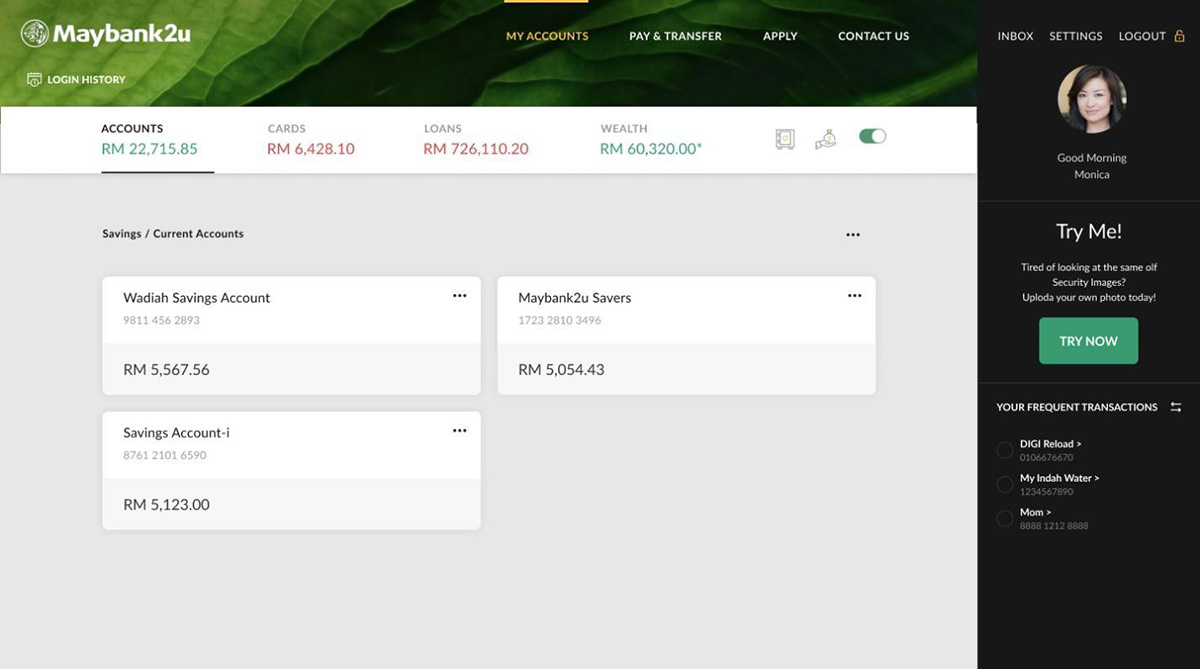

It’s hard to overstate how much we rely on modern technology and automation. Cybersecurity is evolving to help us be safe online, but hackers are always finding new loopholes to exploit. If you find yourself on the receiving end of a banking scam, then worry no more! In accordance with Bank Negara’s five measures to combat fraud (which are securer authentication methods, tighter fraud detection, a cool-off period, one mobile restriction, and dedicated hotlines), Maybank has added another line of defence to increase security: the Kill Switch.

As an added step to bolstering security in your banking experience, Kill Switch is a dedicated fallback system in the event of a cyberattack. If you believe that you are currently under attack or suspect someone of syphoning your funds, Kill Switch can deactivate your Maybank2u access, stopping further attempts at online theft with a push of a button.

Under Attack: When to Use It?

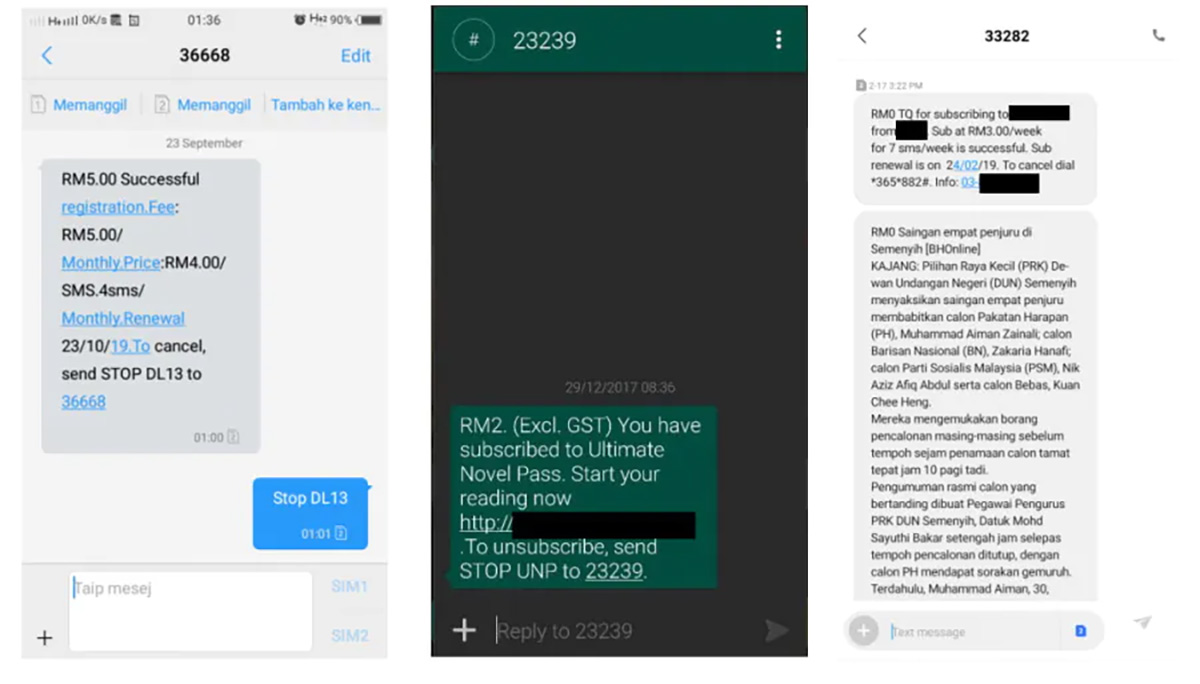

This feature can lessen the harm done by various scams, including phishing schemes. To those unaware, phishing schemes work by sending messages that look like they are from a legitimate company or website. Oftentimes, you will receive messages that usually contain a link that takes the user to a fake website that looks authentic. The user is then asked to enter personal information, such as their banking details and password, or receive prompts to download apps or .apks that may be malware in disguise. Please do not respond to these messages and only download apps from your phone’s respective app store.

When you fall prey to these, hackers may have already gained access to your account, and your hard-earned funds are at their mercy. Even identity theft is all but guaranteed with this.

Avoid responding to numbers you don’t recognise, deals that sound too good to be true, or a message that asks you to click on the links they provide. More often than not, these are well-organised schemes with a complex system, making it difficult to retrieve stolen information.

New Layer of Defense: What Does Kill Switch Do?

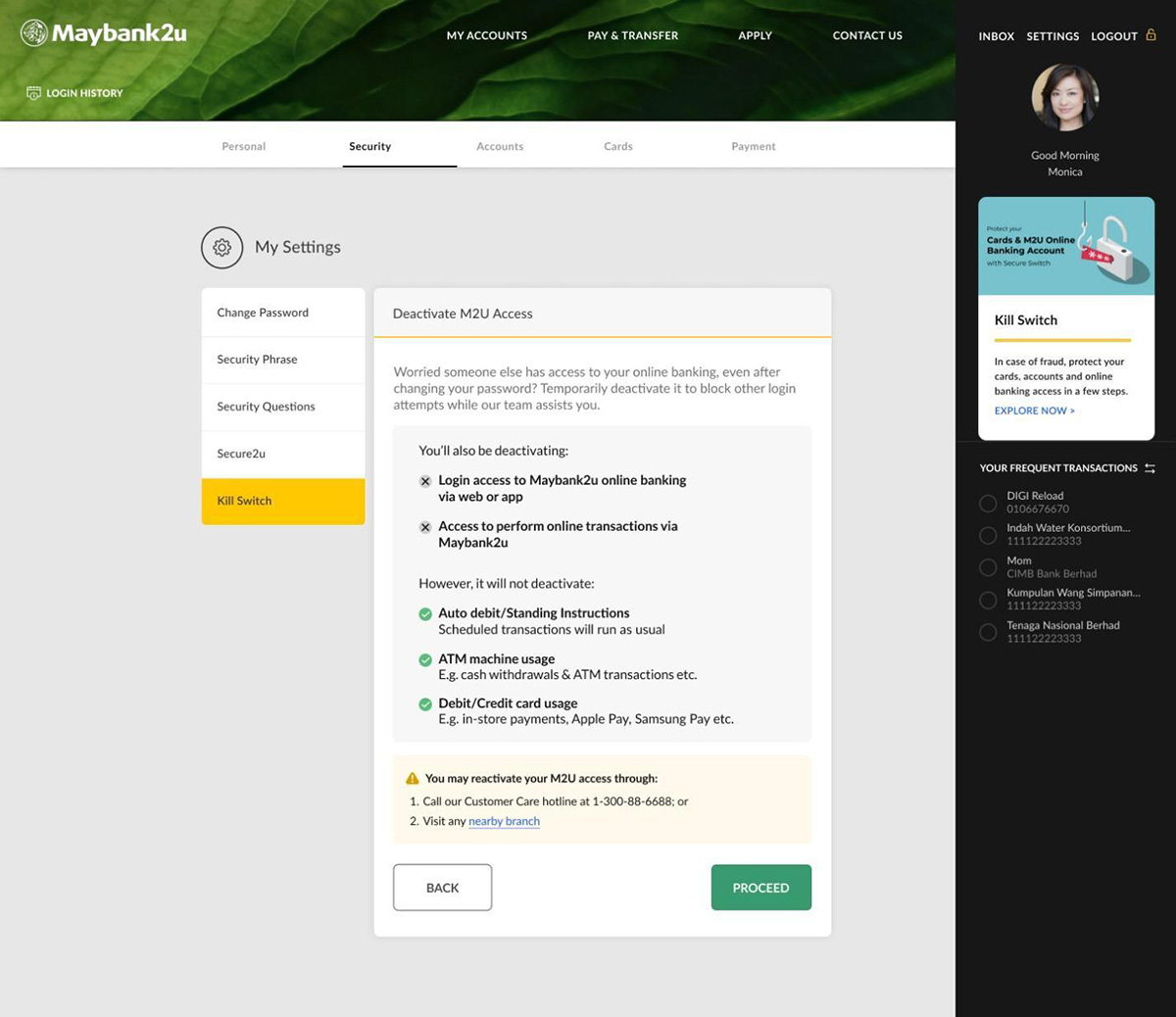

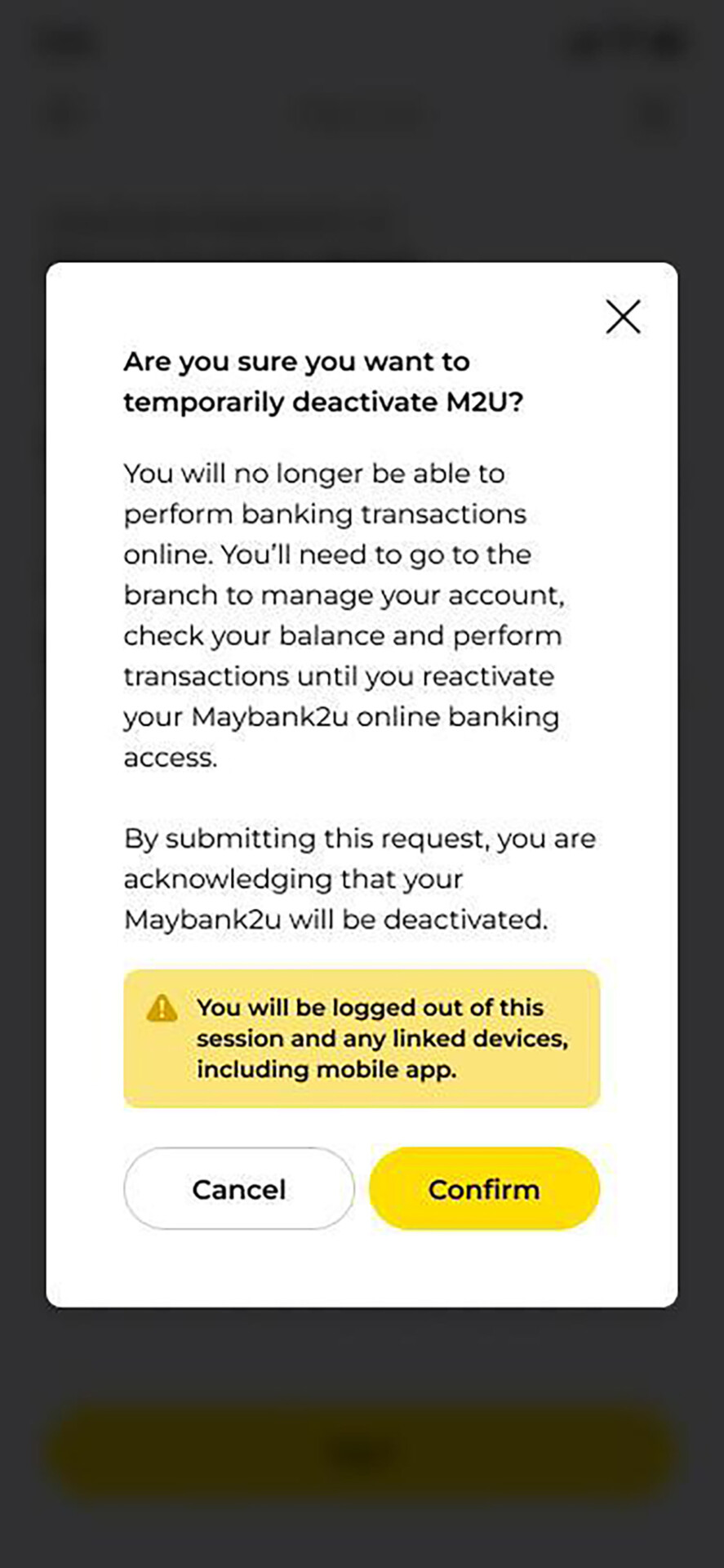

But you are able to secure your account in a matter of seconds after the attack with Kill Switch. Kill Switch is a manual security function that allows you to deactivate your online banking access via Maybank2u website or the MAE app. Kill Switch will immediately log out any active sessions in the MAE app, M2U MY app, and Maybank2u website, as well as bar any subsequent login attempts. With your Maybank2u access down, your funds are safe from online hacking attempts until you are ready to reactivate it.

Getting Back Up: What to Do After an Attack?

First things first: before using Kill Switch, immediately report the fraud after an attack. This is so the bank can take the necessary steps to safeguard your funds and personal information. Before using the Kill Switch, please contact the National Scam Response Centre (NSRC) hotline at 997 (8 AM–8 PM) or Maybank’s Fraud Hotline at 03-5891-4744 (24/7).

While Kill Switch is active, your Maybank2u access will be disabled and can remain in this state for 12 months until you’re ready to reactivate it. This is only temporary, and it can go back online once you have resecured your online access. However, take note that this is not a preventative measure.

This function should only be used after an attack because it immediately logs out all active sessions, preventing further unauthorised transactions. Every use must be treated as an emergency. “Testing” to see if Kill Switch works is highly discouraged, as there is a strict verification process in order to regain online access. Using the Kill Switch without an actual threat to your security is highly frowned upon.

When you are ready to reactivate your Maybank2u access, just visit any Maybank branch or contact Maybank Group Customer Care (MGCC) at 1-300-88-6688.

With Kill Switch, you’re in charge.

For more information, kindly visit Maybank’s website through this link.

This article is brought to you by Maybank.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.