Western Digital (WD) announced that it will not be acquired or merging with the Japanese memory brand and break-off from Toshiba, Kioxia. The decision by the former comes after plans to merge with the latter stalled and ultimately fell through, more than two years after the merger was announced.

The split will see WD separate its flash memory business, primarily due to a supply glut but more to the point, to placate the demands of one of its primary investors, Elliott. This means that the memory company will now be trading under two public companies while retaining its traditional hard disk drive business. In light of the split, the company also saw its shares rise 10% in the stock market.

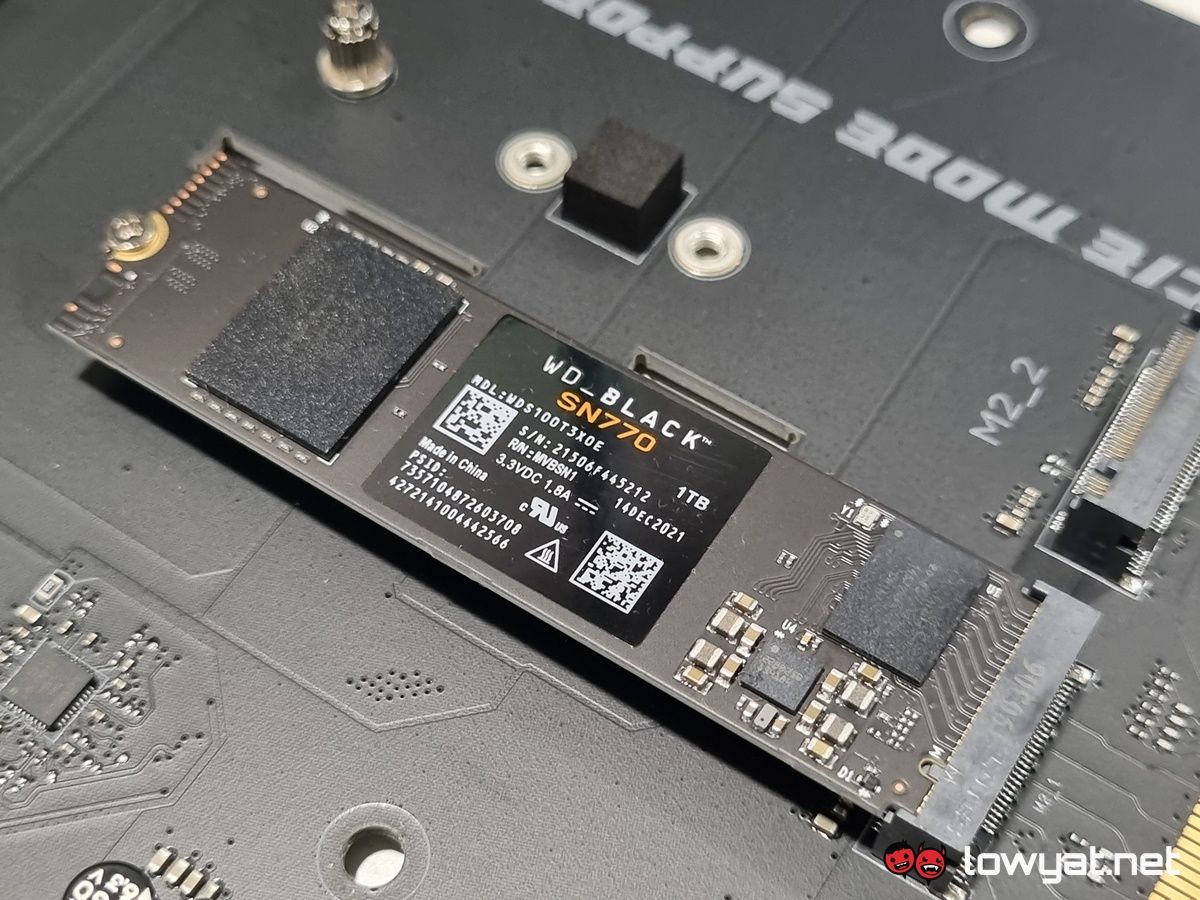

It’s no secret that the pandemic saw a surge in demand for PC components, chief among them being flash memory products such as NVMe SSDs. Post-pandemic, both WD and Kioxia experienced a supply glut, bringing about a slump in demand that has dragged on till today. Had the two companies completed their mergers, the partnership would have seen them become a single major player, with control of more than a third of the global NAND flash market.

But that wasn’t to be, as this recent news indicates. According to CNBC, the latest stall in the deal was brought about after Kioxia’s investor, SK Hynix – which is also another major memory chip player in the industry – objected to it.

(Source: CNBC, Reuters, Techspot)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.