Earlier this week, Maybank sent out a reminder through its social media channels that it will be migrating its online card transactions to Secure2u. It was not the only bank to do so, as CIMB has done something similar, albeit a day later. As per its announcement, the bank will soon require all of its online transactions get SecureTAC approval before they go through.

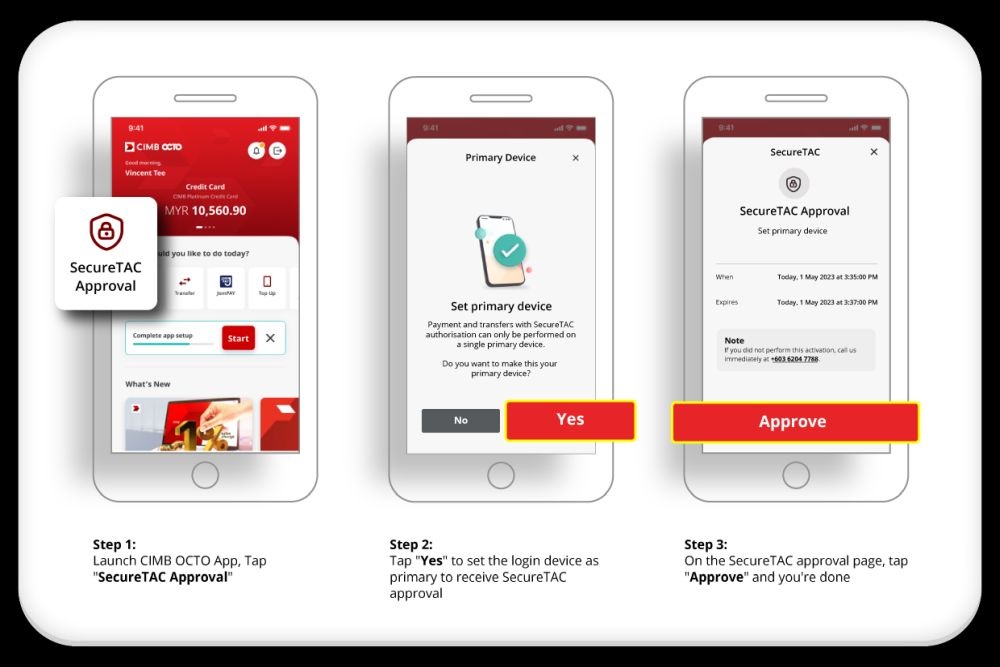

According to the announcement post on its website as well as its official Facebook page, this will come into effect on 20 May. You will need to be using the bank’s CIMB Clicks or OCTO apps to use SecureTAC. So if you are a customer of the bank but have been putting off using either, it looks like that won’t be possible for much longer.

Back in March of this year, CIMB has announced that FPX transactions above RM100 needed SecureTac approval, so in a sense this looks to be the natural next step. There’s also the matter of complying with the mandate by Bank Negara Malaysia (BNM) to move away from using one-time password (OTP) SMS, which was announced in September last year. Other mandates include only allowing for one device to authenticate and authorise online transactions, which is also mentioned in the FAQ section of the announcement page.

On that note, there is an entry that mentions the possibility of customers still getting SMS TAC despite already activating SecureTAC. CIMB says that this is being rolled out in phases, and because of this, some transactions will still require SMS TAC for the time being. This will likely stop being a thing once the mentioned 20 May date rolls around. But until then, if you do lose your phone and have activated SecureTAC on another device, you should contact the bank to deactivate the feature on the lost phone.

(Source: CIMB)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.