GXBank has recently revealed that it will be debuting its much anticipated debit card (aka GX Card) in January next year. However, the bank did not specify whether both the physical and digital versions are released at the same time, though it did note on its website that users can immediately access the latter once it is available.

As made known by GXBank last month, its upcoming debit card will be released in partnership with Mastercard. Benefits for using the card include unlimited 1% cashback, zero markups or fees on foreign transactions, RM1 fee waiver for withdrawals via over 10,000 MEPS supported automatic teller machines (ATM) nationwide, and 1.5x GrabRewards points when spending at Jaya Grocer stores across the nation.

Keep in mind that certain abilities such as cash withdrawals via ATMs and payWave-based payments are only available with the physical GX Card. And unfortunately, there’s still no mention of Apple Pay, Google Pay or Samsung Pay support for contactless payments just yet.

We should also note that GXBank has released additional details regarding its debit card via a product disclosure sheet that’s available on its website. In the document, it mentioned that the card can only be used overseas or for Card-Not-Present (CNP) transactions (ie; online transactions) once you’ve opted to do so. As with most payments via a Point of Sale (POS) terminal with a debit card, no PIN is required for transactions up to RM250 in Malaysia. Meanwhile, cash withdrawals can only be done from local and overseas ATMs that support MEPS and Mastercard.

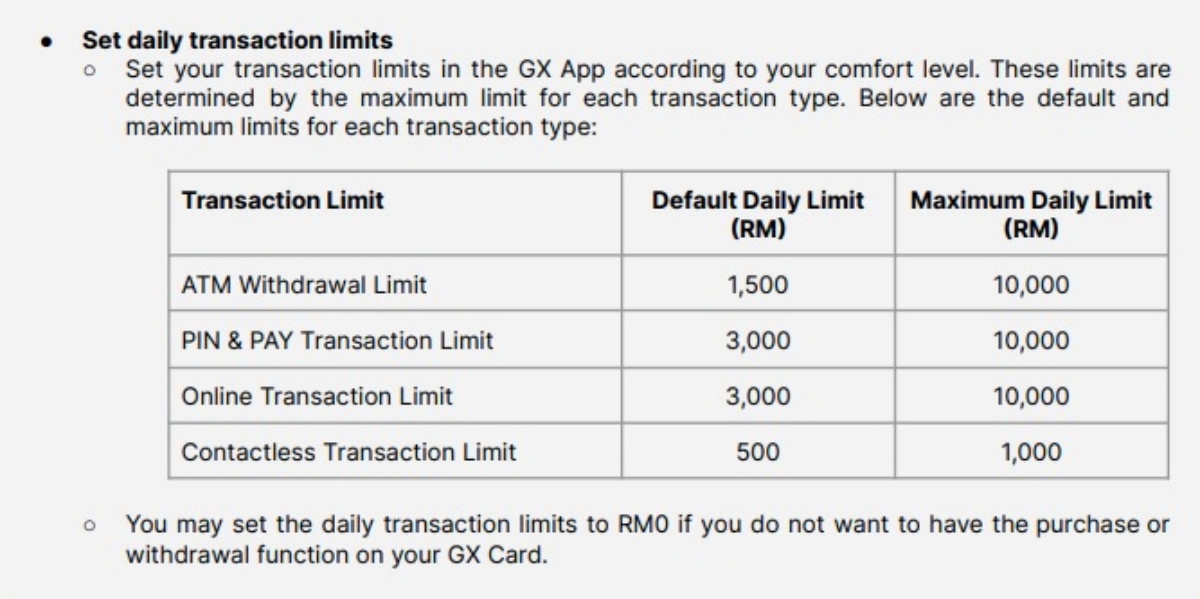

The bank also notes that the default GX Card daily limit for ATM withdrawal is at RM1,500, PIN & PAY transactions at RM3,000, online transactions at RM3,000, and contactless transactions at RM500. Users have the option to set the first three to a maximum of RM10,000 per day, while the latter at RM1,000. Additionally, you can set your daily transaction limit to RM0 if you do not want to have the purchase or withdrawal function on your card.

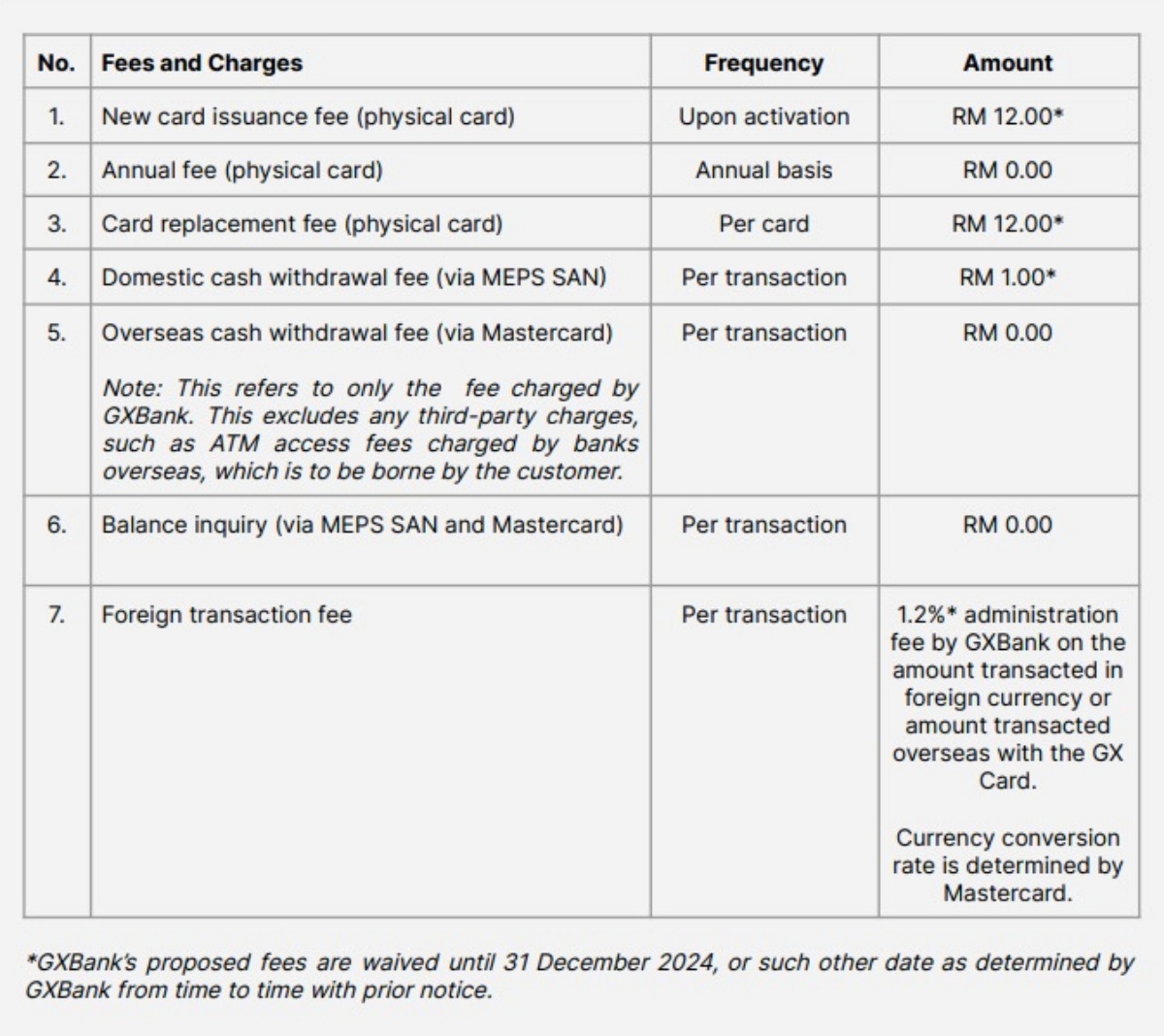

As for fees, GX Bank says it will waive all charges for new card issuance or replacement as well as domestic and international withdrawals until 31 December 2024, or such other date as determined by it from time to time with prior notice. Users will not be charged an annual fee for physical GX Cards, or when conducting balance inquiry via MEPS or Mastercard supported ATMs.

In regards to foreign transaction fees, it is noted that a 1.2% administration fee will be imposed on the amount transacted in foreign currency or amount transacted overseas with the GX Card. However, as with those mentioned above, this too will be waived by the bank until 31 December 2024, or until further notice. Currency conversion, on the other hand, is determined by Mastercard.

Other things pointed out by the document includes a pre-authorisation amount of up to RM200 charged when using the GX Card at self-service pumps or automated fuel dispensers, which is pretty common for most debit card-based payments at petrol stations. As such, the bank will only release any extra on-hold amount from designated accounts within three calendar days after the date of the transaction. Of course, should your bank balance fall below the RM200 minimum, the transaction will be rejected.

Just in case you missed it, GXBank officially launched its mobile app and its banking services last month. The app itself is available now via Apple App Store and Google Play, while registration is only available for Malaysian residents.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.