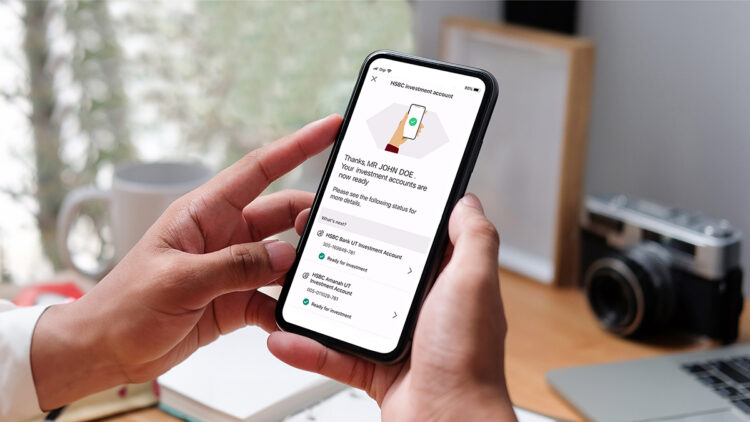

HSBC users can now easily open investment accounts with the bank from the convenience of their mobile phones. The bank today has officially launched the new Investment Opening Service feature on its official app, and is the first in Malaysia to offer customers with the ability to both bond and the sharia compliant Sukuk investments through mobile means.

“As our customers build their wealth portfolios both in Malaysia and across the globe, we will capitalise on the strength of HSBC’s international network to play an integral part in their journey, by providing our customers access to our market leading products and services,” said the bank’s country head of wealth and personal banking Linda Yip via an official statement. “We use a hybrid model of relationship managers and wealth specialists, supported by digital wealth capabilities to serve our customers holistically.”

On top of the ones mentioned earlier, HSBC’s wealth solutions also include a comprehensive shelf of unit trusts, structured investments, dual currency investments, foreign currencies and insurance. However, the bank notes that customers would still need the assistance of their relationship managers to further transact in bonds or Sukuk trading, buying and selling activities. They can conduct this either face to face with the managers, or through HSBC’s Remote Engagement Service, which is an alternate channel for customers to interact with the bank via Zoom or Live Sign.

To access the new Investment Account Opening feature, simply navigate to the Wealth tab in the HSBC Malaysia mobile banking application. The bank’s app is available on both Android and iOS devices, and can be downloaded from the Google Play Store and Apple App Store.