The Employees Provident Fund (EPF) has officially introduced Akaun Fleksibel, otherwise known as Account 3, which is intended to enhance members’ income security after retirement while addressing their current needs. This new addition is set to be fully implemented starting 11 May 2024.

With this restructuring, all members under 55 will have a total of three accounts: Akaun Persaraan (Account 1), Akaun Sejahtera (Account 2), and Akaun Fleksibel (Account 3). For the sake of simplicity, we’ll be referring to all three accounts by their legacy names in this article.

A New Account That Allows For Withdrawals At Any Time

Unlike the existing two, the newly added Account 3 provides flexibility for short-term financial needs, therefore allowing members to withdraw their savings in this account at any time. Starting from 12 May, members will have the option to submit withdrawal requests either through the KWSP i-Akaun app or at EPF branches, providing them with convenient access to manage their accounts.

Of course, members will need to provide their bank details to facilitate withdrawals. According to EPF, the minimum withdrawal amount is RM50, and payments will be made within seven working days after the application has been approved.

The upcoming addition of Account 3 is permanent for all EPF members under 55. There is no option to retain the existing two-account system.

Changes In Contributions

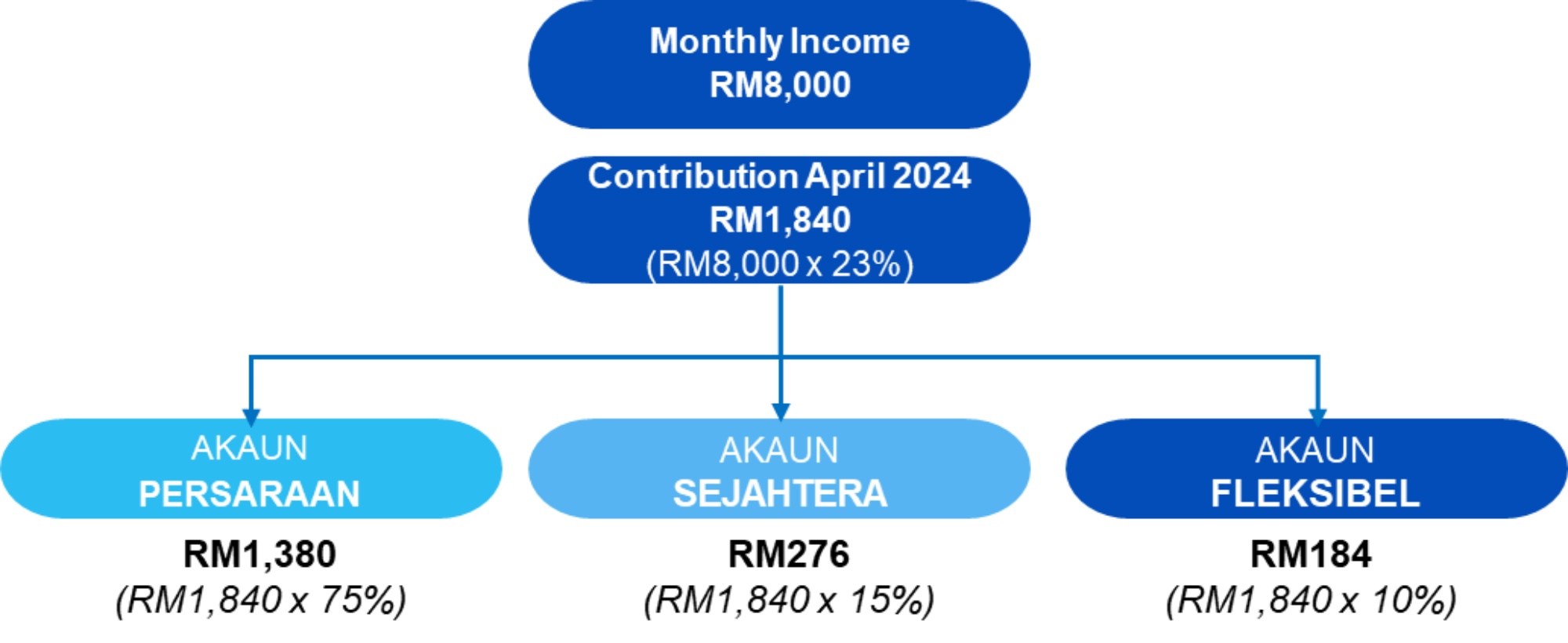

Savings stored in Account 1 and 2 will remain unchanged with this new change, while Account 3 would start with a zero balance. Starting 11 May 2024, contributions would be split three ways with 75% going into Account 1, 15% into Account 2 and 10% into Account 3.

EPF did not mention dividends in its notice or FAQ section on its website. However, it did clarify via a reply on X (formerly Twitter) that dividends for Account 3 will be the same as Account 1 and Account 2.

One-Time Transfer From Account 2 To Account 3

In addition, EPF is allowing members a one-time choice to transfer funds from their existing Account 2 to the newly launched Account 3 for a limited time. This option is available between May 11 and Aug 31, and transferred funds will reflect in Account 3 within three to five days.

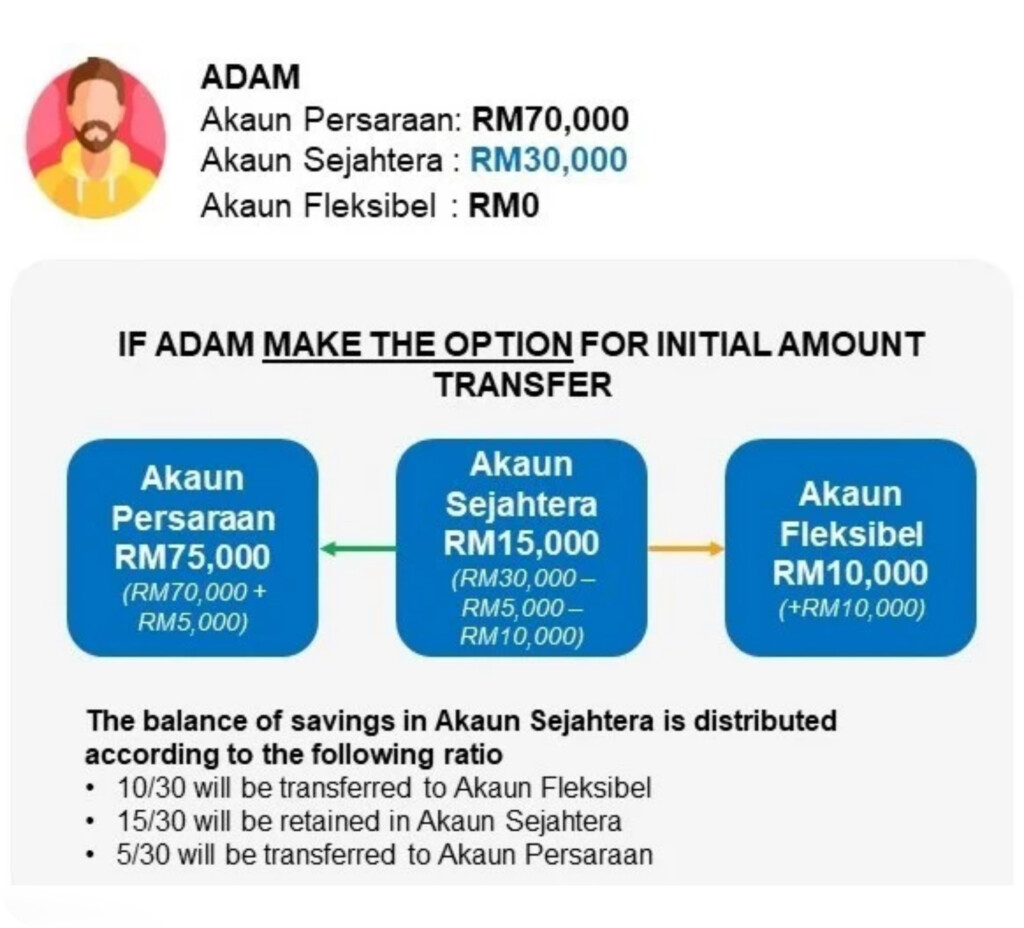

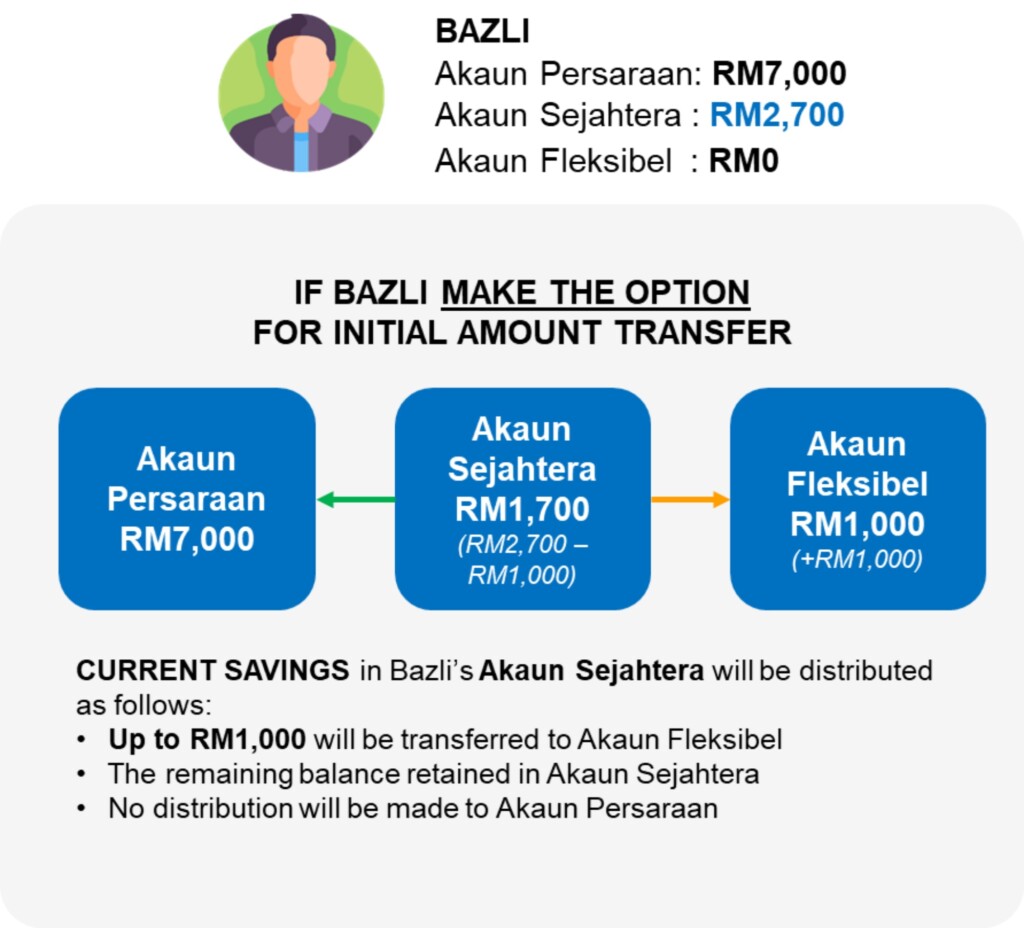

The transfer process varies based on the balance in Account 2 at the time of application. Members with over RM3,000 will see a portion transferred to Account 3 and Account 1, while those with less than RM3,000 will have the full balance or a portion thereof transferred to Account 3, with no distribution to Account 1 for balances below RM3,000.

You can apply for this one-off transfer through the KWSP i-Akaun app which is available on Apple App Store, Google Play, and Huawei AppGallery starting from 11 May. Alternatively, you can also do it via Self-Service Terminals at all EPF branches nationwide.

What Happens If You Opt Out From The One-Time Transfer?

If a member opts not to transfer funds initially, the balance in the existing account will remain in Account 1 and Account 2. New contributions will only be accumulated in Account 3 after the implementation date, as per the rates detailed in Changes In Contributions segment above. Meanwhile, withdrawals from the newer account are subject to current withdrawal terms and conditions.

Can You Transfer Savings From Account 3 To Account 1/2?

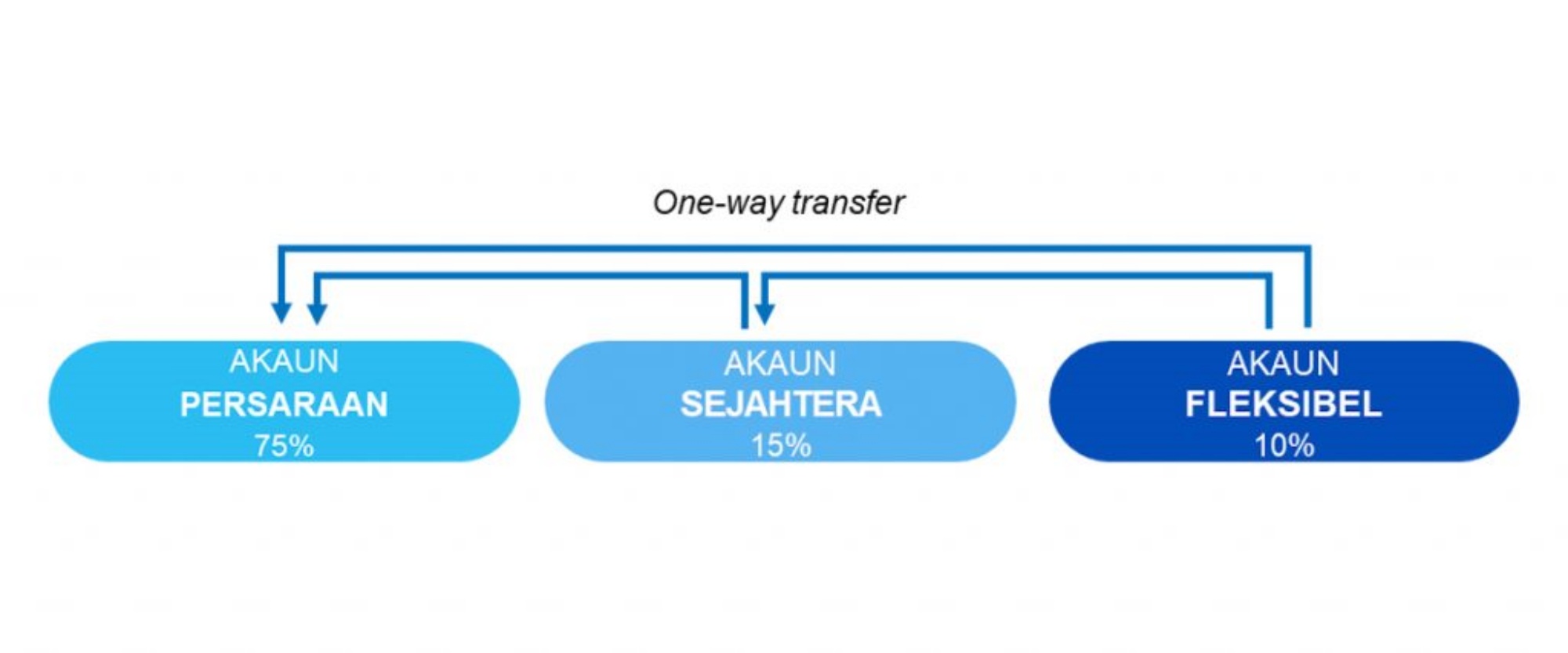

Yes, EPF revealed that you can actually transfer balance from Account 3 to Account 1 and 2 once you’ve accumulated enough in the future. Similarly, you can also apply to shift over your savings from Account 2 to Account 1.

However, do take note that the transfer process is one-way only, therefore savings transferred cannot be reversed into the original account. Additionally, given that Account 1’s priority is for retirement, transfers from this account to Account 2 and/or Account 3 are not allowed.

What About Akaun 55 And Akaun Emas?

According to EPF, all remaining savings in all three accounts will be transferred to Akaun 55 once members have reached the age of 55. Consecutively, new contributions after the age of 55 will be credited into Akaun Emas.

(Source: EPF official website [1] [2])

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.