Touch ‘n Go has introduced a new insurance product called ParkInsure. Costing RM5 per month, the Personal Accident insurance covers several incidences that could occur on parking sites as long as you use a TnG card to enter.

Customers have two ParkInsure options under the GOprotect tab on the TnG eWallet app. They can opt for either takaful underwritten by Zurich General Takaful Malaysia or conventional insurance underwritten by Allianz Malaysia. Each plan has its own set of exclusive benefits with some similarities shared between them.

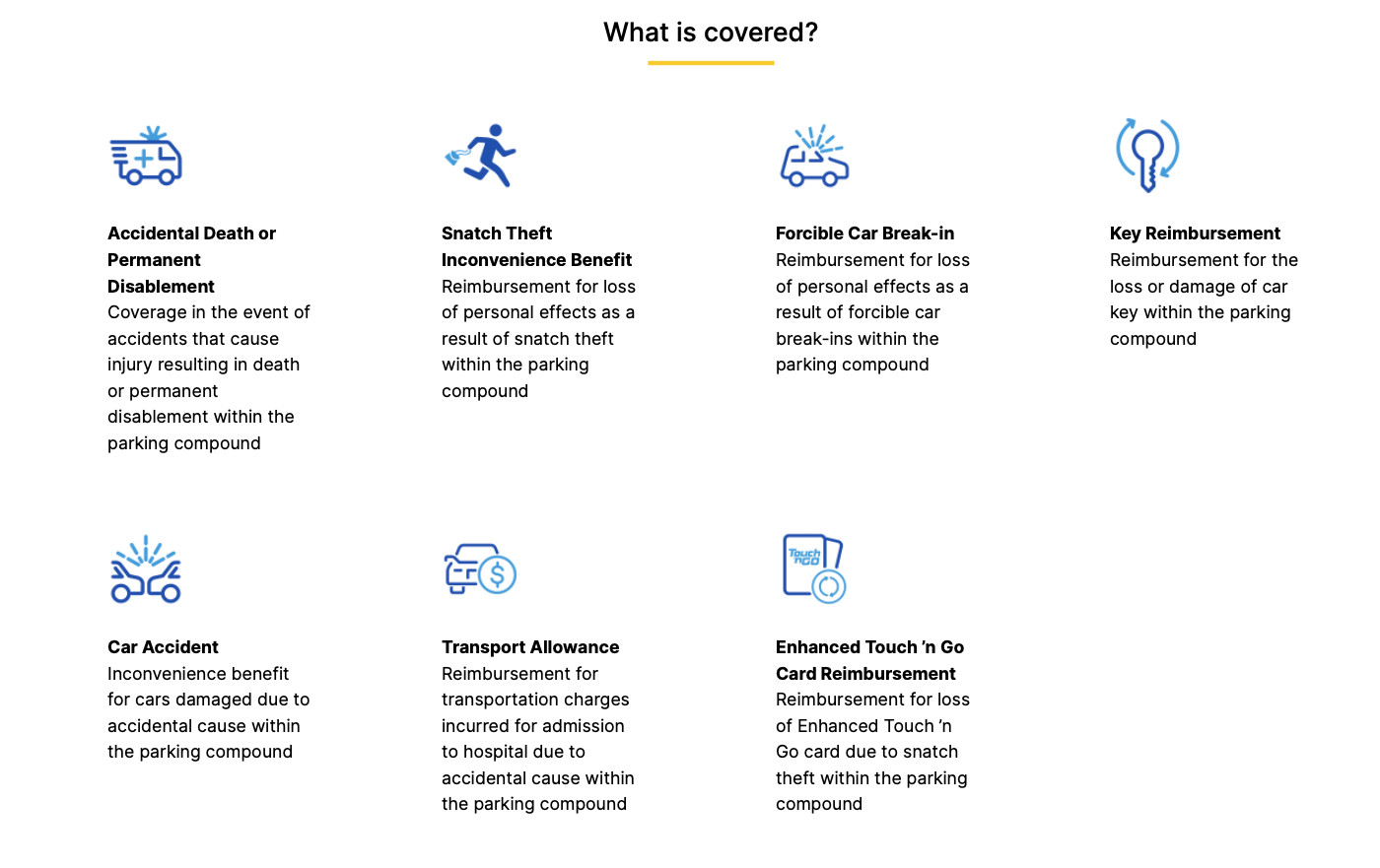

The two plans provide a reimbursement of up to RM70,000 for accidental death or permanent disablement caused by an accident within the car park, as well as up to RM1,500 for snatch theft, with the Zurich plan also covering the enhanced TnG card for RM10 . For forcible car break-ins within the car park, conventional users can get up to RM1,500 while those on takaful can only get a maximum of RM1,000.

If your car key is stolen or damaged, ParkInsure will reimburse up to RM100 for conventional users and RM200 for Allianz customers. In the case of an accident on the parking site, the takaful plan will give up to RM200 for any damages to your car, while the conventional plan will only cover up to RM200 in transportation charges if you need to go to the hospital.

You must link a TnG card to ParkInsure and that same card must be used to enter and exit the parking site in order for the insurance to kick in. If any of the covered incidents occur, you must file a police report within 24 hours and submit a claim through the TnG eWallet within 30 days.

(Source: TnG Press Release)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.