The majority of us are aware that financial fraud and scams are on the rise. This is especially true in an era where technology is evolving at a rapid pace. At first glance, most online scams appear legitimate and are not easily detectable. Online scammers are experts at exploiting technology and will even target you through your most frequented social media apps such as Telegram, SMS or even WhatsApp. It is important for us to exercise caution to protect themselves from falling victim to scams.

CIMB Bank is dedicated to making sure that customers can bank safely and confidently at all times. In January 2023, the bank launched the self-service “Lock Clicks ID” feature, which acts as a “kill switch” for both its CIMB Clicks and CIMB OCTO Apps.

This feature empowers customers to act first if they suspect their accounts have been compromised, freezing their digital profiles to temporarily prevent any new outgoing transactions.

All from the convenience of their own devices.

What is the Lock Clicks ID feature?

The Lock Clicks ID function is the most recent enhancement made by CIMB Bank as part of a series of steps to improve banking security and safeguard its customers from financial fraud.

If customers see any strange or suspicious transactions or believe their account has been compromised, they can immediately take action and freeze their CIMB Clicks ID. This is achievable through a straightforward process thanks to the Lock Clicks ID feature CIMB has integrated wholly within the app.

How To Activate This Feature:

Activating this feature is simple. All it takes is three simple steps and you’re set! The steps are:

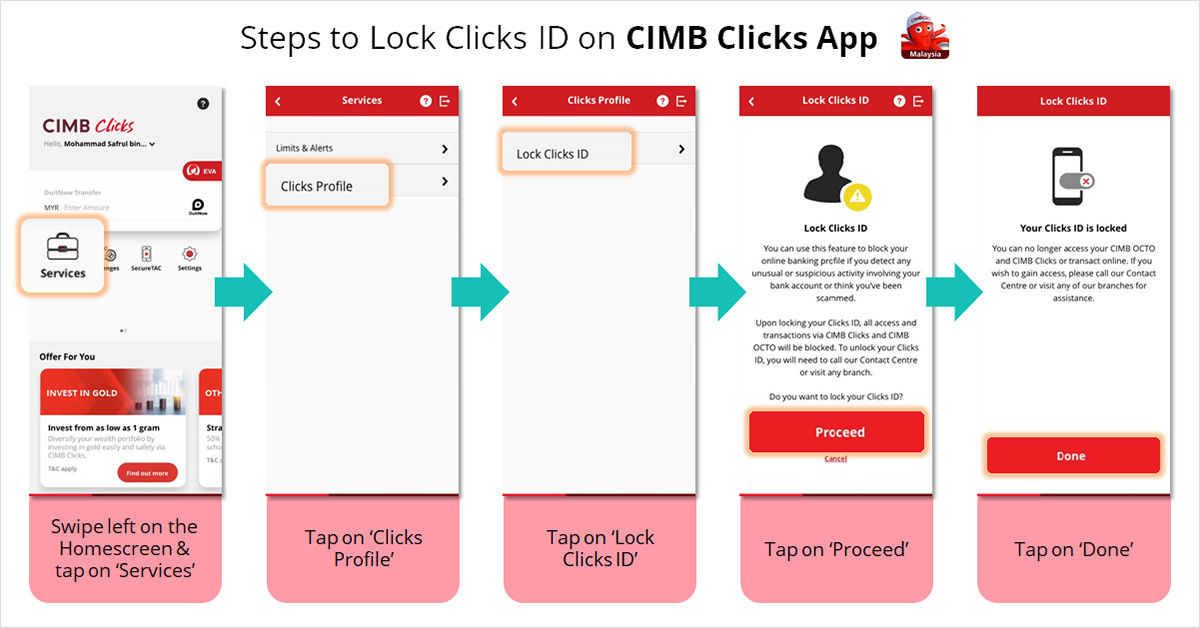

CIMB Clicks App

- Log in to your CIMB Clicks App and swipe left on the Homepage menu.

- Tap on ‘Services’ › ‘Clicks Profile’ › ‘Lock Clicks ID’

- Tap on ‘Proceed’ to lock your Clicks account

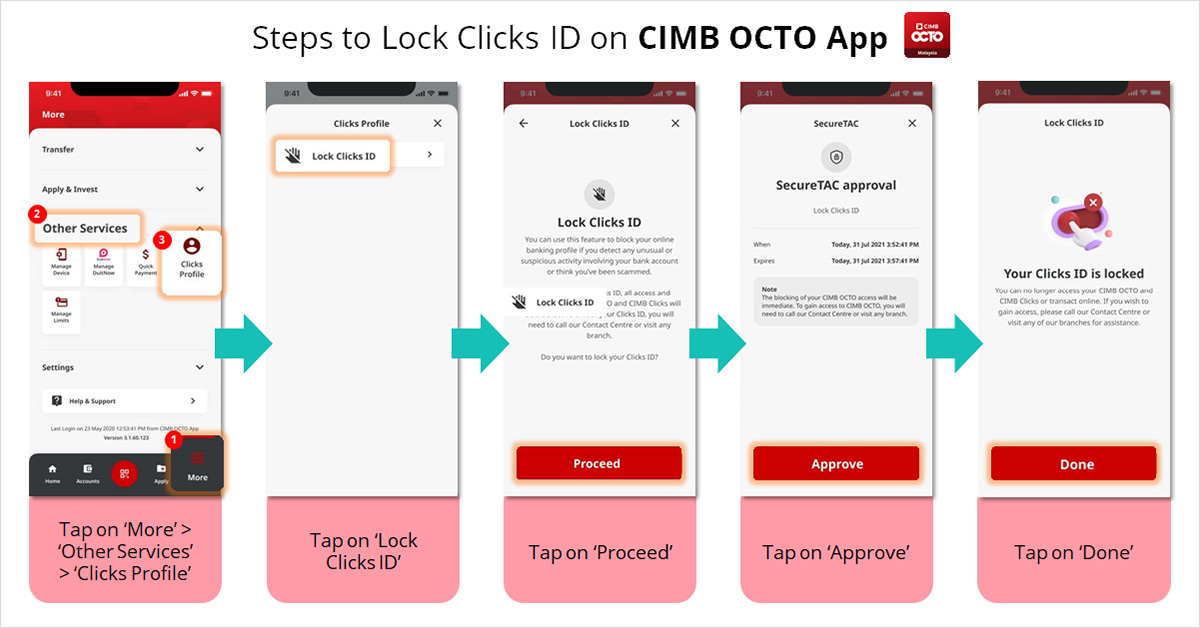

CIMB OCTO App

- Log in to your CIMB OCTO App

- Tap on ‘More’ > ‘Services’ > ‘Clicks Profile’ > ‘Lock Clicks ID’

- Tap ‘Proceed’ then ‘Approve’ on the SecureTAC approval page > Tap on ‘Done’

Easy peasy!

What Happens After You Activate The Lock Clicks ID Feature?

Once you’ve locked your CIMB Clicks ID, you will no longer be able to login and perform any new outgoing transactions. However, you can still operate your accounts as usual at ATMs or official CIMB branches.

You will need to get in touch with the bank’s Consumer Contact Center and complete the required verifications to unlock your CIMB Clicks ID. Only then will you be able to access your banking applications using your existing login information; however, to be safe, it is always advisable to change your password once your CIMB Clicks ID has been unlocked.

Precautions You Should Consider

Always make sure your device is updated to the most recent version of its respective operating system.

You should only download your banking apps from legitimate platforms such as the Apple App Store, Google Play Store, or HUAWEI AppGallery.

What To Do If You Detect Unusual Activity/Transactions:

- Activate the Lock Clicks ID feature

- Notify the Bank by calling CIMB’s Consumer Contact Centre at +603-6204 7788 (available 24/7)

- Change your account password/PIN (after reactivating your CIMB Clicks ID, if applicable)

- Lodge a police report to facilitate the investigation.

So, keep you and your bank account safe and be sure to utilize the Lock Clicks ID feature as the first step when you detect any suspicious activity. Stay safe, and as always: Stop, Think, Block.

This article is brought to you by CIMB.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.