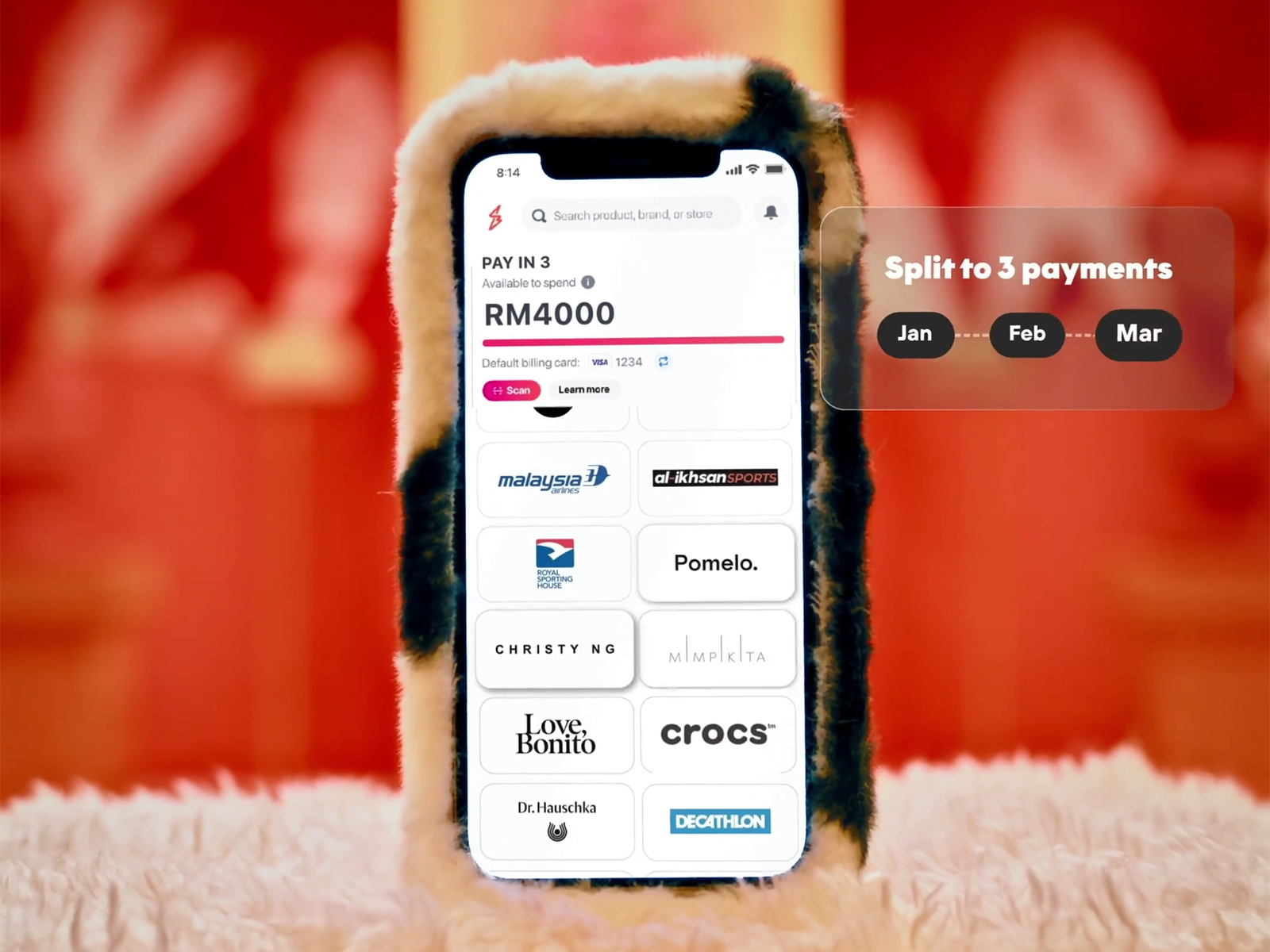

ShopBack is introducing a new Buy Now Pay Later (BNPL) scheme on its app called PayLater. This comes after the company acquired BNPL firm hoolah last December, making it the latest competitor in the short-term financing space along with other local players such as Grab, Shopee, Fave, Atome, and IOUpay.

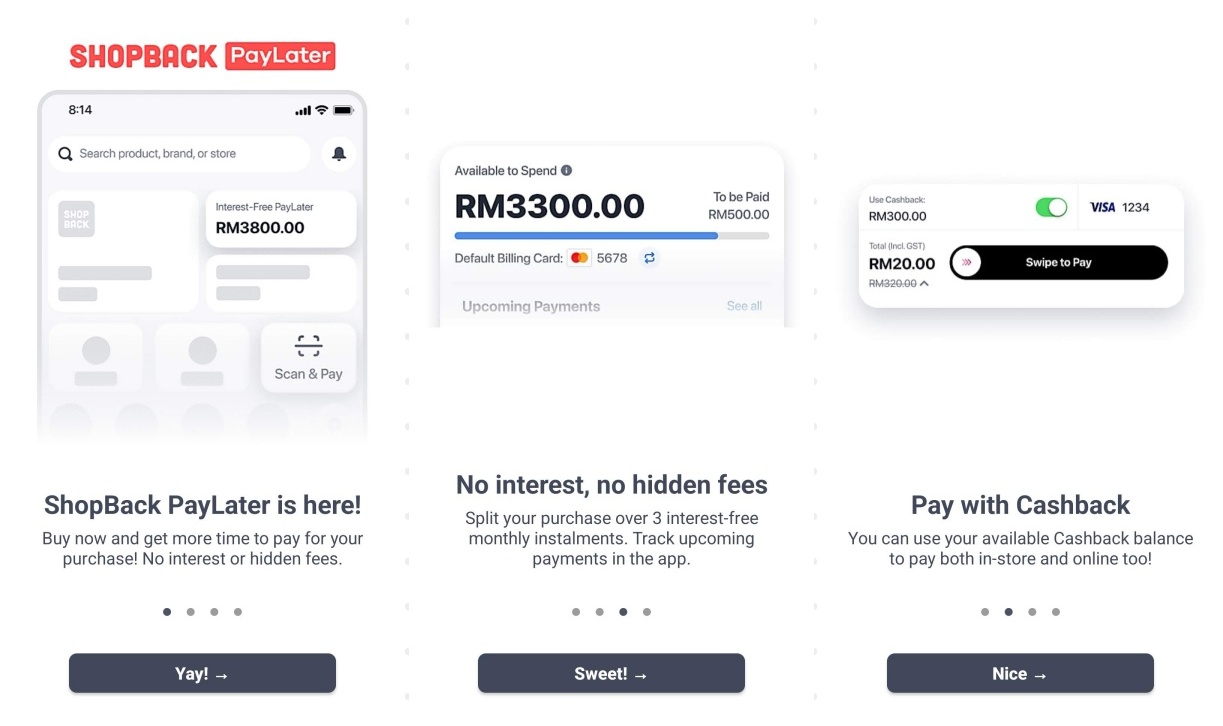

According to its FAQ, hoolah still provides the payment services such as payment accounts and money transfers, but ShopBack provides the user interface through its app. PayLater allows users to spread out any purchase over three monthly instalments, charging you one-third of the cost up front with the second and third payments due 30 days and 60 days after purchase respectively, with your default card being charged automatically on the scheduled dates.

The platform charges no interest or hidden fees for the BNPL plan, but there will be late payment fees if you miss any payments. Late payments will be charged an additional RM7.50 for orders under RM100, RM25 for orders under RM500, and RM75 for orders worth RM500 and above.

To use PayLater on the ShopBack app, you must first activate it by verifying your identity using your IC and linking your debit/credit card — keep in mind that prepaid cards are not accepted. You will then have a RM1,600 credit limit to spend, though it might be adjusted based on your repayment history.

You can choose PayLater as your payment method on supported websites as well as scan the QR code to use it in select stores. Additionally, you will still receive cashback on your purchase even when using the BNPL feature and you can use your existing cashback to offset the first instalment.

It seems you can only choose to split the bill into three payments with PayLater, with no longer options available. The good news is that ShopBack is giving users a 25% discount on their first PayLater order up to RM25 with no minimum order amount. The offer is valid until 31 July.

(Source: ShopBack/Facebook)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.