Touch ‘n Go (TnG) Digital, together with its collaborator CIMB Bank Berhad, today has launched e-Mas, a gold investment feature now available within its TnG eWallet app. It is available to all eKYC-verified users on the platform, providing an accessible entry point into gold investment from as low as RM10 with no hidden cost.

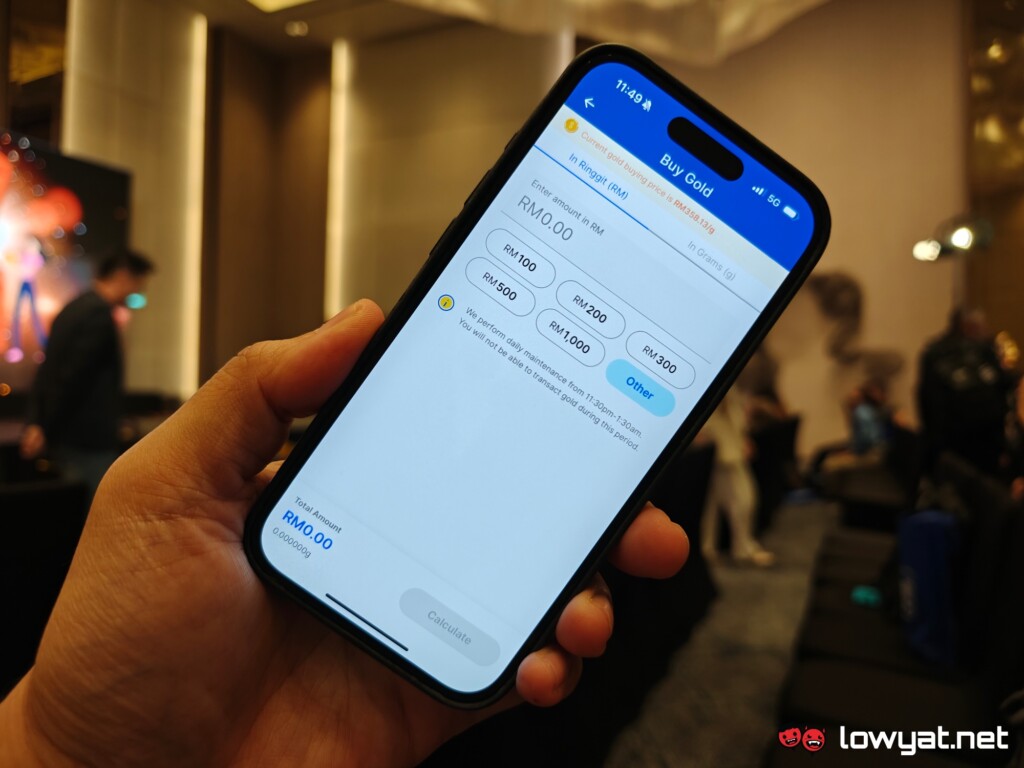

Apart from buying and selling, TnG eWallet app users can also monitor gold prices with live updates and manage their investments directly via e-Mas. You can buy or sell gold in either RM or grams by keying the amount manually or selecting a preset value. It should be noted that the minimum sell value is also RM10, or the grammage value equivalent to that.

During the launch’s Q&A session earlier, both TnG Digital and CIMB clarified that gold investments done through e-Mas are not Shariah compliant due to its digital nature. That said, both parties are working together to introduce Shariah-compliant offerings in the future.

The panel added that it is currently not possible for users to redeem physical gold bars, which are revealed to be held in custody by CIMB. However, there are plans to implement the ability once the feature enters its second phase, which TnG Digital says is still a long way off.

To access e-Mas, simply launch TnG eWallet and tap on the feature’s icon in the Recommended section. Alternatively, you can also find it under the “Investment” category via the app’s GOfinance feature. Remember to update the eWallet to the latest version in order to enjoy the feature, as well as any other new offerings from TnG.

(Additional source: TnG [official website])

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.