The ministry of transportation (MOT) has finally unveiled the new road tax structure for electric vehicles (EVs), which was originally scheduled for announcement in April. This new rate will be effective from 1 January 2026, following the expiration of the current EV road tax exemption on 31 December 2025.

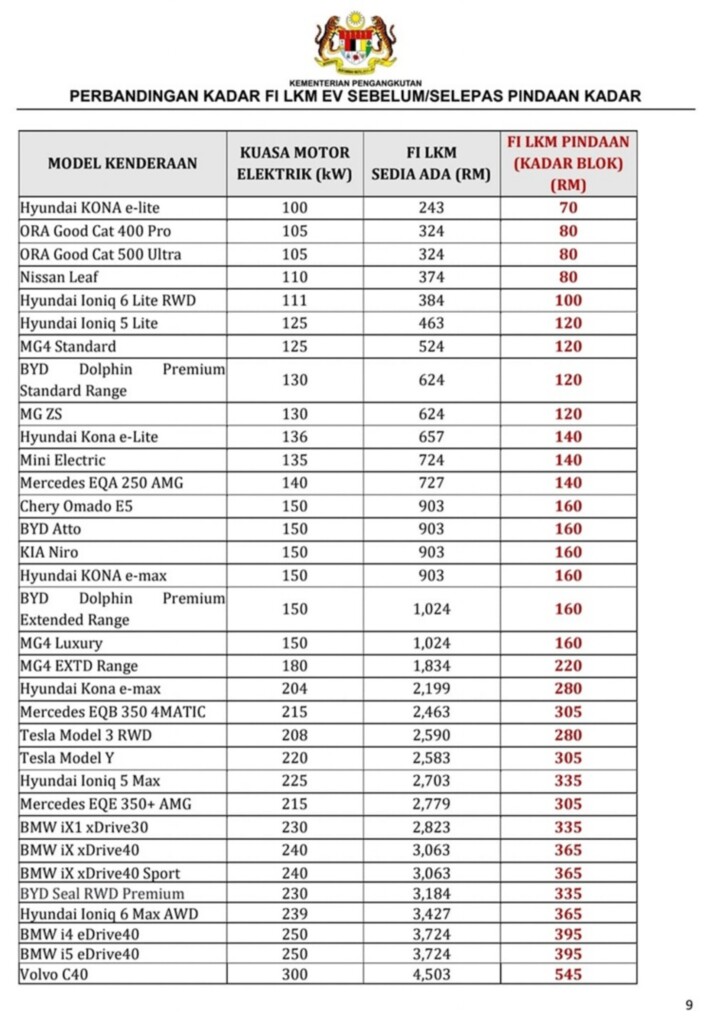

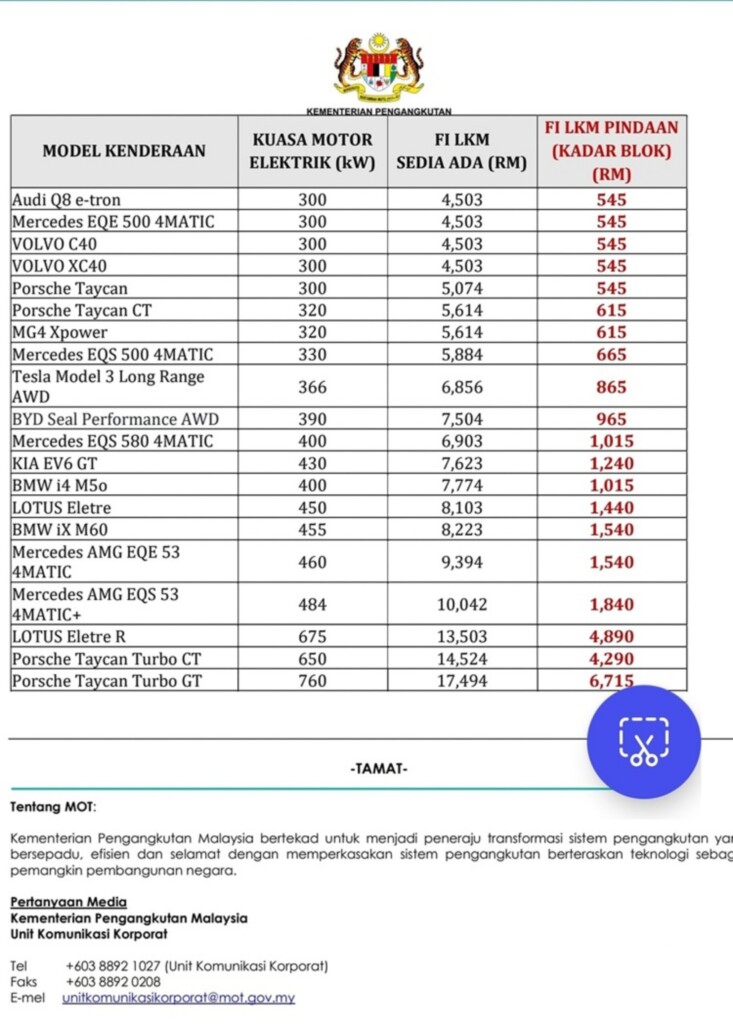

The revised road tax is based on kilowatt (kW) output, grouped into motor output power bands. Fees are arranged in 9.9 kW blocks within each power band. The new rates start at RM20 for the lowest tier (1 watt to 9.9kW), though this tier will not apply to most EVs.

In the up-to-100,000 watt (100kW) band, the rate increases by RM10 per block, capped at RM70 at 100 kW. For the 100,001 to 210,000 watt (210kW) band, road tax varies from RM80 to RM280, with a RM20 increase per 9.9 kW block.

For the 210,001 to 310,000 watt (310kW) band, fees range from RM305 to RM575, with each block increasing by RM30. In the 310,001 to 410,000 watt (410kW) band, fees range from RM615 to RM1,065, with each 9.9kW block increasing by RM50.

Overall, the new EV road tax rates range from RM20 to a maximum value of RM20,000. Transport minister Anthony Loke stated that these rates will be reviewed every five years to assess their impact on government revenue and the transition to zero-emission vehicles.

Rates for electric motorcycles remain unchanged, ranging from RM9 to RM42. Additionally, persons with disabilities will continue to be exempt from paying road tax for one EV, as mentioned in Budget 2022.

(Source: Bernama / paultan.org [Automotive/Car Discussion Facebook Group])

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.