Touch ‘n Go (TnG) Digital has announced that it will introduce a 1% fee for all credit card-based reloads on TnG eWallet starting 23 February 2024. The company explained that the move is intended to curb excessive cashing out of credit card balance to bank accounts, and to offset the heavy cost of credit card reload which it has been subsidising since its inception.

Prior to this, TnG Digital began implementing a 1% fee on manual credit card reloads exceeding RM1,000 back in November last year. This upcoming change will no longer exempt other credit card-based approaches regardless of top-up value.

In a press statement, CEO Alan Ni said credit cards will remain as one of the reload channels available on TnG eWallet for the sake of giving customers more options. However, he is urging users to utilise DuitNow Transfer or debit cards instead, which will continue to be free of charge. The company also emphasised that bank transfers via DuitNow are subjected to enhanced anti-fraud measures such as biometric authentication and device binding, therefore making it one of the safest reload methods available.

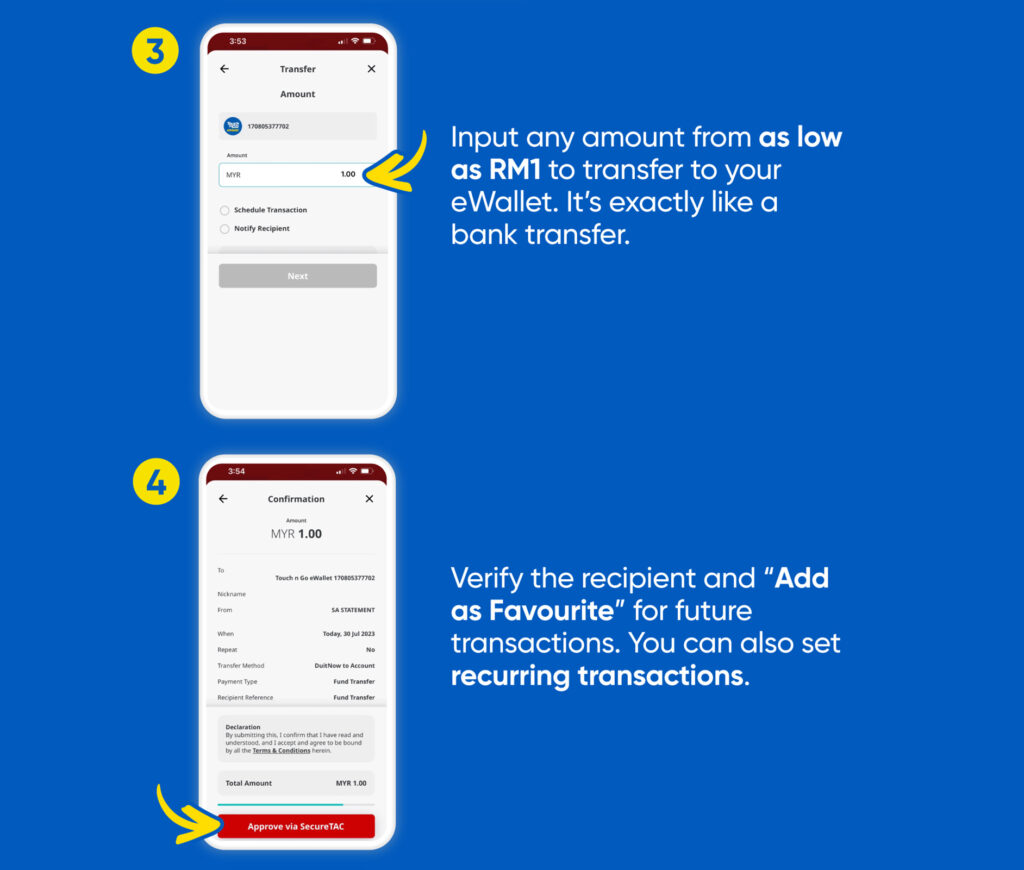

All users are given a DuitNow account number whenever they open an eWallet account, which can be found in the Profile section in the service’s app. To reload funds from their bank account to TnG eWallet, users must log into their respective bank apps or websites, select “other banks/eWallet” under the Transfer function, choose “Touch ‘n Go eWallet” as the destination account, enter their TnG eWallet DuitNow account number, and then complete the same steps needed for regular bank transfers.

The company is advising customers to save this transaction as “favourite” for the ease of future top-ups. As an alternative, they can also set it as a recurring transaction.

(Source: TnG Digital press release / official website)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.