Investing isn’t just for the wealthy. It is a crucial step for anyone looking to secure their financial future. Investing can help beat inflation, save for retirement, and achieve other financial milestones.

With the right strategy, even small amounts can compound over time, leading to significant growth. In this article, Octa Broker‘s investing experts overview the most suitable investment instruments to make the most of US$100, US$1000, or US$10,000.

How to invest US$100

Investing small amounts might seem insignificant, but it’s the best way to begin as a newbie. It allows aspiring investors to learn, make mistakes, and gain experience without risking a large portion of their savings. Starting with small amounts also instils discipline and helps better understand the market dynamics. Here are some suggestions suitable for a starting capital as low as $100:

Opening a brokerage account

Trading can be an option for accumulating a larger capital over time and allocating it towards long-term investments. You can start trading by opening a brokerage account. For instance, Octa Broker offers attractive terms for beginners, including a minimum deposit requirement of just US$25, zero fees and free leverage of up to 1:1000, which can magnify your investment’s potential.

CFDs on indices

With a small capital, investing in Contract for Difference (CFD) on indices like the Dow Jones, S&P 500, and FTSE 100 can be a smart move. CFDs allow one to speculate on the price movements of these indices without actually owning the underlying assets. The leverage offered by brokers can help amplify gains, which is ideal for beginners with limited funds. However, beginners should remember that leverage also amplifies the potential losses, so they should always utilise risk management techniques.

Forex trading

Another avenue is Forex trading. The currency market is vast and highly liquid, meaning that traders can quickly and easily buy or sell their assets, which may include currency pairs and crypto pairs. It’s recommended to start with well-known pairs like EURUSD, as they have high liquidity and lower volatility or price fluctuations. Beginners should concentrate on just one or two assets and learn the factors, such as economic news, that affect their performance and how to capitalise on them.

Even with US$100, diversification is key. Instead of putting all their money in just one asset, investors should spread it across different instruments to reduce risk. For instance, one might allocate US$50 to XAUUSD and US$50 to NZDCHF.

How to invest US$1000

Malaysian bonds

With US$1000, one can start investing in bonds, which are relatively safe and provide steady returns. Malaysian government and corporate bonds are good options. They offer higher interest rates compared to savings accounts and are a low-risk investment. The low yield on 10-year Malaysian Government Securities (MGS) reflects Malaysia’s economic stability. As of mid-2023, the yield was around 3.5% to 4%. This means if you invest in a 10-year MGS, you can expect an annual return of about 3.5% to 4%.

Unit trusts

Unit trusts pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. This can be a good option for those who want professional management of their investments and prefer to rely on external expertise rather than developing their own. When choosing the fund, investors should pay attention to their track record, management fees, and alignment with their risk tolerance level. It’s also important to keep in mind that even reputable funds can experience periods of negative returns, especially in highly volatile markets.

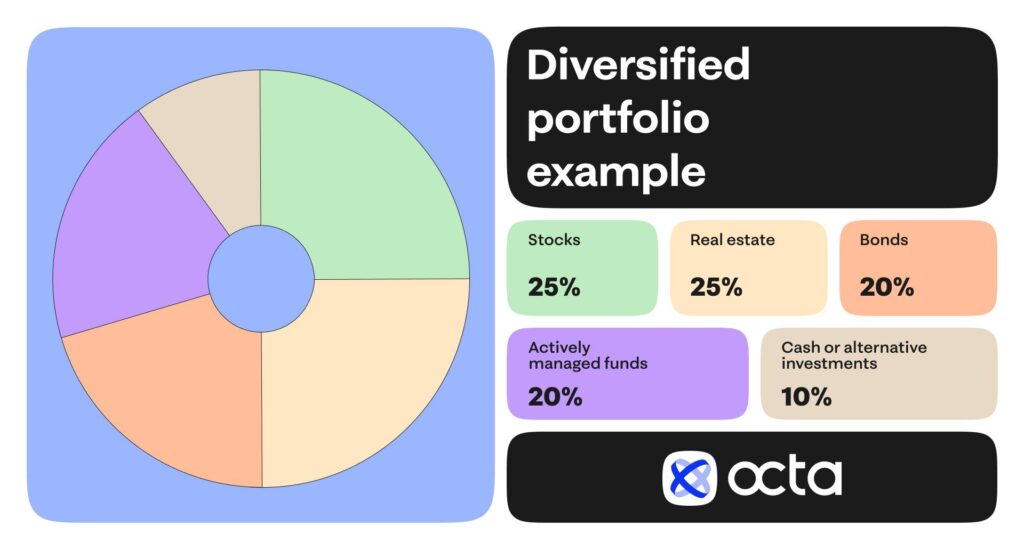

Just like with a small amount, with more capital, it’s even more essential to diversify the portfolio. Experienced investors recommend allocating a portion of one’s funds to low-risk assets like bonds, a portion to medium-risk unit trusts, and the remaining to higher-risk investments like stocks or Forex trading.

How to Invest US$10,000

Malaysian growth stocks

With US$10,000, investors may experiment with individual stocks of promising Malaysian or foreign companies or businesses they believe in and care about. However, this option is more suitable for experienced investors, as it requires careful research to find companies with strong growth potential, robust financials, and a competitive edge in their industry.

Actively managed unit trusts

As an alternative to stocks, one may consider investing in actively managed unit trusts. These funds aim to outperform the market by making strategic investment decisions. They might charge higher fees, but the expertise of fund managers can lead to higher returns, especially in a bullish market.

Just as with smaller amounts, funds should be distributed across different asset classes—stocks, bonds, unit trusts, and, with larger amounts, possibly real estate. An investor’s portfolio should reflect their investment goals, time horizon, and risk tolerance.

Investing is not a one-size-fits-all endeavour. The amount of money each investor has dictates their investment options, but every sum can be put to work effectively. A good strategy is to start small, learn, and gradually build one’s portfolio along with gaining confidence and knowledge. Those with smaller amounts may start with trading. Brokers like Octa offer a free demo account for traders to gain a feel of the market and practise without risking their own funds.

By investing wisely, everyone can achieve their financial goals and enjoy a more secure future. Never let the size of your initial investment deter you. Every journey begins with a single step—take yours today.

This article is brought to you by Octa.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.