Grab-led digital bank GXBank today has begun rolling out beta trials for its mobile app to a select number of users in Malaysia. For now, access is only limited to 20,000 users across the country, with a public rollout expected to commence by late 2023.

The app itself is promised to offer a clean and easy navigation interface, along with key safety functions in order to secure user trust and security. According to GXBank, each step of its development is in line with regulatory expectations and norms to ensure it achieves the technical requirements of a digital bank, prioritising the safety and security of user data and funds.

Throughout the beta testing period, users are able to create a GXBank Savings Account and are given access to the bank’s Pockets feature. The latter of which is as implied by its name, where it lets you create up to 10 sub–accounts for the purpose of saving cash for specific goals, such as a vacation or purchasing a luxurious item. The bank adds that money parked in each Pocket will earn daily interest of up to 3% p.a., while the app itself will also provide users with periodic tips to fast-track their savings goals. And should you decide to cancel certain goals due to whatever reason, you may choose to withdraw the amount back into your primary account at no cost.

In line with Bank Negara Malaysia regulations, GXBank assures that all deposits are protected by Perbadanan Insurans Deposit Malaysia (PDIM), with up to RM250,000 for each depositor. Additionally, the bank also provides users the ability to lock and secure their accounts directly via the app should they observe any fraudulent or unauthorised transactions, as well as impose a limit to daily spending in order to help users not to overspend.

The GXBank app currently supports deposits from a select number of banks, with the plan to include e-wallets later on. However, it is worth noting that its fund transfer feature does support digital wallets (namely TnG eWallet and BigPay for now), on top of over 30 other banks that are both local and international.

In addition, users may also choose to wirelessly send cash to receivers by simply entering their mobile number, MyKad or army/police ID, passport number, or even their business registration number. There’s no support for QR– or NFC-based payments such as DuitNow QR, Apple Pay or Google Wallet just yet, unfortunately.

For now, testers can enjoy a RM20 cashback with a minimum deposit of RM100. GXBank promises to offer even more benefits to its users in the near future, including unlimited cashback every time they spend with its upcoming debit card, no markups on foreign transactions, as well as RM1 processing fee waiver for cash withdrawals at MEPS supported ATMs nationwide.

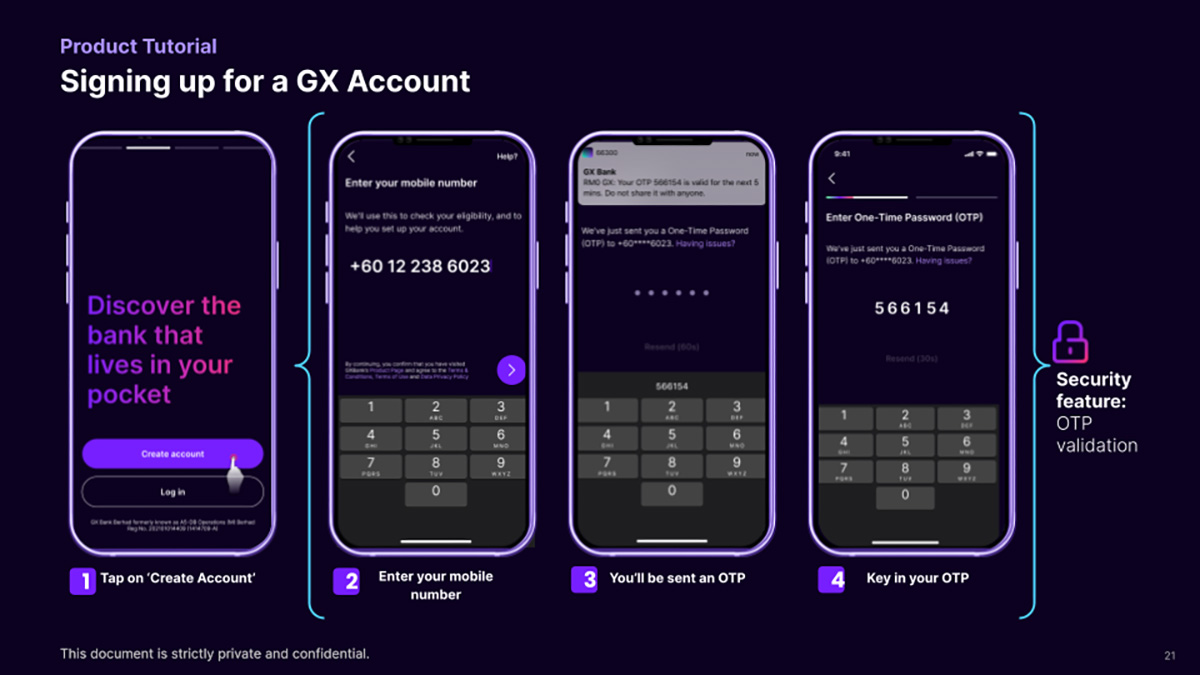

Users can download the GXBank app via the Apple App Store or Google PlayStore, while it is also worth noting that existing Grab users can also access it through the Grab app itself. Once acquired, users need to undergo the necessary eKYC (electronic Know Your Customer) process for registration, which requires you to provide the bank with your phone number and a digital copy of your MyKad. On that note, sign ups are only available for Malaysian citizens at this time.

Upon successful registration, users can choose to set up their app login by passcode or through biometric authentication. Also keep in mind that a minimum off RM10 in your savings account is required if you wish to try out the Pockets feature.

For those who missed the current beta period, you can register to be part of GXBank’s subsequent testing phases through this link.

(Source: GXBank press release)