Hong Leong Bank (HLB) today has officially launched two new security features to its HLB Connect service on both web and mobile app platforms. These include the Emergency Lock and Cooling-Off Period functions, which act as safeguards against potential scams or in the event that the customer suspects that their account has been compromised.

Emergency Lock is essentially a “kill switch” tool that allows users to quickly block their account(s) at anytime and anywhere, without needing to contact Hong Leong Bank’s call centre. Activating the feature will limit the activity on the account with View Only access, with no transactions allowed to take place. Despite this, customers can still log in to review their details and balance in this state, while any existing scheduled instructions or recurring transactions (such as automated bill payments, etc) will continue without interruptions.

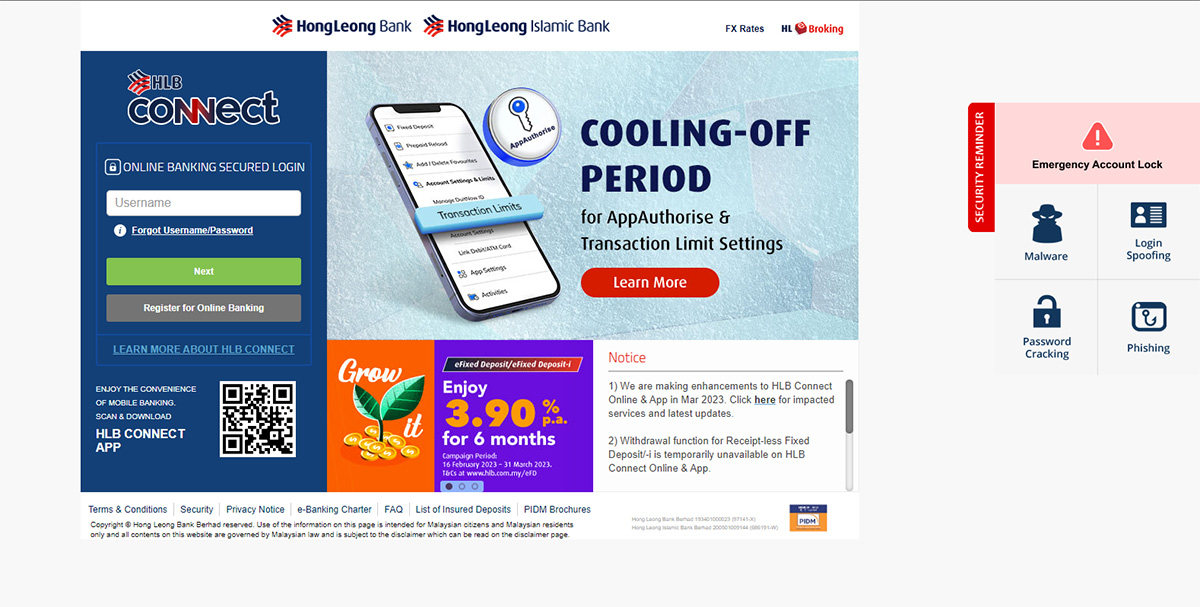

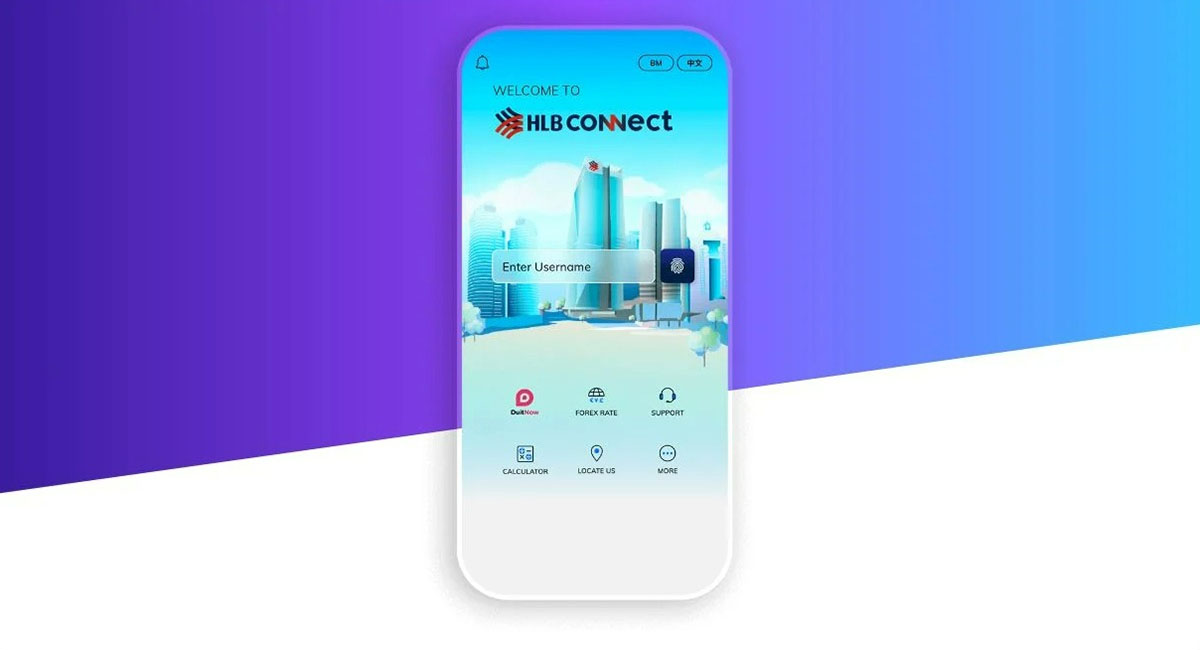

To activate this feature on the HLB Connect Online, hover your mouse cursor on the Security Reminder tab on the top right of the home page, and then click on Emergency Account Lock. For the mobile app, simply tap on the Emergency Lock icon that’s situated on the lower part of the login screen. Hong Leong Bank also encourages customers to immediately reach out to its Contact Centre after activating the security feature in order to receive guidance on the next steps they should take, especially on how to deactivate the lock.

On a related note, other banks have also introduced similar “kill switch” functions of their own as of late. These include OCBC Malaysia back in December 2022, as well as CIMB and Maybank in January this year. The introduction of the feature is in line with Bank Negara Malaysia’s mandate on local banks to further strengthen their security against scams and other potential threats.

The second addition to Hong Leong Bank’s multi-layered security is the Cooling-Off Period function, which is automatically activated when users increase their daily online transaction limit, or set up their HLB Connect mobile banking app and enable the AppAuthorise security function for the first time on a new device. When in effect, this measure provides them with a short “pause” window where they can review any proposed account activity and take necessary actions if they suspect that they’ve fallen prey to a scam, or have noticed that their account has been compromised. The duration of the Cooling-Off Period will be shown to you when you go through the HLB Connect App set-up process.

Following its activation, customers will have the ability to conduct online transactions using the AppAuthorise function to approve their transactions. Any changes to their transaction limit will only come into effect after the period has ended. Hong Leong Bank notes that if another request to increase the limit is done before the first Cooling-Period is over, the timer will start over again.

(Source: Hong Leong Bank press release / official website)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.