Shopee has quietly begun to offer a personal loan service called the SLoan to selected users in Malaysia. The company has previously offered the service in the Philippines while in Indonesia and Thailand, the service is known as SPinjam and SEasy Cash, respectively.

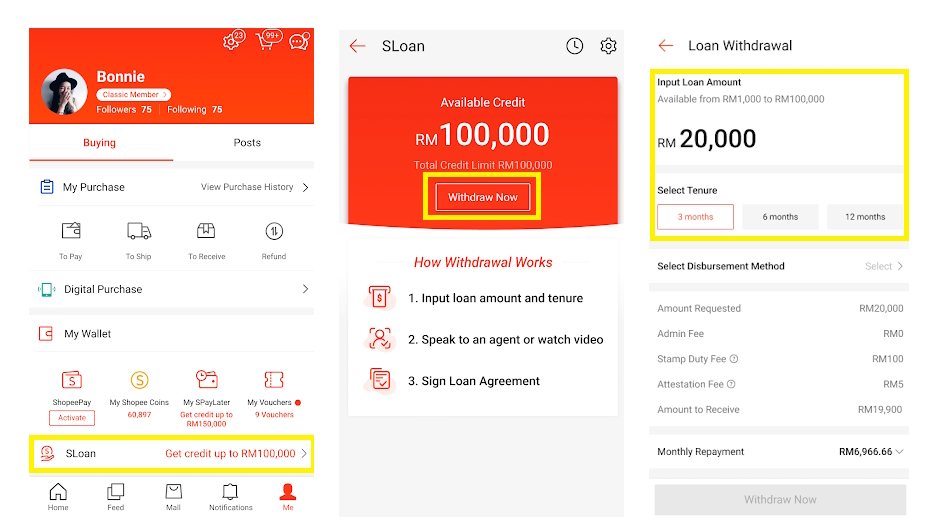

Through SLoan, Shopee Malaysia customers are able to obtain cash loans within 24 hours. According to the service’s FAQ document, the first withdrawal from the service must be at least RM1,000 while subsequent withdrawals have to be in multiples of RM100.

While the document explicitly noted the minimum loan amount, it didn’t provide any information regarding the maximum amount of loan that customers can obtain from the service. That being said, several screenshots within the FAQ document noted that the maximum amount of loan is RM100,000.

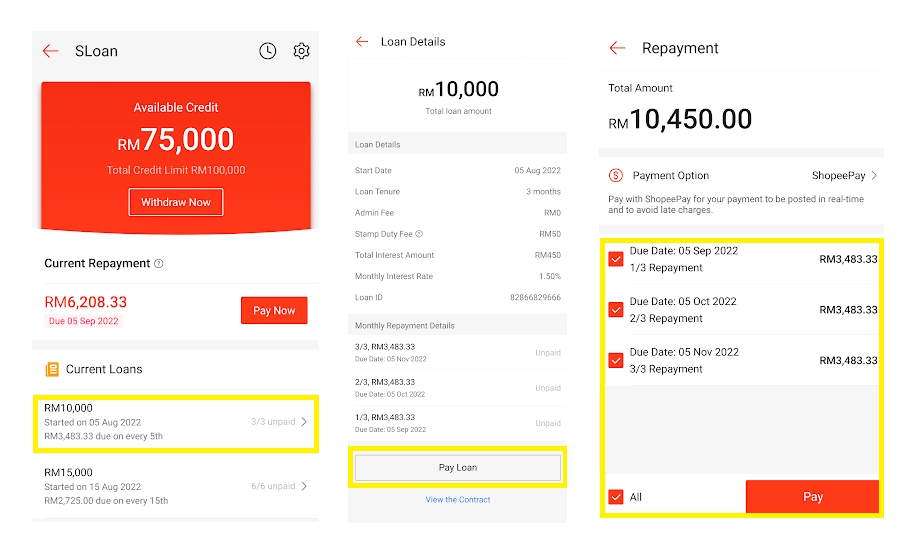

When it comes to interest rate, Shopee has set it at 1.5% per month which is equivalent to 18% per annum. Customers also should take note of other costs that are associated with this service including the stamping fee which is 0.5% of the loan amount, and the RM5 attestation fee for each loan withdrawal.

More importantly, there is also the late payment which was listed at 8% per annum on the overdue monthly instalment. Not only that, this penalty is being charged on daily basis.

As mentioned earlier, Shopee Malaysia is currently providing the SLoan service only to selected users for the time being. If you are one of them, you should be able to see the option just underneath the My Wallet section of your profile within the Shopee mobile app.

[Thanks to anon for the tips!]

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.