The Association of E-Money Issuer (AEMI), a group of e-wallet companies, has asked the government for an extension of the current Sales and Service Tax (SST) exemption for digital financial services. The “recommendation”, as the association calls it, comes ahead of the tabling of Budget 2025, which is set to be tabled in Parliament on 18 October 2024.

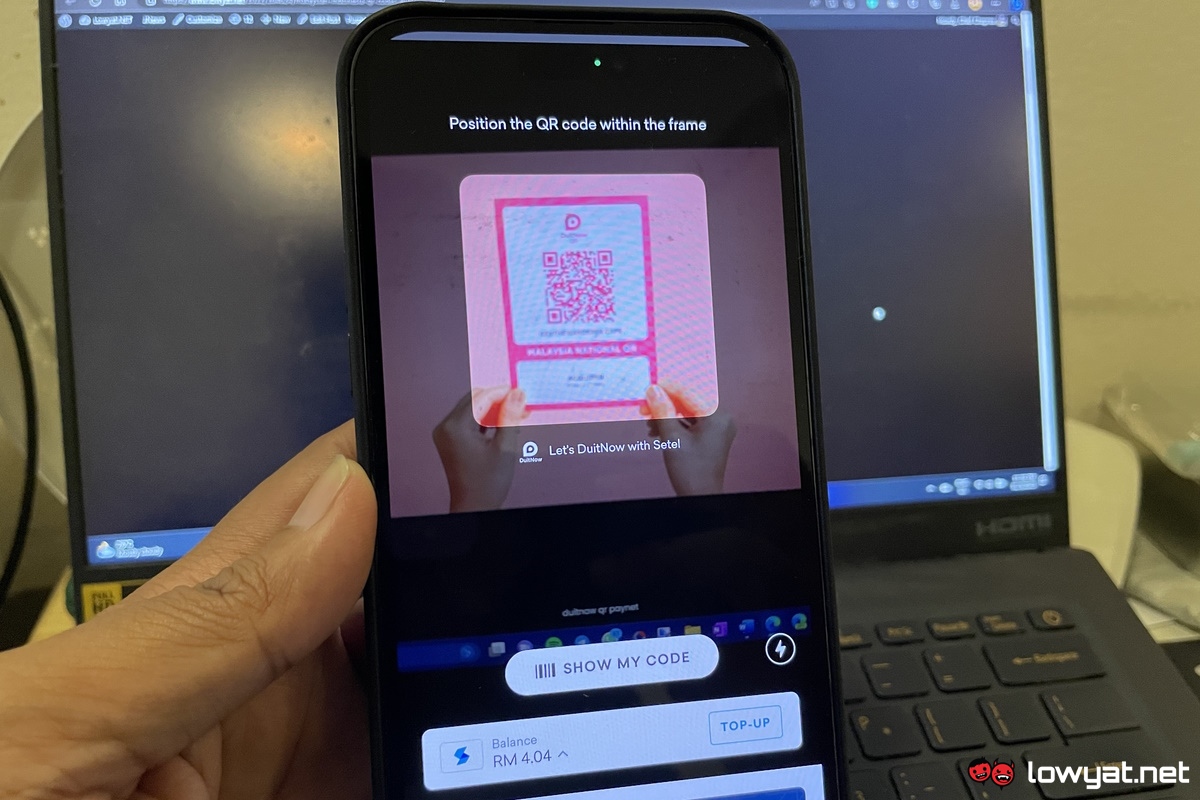

AEMI claims that its members, made up of 35 e-wallet operators, have played a pivotal role in delivering digital financial services to a diverse user base, including the B40 and M40 groups as well as micro-SMEs. It also expounds that the current SST exemption has been crucial in making digital financial services affordable.

As such, the association is formally proposing for the government to extend the exemption in Budget 2025 to promote a wider adoption of cashless payments. TNG Digital, which is part of the association, made a similar plea last week, along with a recommendation to expand high-speed internet access in under-served regions to facilitate greater participation in the digital economy.

As such, the association is formally proposing for the government to extend the exemption in Budget 2025 to promote a wider adoption of cashless payments. TNG Digital, which is part of the association, made a similar plea last week, along with a recommendation to expand high-speed internet access in under-served regions to facilitate greater participation in the digital economy.

Earlier this year, the government increased the SST rate from 6% to 8%. While certain categories such as food and beverages were exempted from the hike, digital platforms including e-commerce and streaming were affected by it as part of the digital tax.

(Source: AEMI Press Release)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.