Investing can be intimidating and it can also be risky, especially if you’re new to the investment world and aren’t fully equipped to make the best decisions. When you imagine stock brokerage, you’d probably imagine men in black suits in a Wolf Of Wall Street setting. Well, that’s actually not the case.

Now with artificial intelligence (AI) and technology, brokerage is no longer about going to the bank to buy and trade stocks. You can learn everything about investing on your phone while having AI manage them for ultimate convenience and peace of mind.

How Does AI Help With Investments?

When it comes to investing, the biggest fear stopping people from starting out is probably the fear of making a mistake. Personal biases and self-doubt can be detrimental when it comes to making investment decisions, and it can deter many from starting out at all.

In this way, AI offers a solution to curb this fear you may feel when first starting out. With AI, you won’t have to constantly stare at your phone, deciding on what to do with your investments. Instead, the AI will help analyse thousands of data points each day, incorporating information from different continents and asset classes in order to develop investment portfolios for clients. By doing so, the AI will be able to determine potential risks associated with specific investments that we probably wouldn’t have on our own.

Now that you know how AI can help with your investments, here’s where KDI Invest comes in.

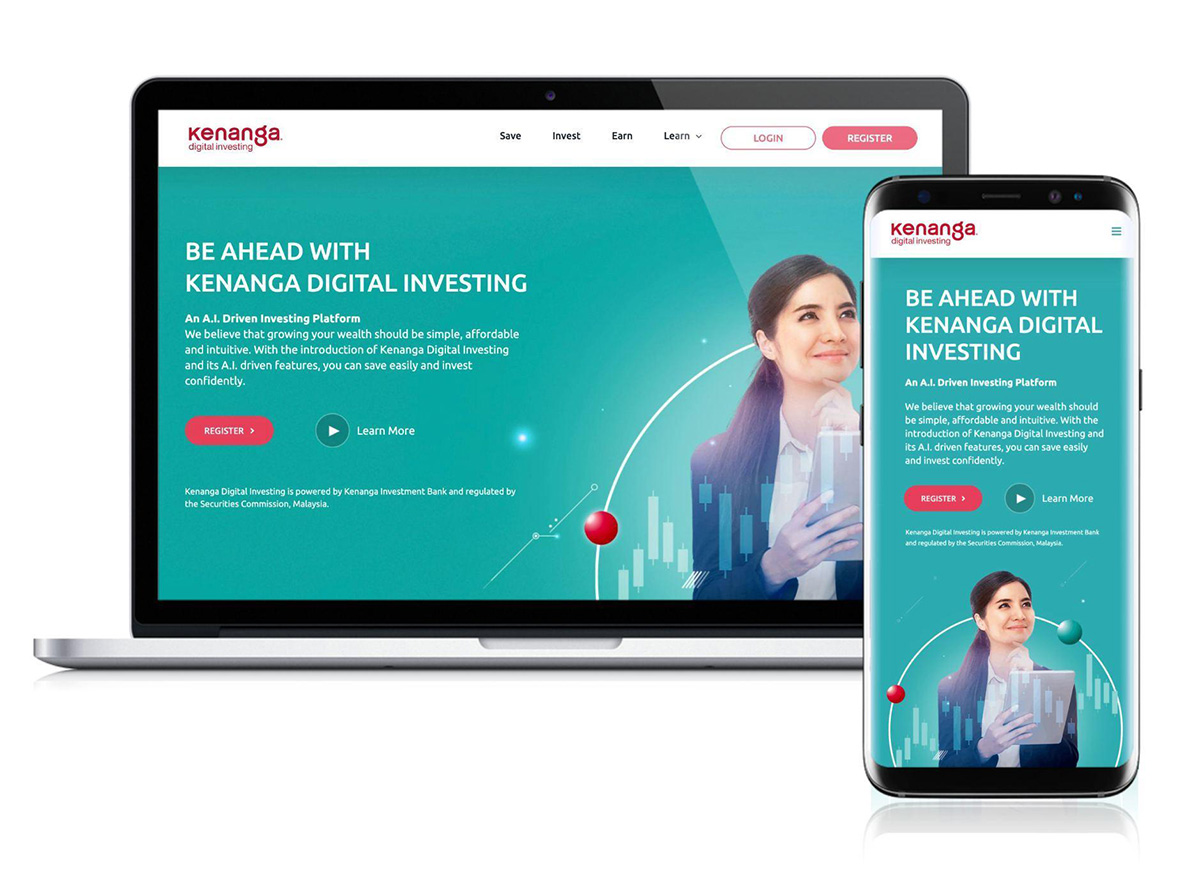

Save, Invest & Earn Now With KDI!

If you’ve been around the block, you’re probably already aware of Kenanga Digital Investing’s KDI Save option. But if you haven’t, here’s a refresher:

KDI Save allows you to earn fixed returns just by saving, without having to pay any additional fees at all. You can start as low as RM100 with no lock-in period, no restrictions and no penalties, either. In addition to all these perks, KDI Save is also transitioning from providing a fixed return of 3.00% interest rate p.a (per annum) to a whopping fixed return of 3.5% interest rate EAR (Effective Annual Rate).

And if that’s not amazing enough, we’re here to tell you that they offer a KDI Invest option to help you earn more on the side, as well!

If you’re new to investing, KDI Invest offers resources for anyone and everyone to get started. You’ll gain access to world-class assets and global investment trends as well as have an AI help with your investing, allowing you to make the best decisions you can make. Their data-driven approach to investments means that you will have an AI managing your assets 24/7, removing emotions from your investment decisions to prevent any potential mistakes.

KDI believes that there should be no barriers stopping people from investing, and this includes expensive fees that may stop you from investing in the first place. With some of the lowest management fees in town, you won’t need to pay any fees at all so long as your total investment amount is under RM3,000! For investments over RM3,000, management fees are merely 0.3% to 0.7% yearly, depending on your AUM (assets under management).

Not only that, KDI Invest also offers no lock-in periods, meaning you can buy, sell and switch your investments immediately after redeeming them if you so wish to. There are also no additional costs when you switch, sell or buy assets.

Additionally, for optimised convenience, KDI is also increasing its FPX limit from RM30k to RM300k. This means that you no longer have to write offline cheques to bank in amounts above RM30k, and can seamlessly transfer larger amounts of money online instead!

What Are You Waiting For?

KDI Invest is offering a unique 100029 code that entitles users to a RM20* bonus on their first investment in KDI Invest with a min. of RM250. The journey to start investing is now even easier and more rewarding. Download the Kenanga Digital Investing app on Apple App or Google Play store. You can also follow them on Facebook, Youtube and TikTok or visit their website to learn more. Do note however, that the campaign period ends on the 4th November 2022.

*T&C apply.

Disclaimer: This advertisement has not been reviewed by the Securities Commission Malaysia. This advertisement is for general information purposes only. It is not intended to constitute professional advice, and should not be relied on or treated as a substitute for specific advice relevant to particular circumstances. Please also consider our risk warning and investment terms before investing with us.

This article is brought to you by Kenanga Digital Investing.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.