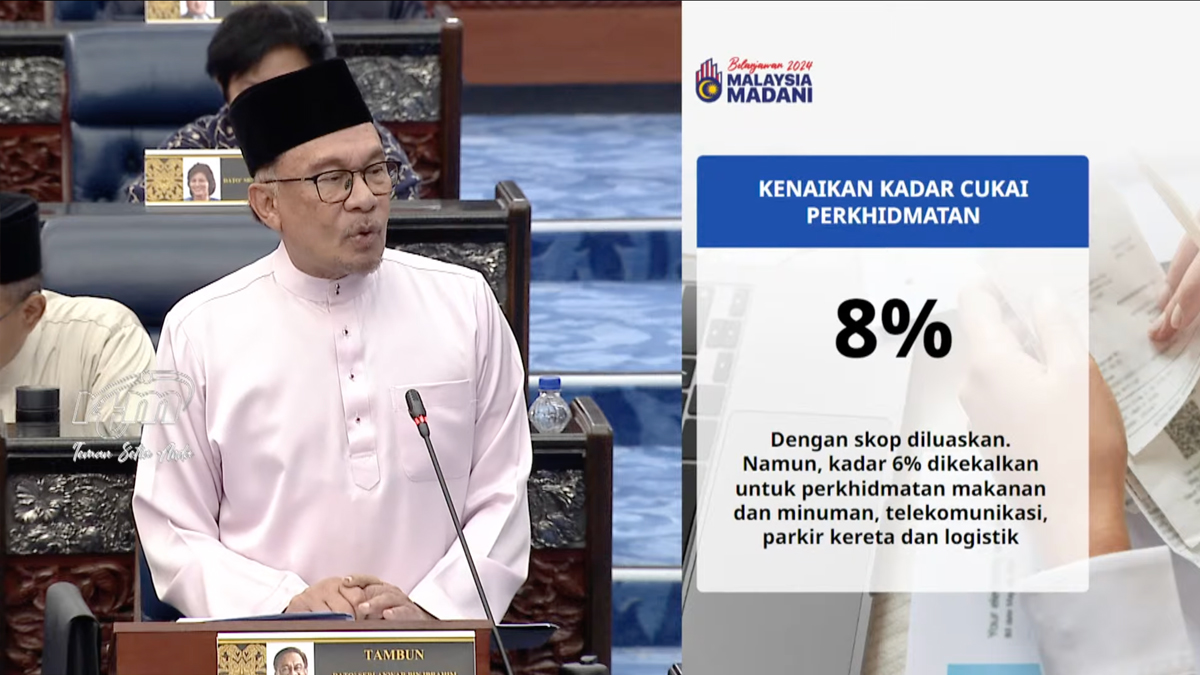

Prime minister Datuk Seri Anwar Ibrahim, who is also the Finance Minister, revealed during Budget 2024 today that the government is planning to increase the service tax rate from 6% to 8%. Despite this, he assured that the tax collected is among the lowest in Asean at 11.8% of gross domestic product compared to Singapore and Thailand, both of which are recorded at 12.6% and 16.4% respectively.

In the interest to not burden the people, Anwar assured that the 8% SST increment will not apply to certain services such as food and beverages, as well as telecommunication. However, he also revealed that the government will expand the number of taxable services under the new service tax to include logistic services, brokerage, underwriting, and karaoke.

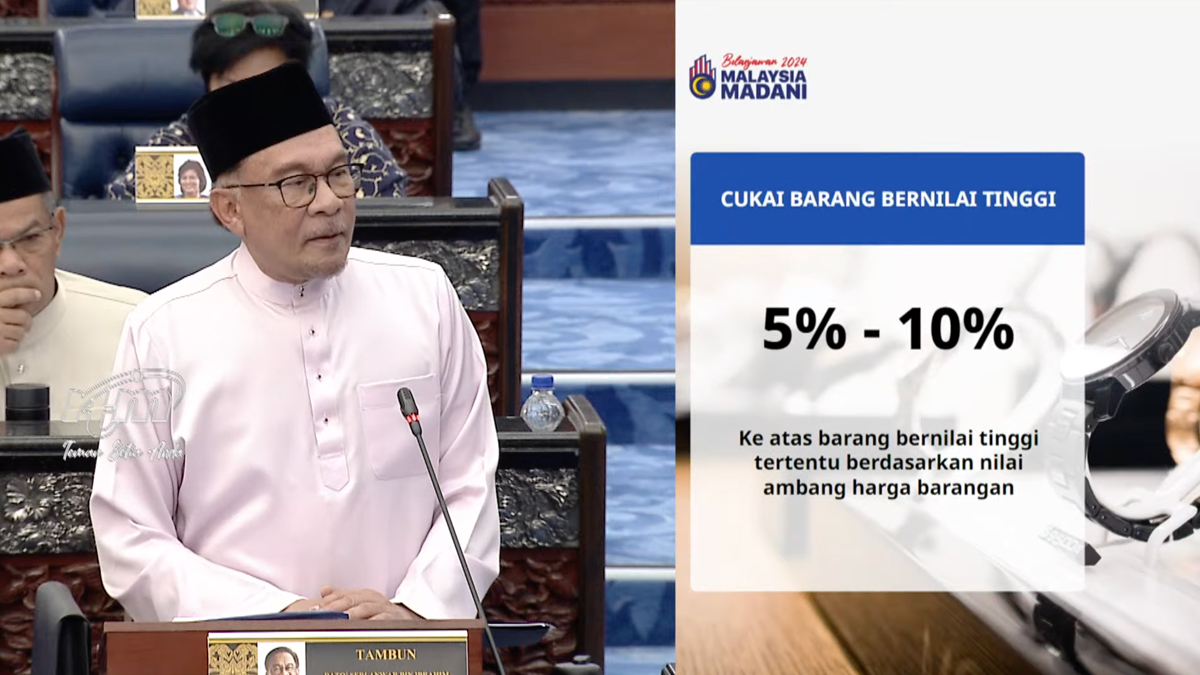

Meanwhile, it’s been revealed that a new legislation to tax certain luxury goods such as jewellery and watches set at between 5 to 10 percent is under consideration, while enforcement of capital gains tax on sale of unlisted shares at a 10% rate is planned to start from 1 March 2024 onwards. Both of these were actually introduced during Budget 2023 earlier this year but appear to have been delayed to 2024 instead.

Last but not least, Anwar also noted that the government is mulling the exemption of capital gains tax on the disposal of shares related to certain activities. These include approved initial public offering (IPO), internal restructuring and venture capital companies subject to specified conditions.

(Source: Budget 2024, via Astro Awani)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.