[UPDATE – 29 September 2023, 4:20pm] PayNet has officially confirmed that it will incur DuitNow QR (DNQR) transaction fees to merchants starting from 1 October 2023. Despite this, Maybank and Public Bank have announced that they will still waive the fee for traders until further notice, while CIMB says it will continue absorb the charge as part of its 0% Promotional Rate until 31 December 2023.

Read the full story here: http://lowy.at/xkdhc

[Original story published on 27 September 2023, 2:26pm]

It is reported that merchants will be charged with transaction fees for receiving payments via PayNet’s DuitNow service starting 1 November 2023. According to MalaysiaNow, the upcoming change will be introduced as a result of price restructuring by the service, which will come into effect across all banks. Prior to this, DuitNow only applied a fixed fee of RM0.50 to transactions exceeding RM5,000.

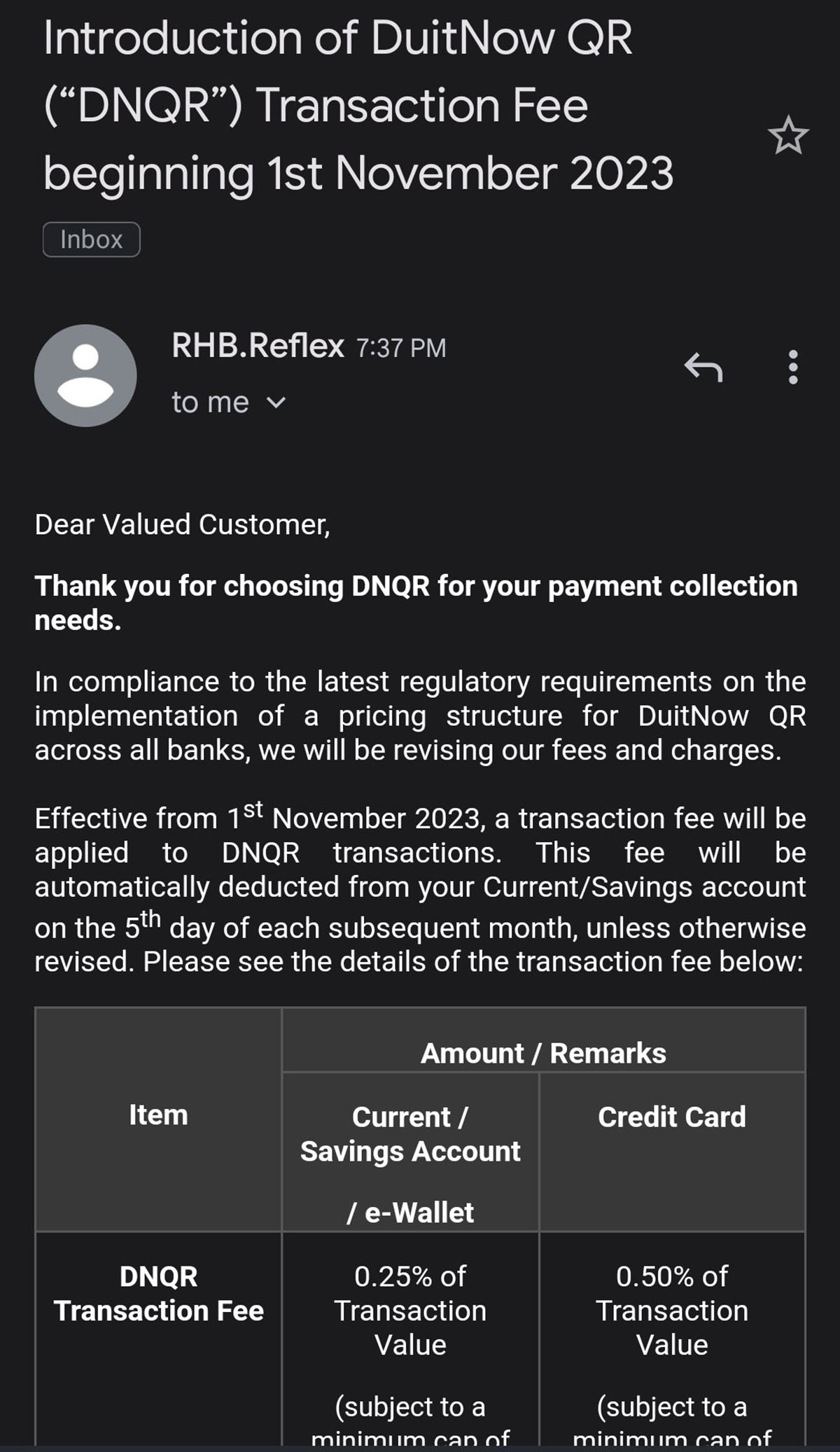

Citing an email from RHB’s Reflex financial portal, it is revealed that these charges will be deducted from merchants’ current or savings account on the fifth day of each month. It is also worth noting that a screenshot featuring the same email has been shared by user helioz666 on X (formerly Twitter) just a couple days prior to the publication’s report. It is unclear whether MalaysiaNow was referencing this, or had received their own copy from the bank.

Responding to a query, Reflex’s customer service department told MalaysiaNow that the fee amount charged would depend on the mode of transfer. “If the payment is made from a current or savings account, a fee of 0.25% will be applied to the trader’s account,” they said. “For transfers made through credit cards, a fee of 0.50% will be levied.”

The publication also claims that Maybank too confirmed the matter, saying that charges will be applied to transfers between banks and applications using the DuitNow service. In the same statement, the bank notes that no charges are incurred when using its Maybank QR for transfer.

Meanwhile, CIMB and HSBC told MalaysiaNow that no such notice or memos indicating charges imposed on traders for using DuitNow have been issued. The latter added that an announcement will be posted on its website if such fees are implemented.

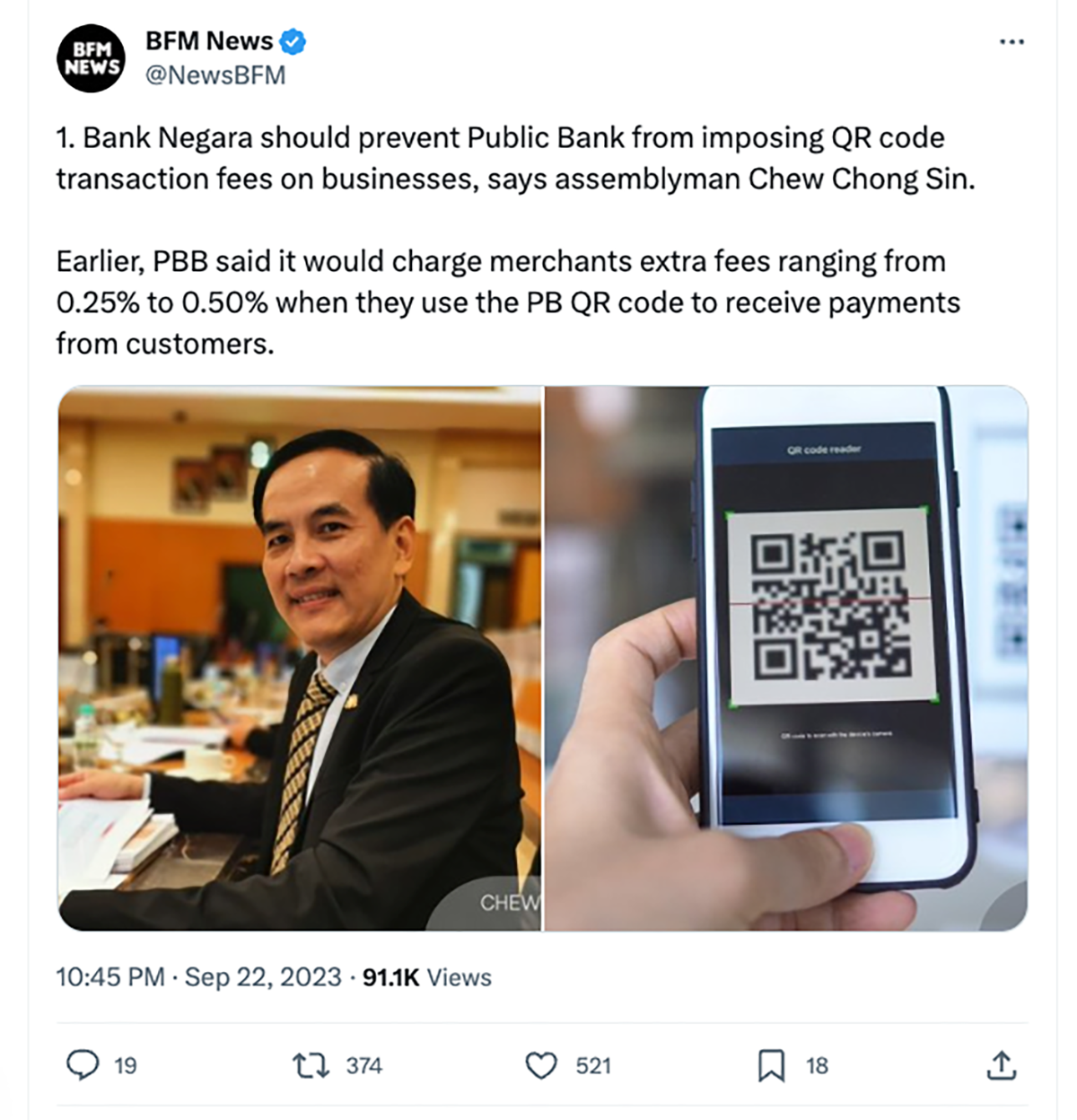

On a somewhat related note, BFM reports that Public Bank Berhad (PBB) would charge merchants extra fees ranging from 0.25% to 0.50% when they use its PB QR code service to receive payments from customers starting 1 October 2023. The local radio station adds that Johor assemblyman Chew Chong Sin is urging Bank Negara Malaysia (BNM) to intervene in PBB’s decision, saying that these charges could encourage other commercial banks to follow suit and will add additional operation costs to businesses.

(Source: MalaysiaNow / BFM / helioz666)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.