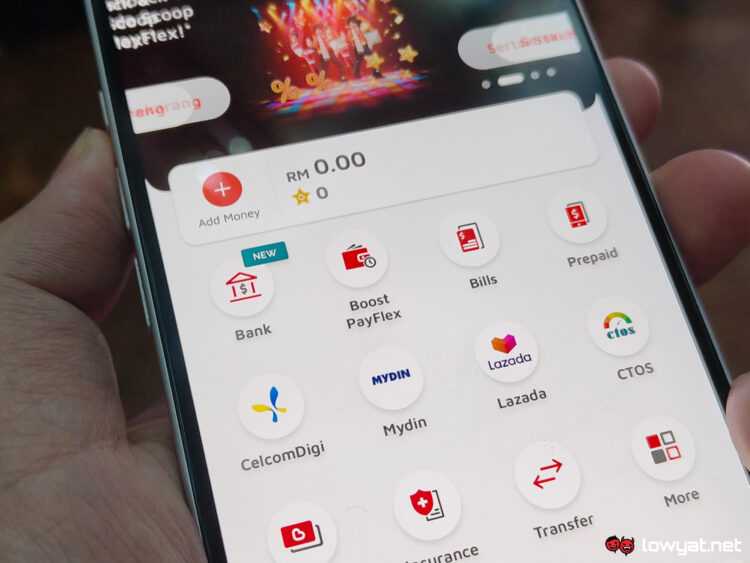

Boost seems to have quietly introduced a new convenience fee for users to top-up their e-wallet using credit cards. Previously, the platform charged a convenience fee of 1% for credit card reloads that exceeded the monthly limit of RM1,000, but now the fee has been reduced at the expanse of it being applied to all credit card reloads.

The new policy was implemented on 14 October 2024, revising the rate to 0.75% and removing the monthly waiver. This means that even if you only reload the minimum amount of RM20 using a credit card, you will be charged the convenience fee.

Boost now joins its competitors in implementing a fee for credit card reloads, as it is a popular practice for users to use this method to cash out funds from the credit card while avoiding hefty cash advance fees. Shopee was one of the first e-wallets to tackle the practice by making funds from credit card reloads non-transferable.

This was followed by BigPay’s implementation of a 1% fee for credit card reloads using Malaysian cards and 3% using overseas cards. Earlier this year, both TnG eWallet and Grab announced a 1% fee for credit card top-ups, although the latter still exempts its co-branded Maybank credit card.

(Source: Boost)