CIMB has announced that it will begin implementing a new security approach for its CIMB Clicks app, where only a single registered device can only be used for authentication. This change arrives in accordance with the Bank Negara Malaysia’s (BNM) instruction from last month where banks are now required to move away from using one-time passwords and adopt more secure verification methods to curb financial scams.

The full implementation of this new system will be made effective by the end of October 2022, CIMB revealed via a press release. Once finalised, all new and existing users who download or reinstall CIMB Clicks will only be able to register only one device for app usage and utilising the SecureTAC authorisation feature for transactions.

The bank also noted that it will also be initiating its migration exercise to a single device at the same time, which is expected to be fully completed by March 2023. The phased approach in implementing this new security measure is intended to give all customers sufficient time to adapt, it added. Post completion, all non-primary registered devices on the CIMB Clicks apps will be automatically deactivated.

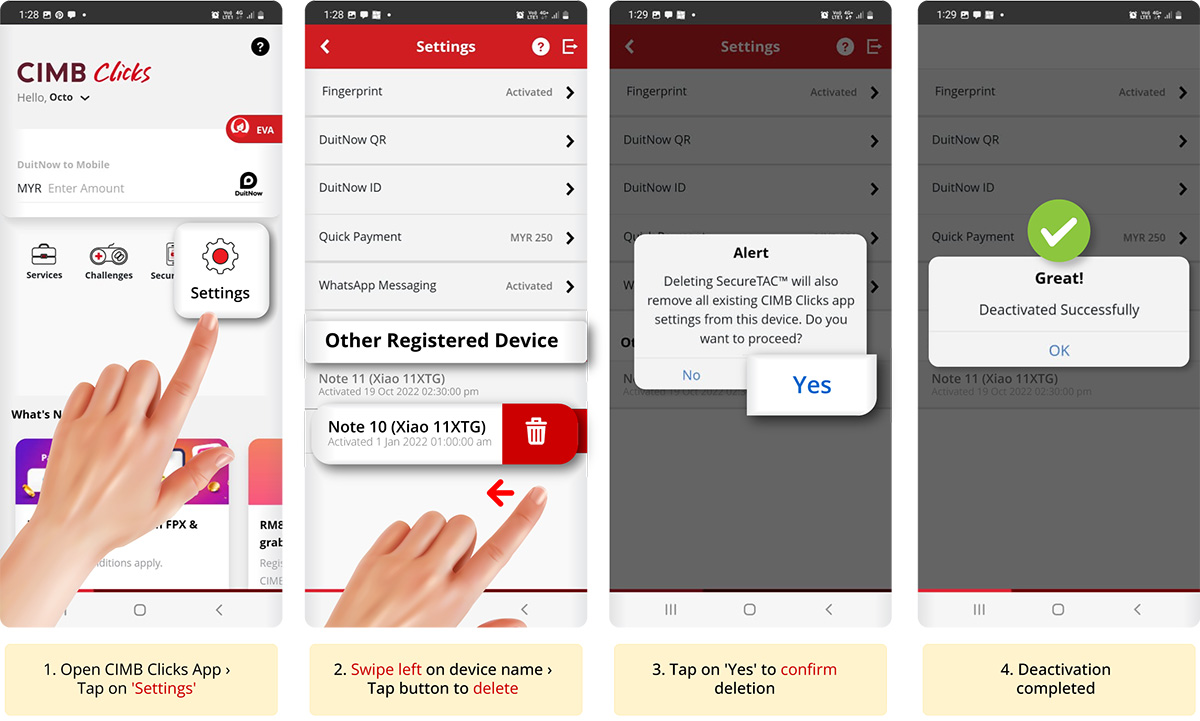

CIMB is urging all users to proactively review their app settings and remove these additional devices as soon as possible for uninterrupted banking services during the implementation. To do this, simply log onto the CIMB Clicks app using your primary device and then navigate to the Other Registered Device section under the Settings page. From there, swipe left on the device name or model that you wish to remove and tap on the Delete button. A SMS notification confirming the deletion will be sent to you after that, which also functions as an alert in case certain actions weren’t performed by you.

Aside from the new authentication approach, CIMB says it will continue to proactively implement more security enhancements as part of its ongoing effort to safeguard customers from fraudulent activities. These upcoming measures have not been detailed just yet but are expected to be rolled out in the coming months, the bank added.

(Source: CIMB press release / official website)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.