Boost Bank, the digital bank created by Axiata and RHB, has officially launched its app, aiming to provide a seamless onboarding experience for users. Approved by Bank Negara Malaysia (BNM) and the Ministry of Finance (MOF), Boost Bank integrates banking features directly into the existing Boost e-wallet app, allowing Premium Wallet users to open a bank account effortlessly.

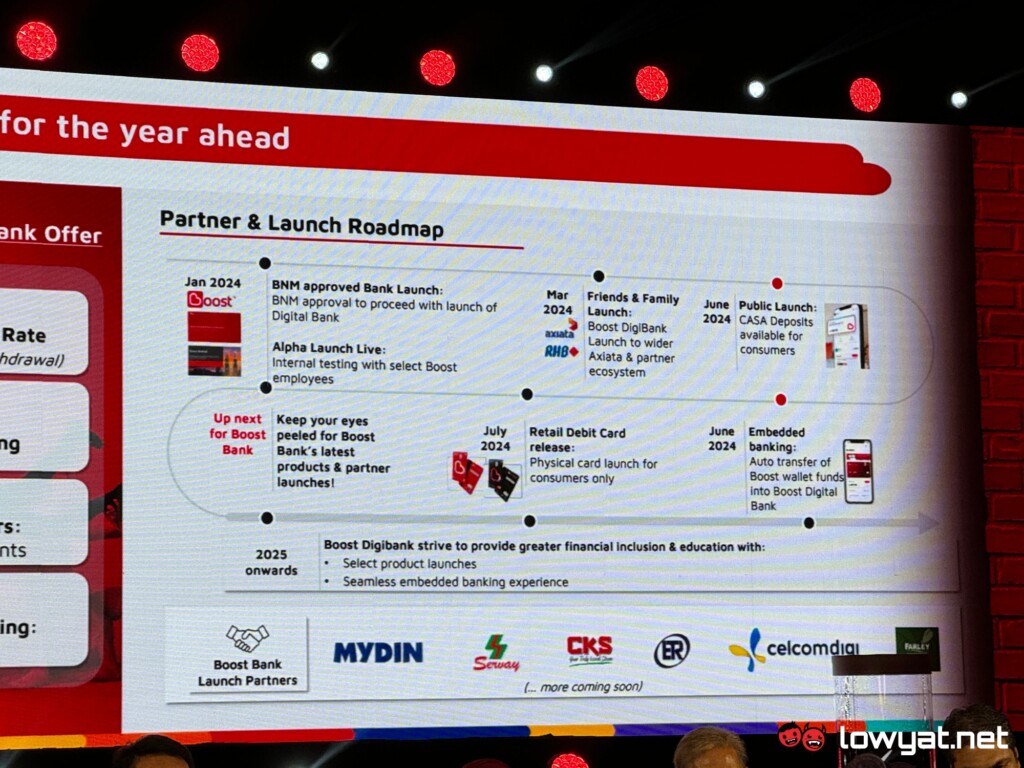

The Boost-RHB Digital Bank consortium, with Boost holding 60% equity and RHB 40%, was among the five successful applicants for a digital bank license by BNM in April 2022. Operations began following regulatory approval on 15 January 2024.

Boost Bank says its primary focus is the unbanked and underbanked populations, offering digital onboarding to those without an existing bank account, aligning with its mission to serve underserved and unserved sectors of society. The partnership between Boost and RHB Banking Group combines the agility of a fintech company with the stability of a traditional bank, ensuring users benefit from innovative financial solutions alongside reliable banking services.

Boost Bank integrates the BoostUP Loyalty Programme, launching a new exclusive rank called “Platinum President.” Users who deposit a minimum of RM2000 to its Savings Jar feature can enjoy a promotional interest rate of up to 3.6% per annum until August 31. After the promotional period, Platinum President users will receive a standard interest rate of 3.2% per annum. This rank also elevates users in the Boost e-wallet app, allowing them to earn up to 3x Boost Stars for eligible transactions.

Deposited funds can be used for DuitNow transfers and QR code payments, ensuring nationwide usability, although this is only exclusively available via the Boost e-wallet app for the time being. Looking ahead, the digital bank plans to expand its features, with a Debit Card already in development and slated to launch sometime in July this year.

Additionally, deposits are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to RM250,000, providing a safety net for users’ funds. To ensure security, Boost Bank offers features like ‘Freeze Account,’ ‘Device Binding,’ and a ‘Cool-Off Period’ for new device logins. A 24/7 Fraud Hotline is also available to address any suspicious activities.

In addition to its own ecosystem, Boost Bank plans to leverage partnerships with well-known brands like CelcomDigi, MYDIN, and various hypermarkets across Malaysia. These collaborations aim to provide rewards and savings on daily necessities, meeting the financial needs of the underbanked and unbanked. Users can also expect higher promotional interest rates for transactions with these launch partners.

Boost Bank is already open for public registration. An existing Boost e-wallet account isn’t necessary for new signups, but customers are encouraged to register to the fintech platform if they wish to use their savings for spending. The digital bank app is also offered as a standalone, available for download via the Apple App Store and Google Play Store.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.