[Update – 6 July 2023, 8:30AM] Maybank has delayed the requirement of Secure2u for subsequent favourite transfers from 4 July to 10 July.

[Original Story – 5 July 2023, 11:39AM]

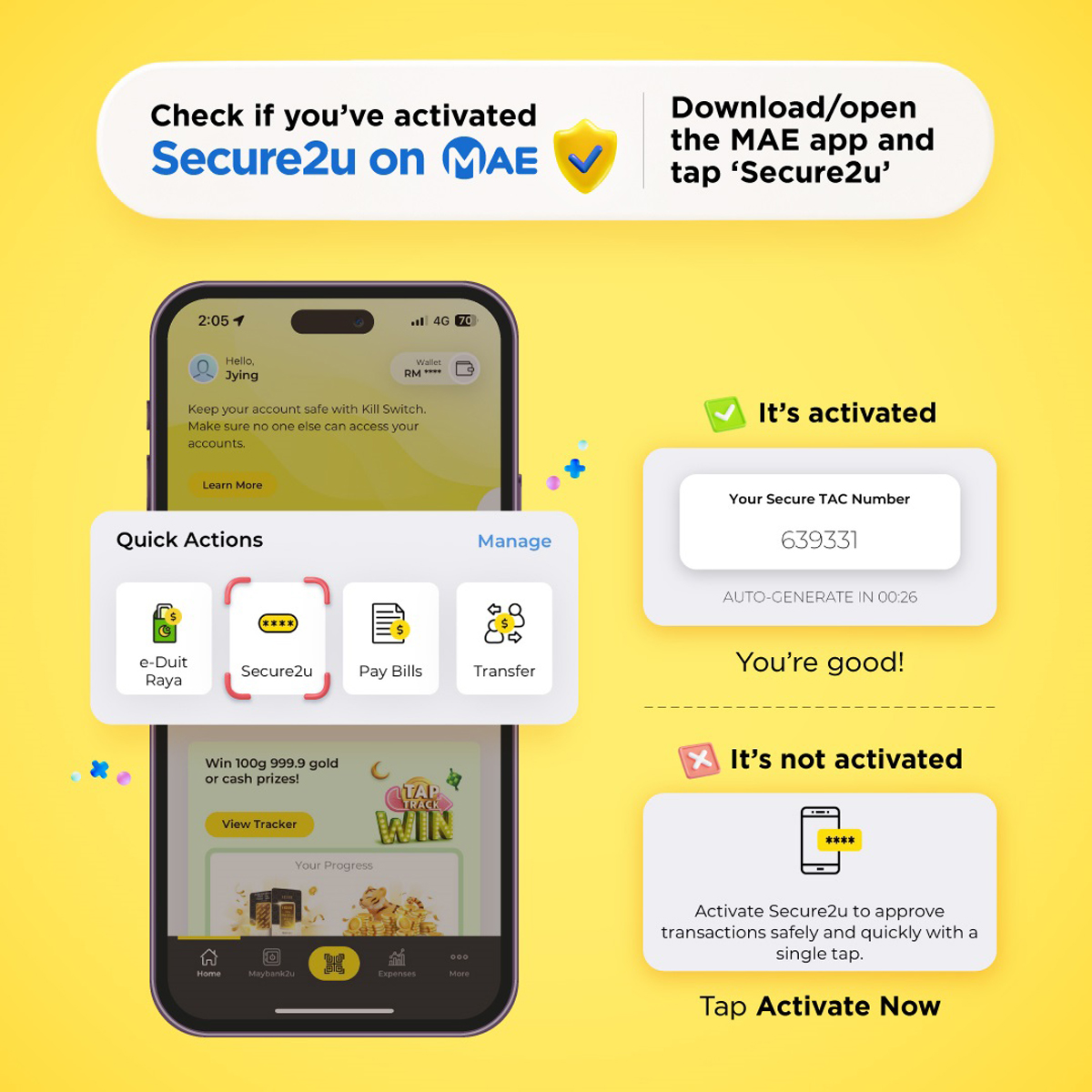

At the beginning of this month, Maybank completed its transition from One-time Passwords (OTP) to Secure2u for online transactions, a move in line with Bank Negara Malaysia (BNM)’s mandate to reduce the risk of online fraud and potential scams. While almost all services and transactions needed to use the feature following the migration, subsequent transfers to favourite accounts were given an exception, at least up until yesterday.

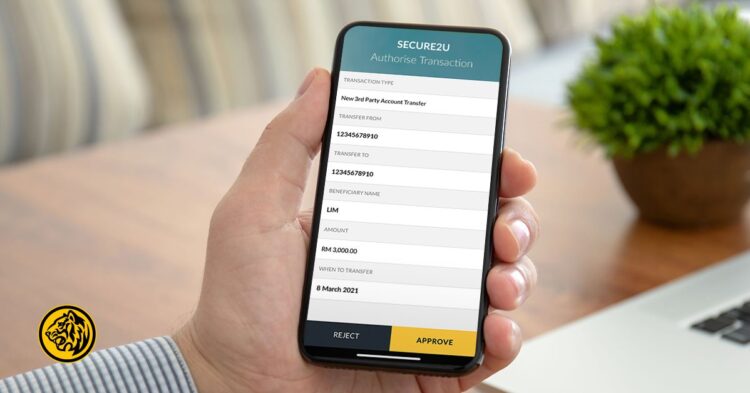

Starting from 4 July 2023, the bank now requires users to authorise any transfers to favourites, whether it be a third-party transfer, DuitNow transfer, or GIRO transfer via Secure2u. Previously, the authorisation method was only required for first-time transfers to favourites.

With the transition, all online transactions for its customers will require a one-tap authorisation from the MAE app. This includes any monetary or non-monetary via Maybank2u web, the M2U app, or the MAE app as well as online debit and credit card transactions.

Keep in mind that if you’re activating Secure2u on MAE for the first time or you’re activating it on a new device, there is a 12-hour waiting period before you can use it. For a full list of transactions that require the MAE-based confirmation method, you can check out the bank’s FAQ.

(Source: Maybank)