AEON Bank has officially been launched as Malaysia’s first Islamic digital bank as well as being the second digital bank overall to be available to the public. Similar to its competitor, GX Bank, the shariah-compliant digital bank offers a free debit card for its users as well as an attractive profit rate for your deposits.

To open an AEON Bank account, you must already have an existing account with a traditional bank and deposit RM20 into the new account to activate it. The RM20 is the minimum amount required to maintain the account and you won’t be able to use it. Moreover, if you decide to close the AEON Bank account within three months of opening it, the app will keep the RM20 as a closure fee.

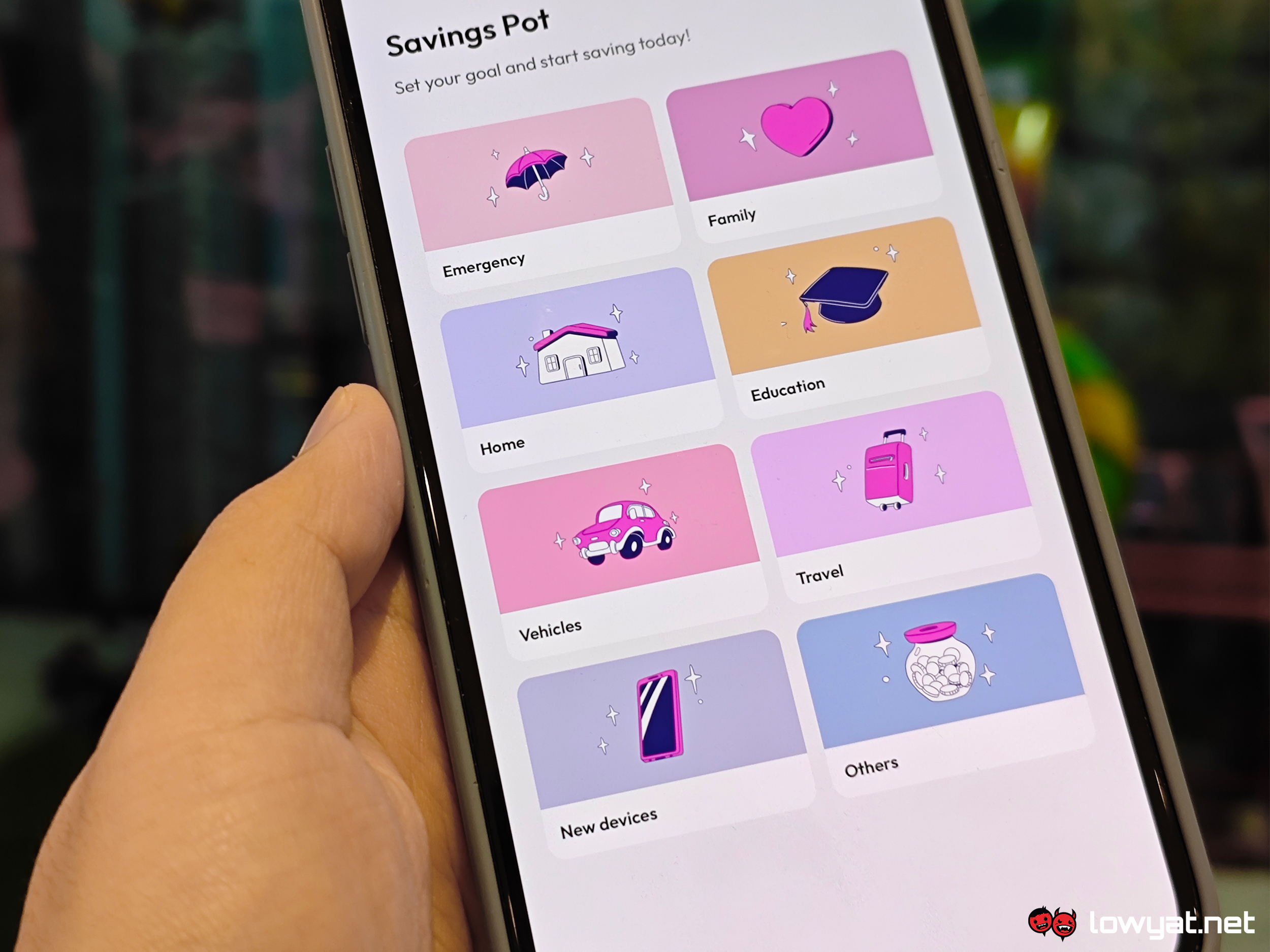

At launch, the digital bank already supports DuitNow transfers as well as DuitNow QR payments. Additionally, it offers a savings pot feature for you to set aside money, with the option for automatic top-ups and round ups. Regardless of whether you keep the money in the savings account-i or a savings pot, the app offers an annual profit rate of 3.88%, with profits deposited monthly. However, this rate is currently under its launch campaign, so it is unclear if the rate will change after the campaign ends.

Speaking of the launch campaign, those who sign up for an AEON Bank account from now until 31 August 2024 will receive 3,000 AEON points. You can also get a free Visa debit card, available in both digital and physical forms, with a reward of three AEON points for every RM1 spent — you will be able to convert the points into cash. The card even allows you to do ATM withdrawals, but you’ll have to pay the RM1 MEPS fee each time.

Other perks under the launch campaign include a one-year membership fee waiver for its points programme. If you’re already a member, your account will be automatically linked to AEON Bank.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.