GXBank has announced quite a number of features for its customers, as you’d expect from a digital bank. Recently, a new one has been added to the list, in the form of GX FlexiCredit, which is described as “a new line of credit where customers will be granted a credit limit that they are bale to draw down funds from”.

If you’re familiar with the world of banking, then chances are you know what drawdowns are. But for those who are not, the idea is that while you have a certain amount of money you can borrow, you’ll only be charged interest for what you’ve used, rather than for the whole loan. And that is the gist of GXBank’s GX FlexiCredit – you’ll be granted a credit limit, and you only pay interest for what you’ve drawn from within said limit into your account.

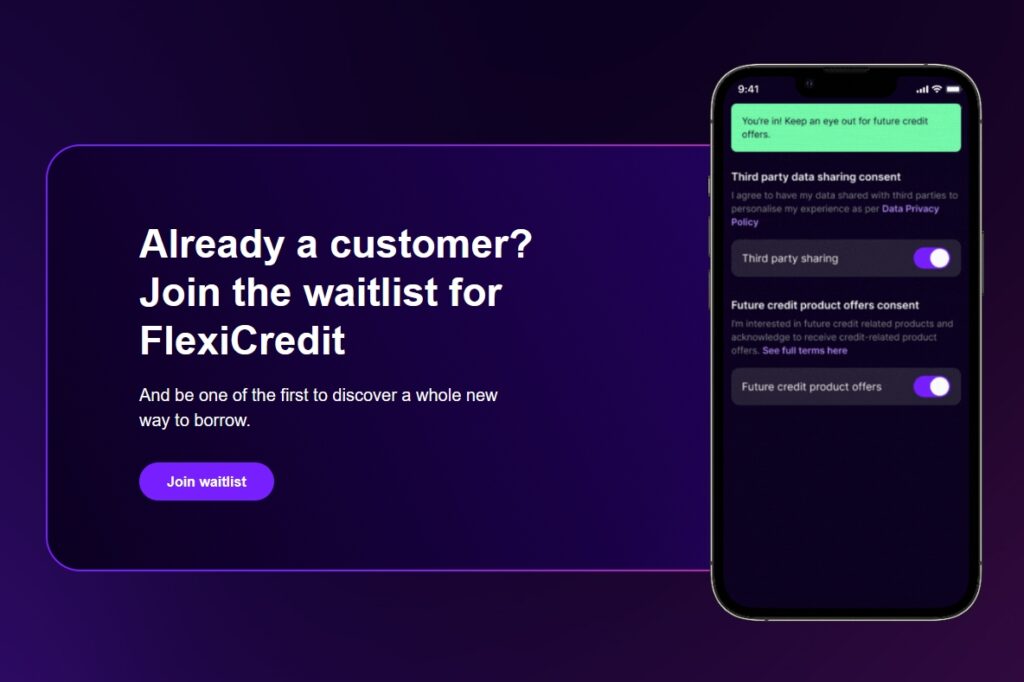

Despite the announcement, GXBank is not making GX FlexiCredit available to just any customer. This will first be rolling out to those who register their interest, who also opt-in to receiving credit-related products and offers. These can be found under the Me tab in “Manage consents”.

Of course, GXBank also has its own criteria that registrants have to meet before being selected as one of the GX FlexiCredit users in its pilot phase. The obvious one is that they have to be an existing customer of the bank. Next on the list is a Malaysian citizenship, followed by falling between the age range of 21 and 64. Finally, registrants will also need to have a minimum monthly income of RM1,500. You can find out more by hitting the link below.

(Source: GXBank)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.