With the rising cases of fraud, everyone wants to feel safe and secure. That is why banks have been stepping up their game and have been increasing their layers of defences for online banking, and Maybank is one of those banks leading the charge for a more secure and reliable banking experience.

With security being their number one priority, Maybank’s updated measure of activation at ATMs not only helps reinforce people’s personal savings but also places the power in their hands, giving them more control over any and all transactions in the future.

You now have to physically visit an ATM to activate your Secure2u before any digital transactions can be done. This change has gone live as of 31 October 2023.

Despite this being an additional layer of security, many have not registered or activated their Secure2u for multiple reasons – either because they are new to the Maybank and/or MAE app, or people who recently switched devices. This is essential, as you will now be required to register your respective devices so that you may use the digital transactions without any interruption.

Though this feature requires more steps, here’s why it is more secure. In order to gain partial or full access to your account, scammers and hackers require several things in order to gain access to your account and, in-turn, savings; fraudsters would need your phone, access to your MAE account, your physical ATM card, and your pin number. Never share your PIN with anyone for maximum security. All of these combined will add several layers of security.

Though it is an additional step, this ATM activation only needs to be done once, like if this is the first time activating your Secure2u or when you have a new phone. It is important to have these systems online and not activated at the last minute or until an urgent transaction comes your way. Here are two ways to help you activate this function:

How to activate with an ATM Card

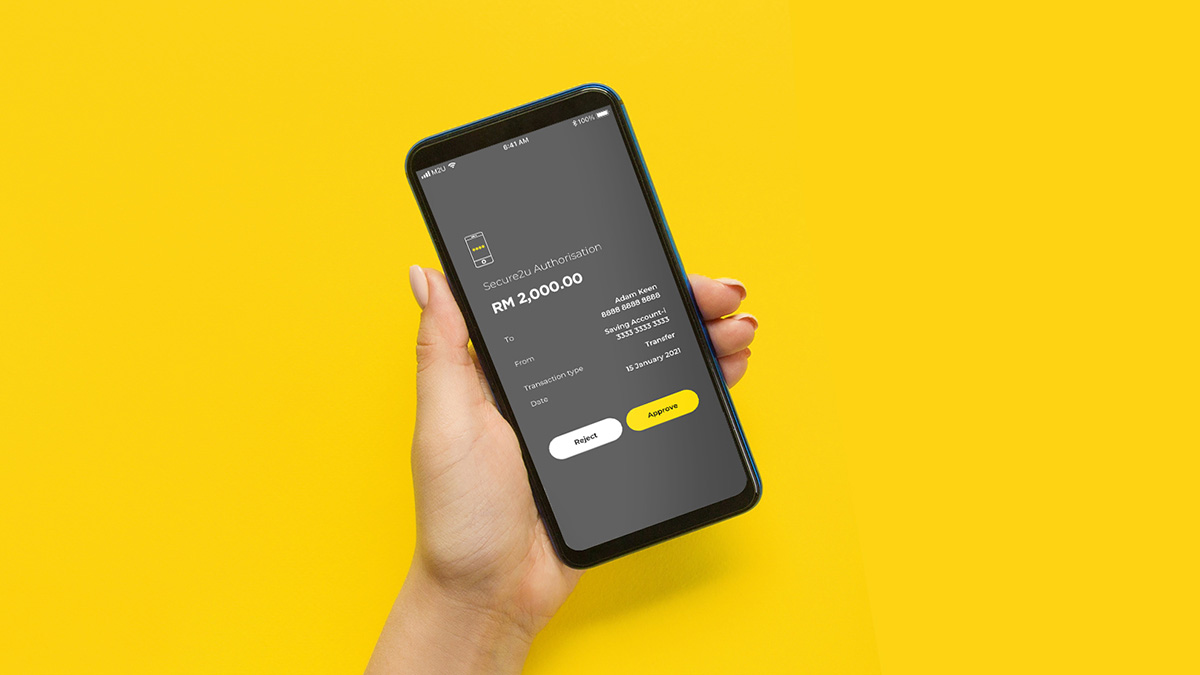

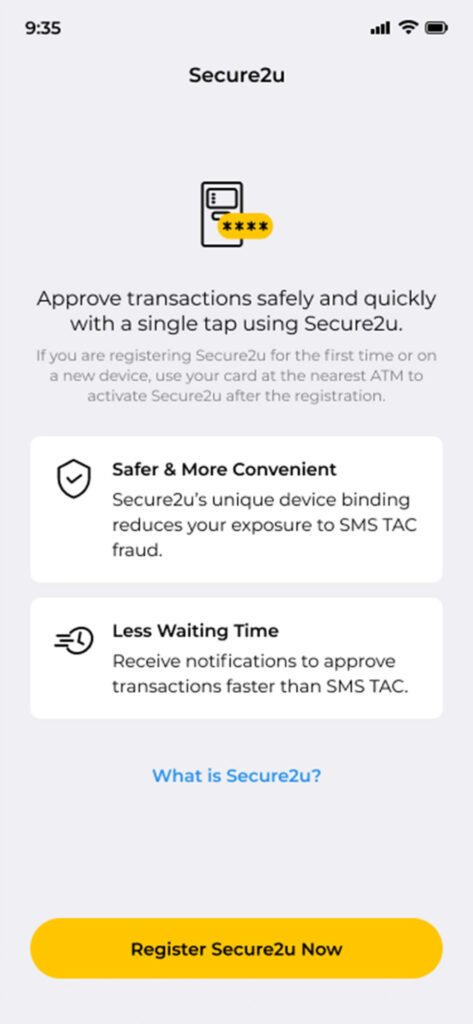

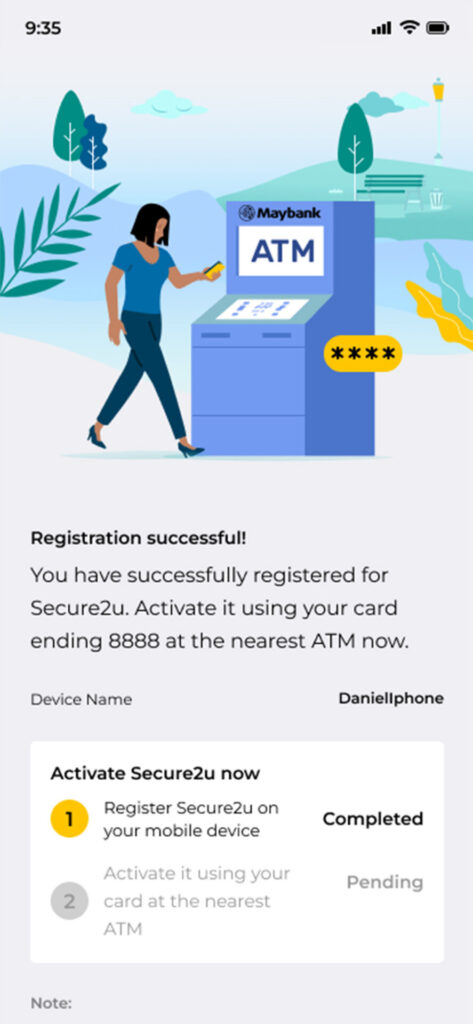

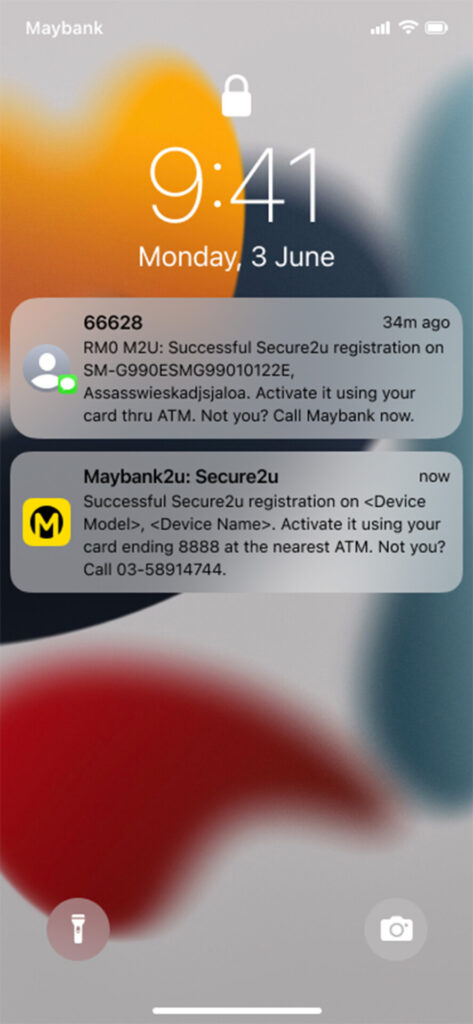

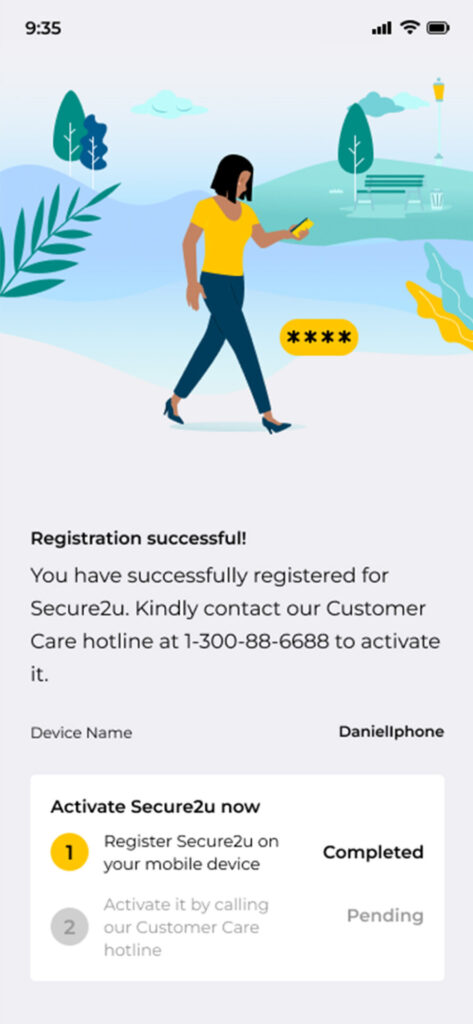

To start, download or launch the MAE app, then under Quick Actions, tap “Secure2u” to register the feature on your device. From there, tap “register Secure2u Now” and then follow the on-screen instructions to complete your registration. Once registration is successful, you will receive a push notification to remind you to activate your Secure2u at a Maybank ATM within 30 days. With more than 2900 ATMs across the country, you can easily visit the nearest one for your convenience.

To activate it at any Maybank ATM, first insert your ATM card, select “Activate Secure2u” and follow the on-screen instructions to complete the process. Note that once you’ve activated Secure2u on MAE app, there will be a minimum 12-hour activation period before you will be able to use the feature in order to prevent any unauthorised transaction approvals.

How to activate through the MAE without an ATM card for MAE account users and overseas customers

Follow the same steps for registration through the MAE app, and once you’ve completed it, call Maybank Group Customer Care (MGCC) within 30 days upon successful registration to complete the activation process. After activating Secure2u on the MAE app, you will still have a minimum 12-hour activation period that will prevent any unauthorised transaction approvals. The activation period before Secure2u on a new mobile device will provide sufficient time for customers to verify and report to the bank in case of any unauthorised registration. For those overseas or those without a physical card may call Maybank Group Customer Care (MGCC) for assistance as well after registering on MAE

Start ramping up your security today. To learn more about Secure2u, visit Maybank’s official page, and don’t forget to also stay up to date on any future announcements by visiting their official Facebook, Instagram, and Twitter pages.

This article is brought to you by Maybank

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.