AirAsia may have made its name as an airline but sure enough, the company has already gone beyond its original aviation roots. Among the non-aviation arena that it has been dabbling in recently is fintech.

But if you think that is about BigPay once again…no, that is not the case at all. Instead, I would like to point you to a new fintech service that AirAsia has just launched for its Super App called AirAsia Pocket.

The name was actually mentioned by the company during the launch of Capital A back in late January 2022. However, at that time, I honestly didn’t give it much thought as I assumed it was just another name for BigPay’s integration with AirAsia Super App.

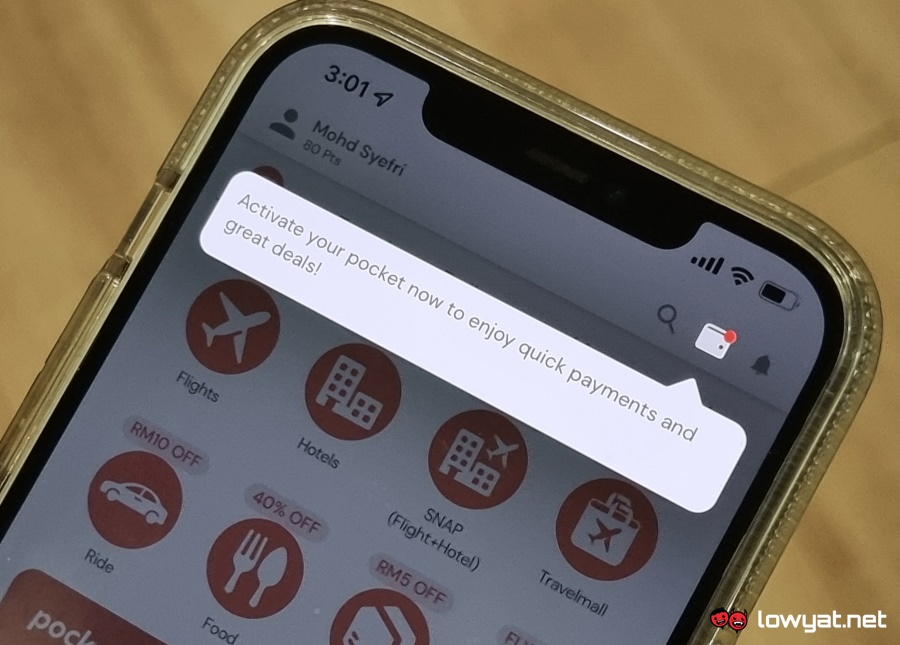

Later in April, Capital A’s 2021 annual report once again mentioned Pocket by noting its plan to launch it within the first half of 2022. It is only now I learned that Pocket has nothing to do with BigPay altogether as I noticed the activation alert in the AirAsia Super App yesterday.

According to the FAQ document on AirAsia’s website, Pocket is powered by Fass Payment Solutions which is more known by its brand name, Fasspay. I believe Fasspay is also the reason why AirAsia Super App is able to provide the e-wallet feature even though there are no other Capital A’s subsidiaries inside Bank Negara’s list of non-bank E-money issuers aside from BigPay.

After all, one of Fasspay’s core products is its white-label e-wallet solution which generally allows any company to create their own e-wallet service. Furthermore, AirAsia Pocket and BigPay have separate quick tabs on the home screen of the AirAsia Super App.

When it comes to AirAsia Pocket’s user experience, it is generally similar to most e-wallets out there since it still uses QR codes as its payment interface. However, one still has to opt-in for the service as it is not being enabled by AirAsia Super App by default.

You should be able to see the activation alert that we mentioned earlier inside your app. Alternatively, just tap on the wallet icon on the top right part of the app and you will be asked for your mobile phone number on the next screen.

Once you submit your number, a One-Time Password (OTP) will be sent to your phone. After the OTP has been verified, you would be then asked to submit your personal details such as full name, e-mail, nationality, MyKad/passport number, and birth date.

You will be then asked to set up a 6-digit PIN code before the activation process is completed. Users will be asked to enter this code to authenticate their payment.

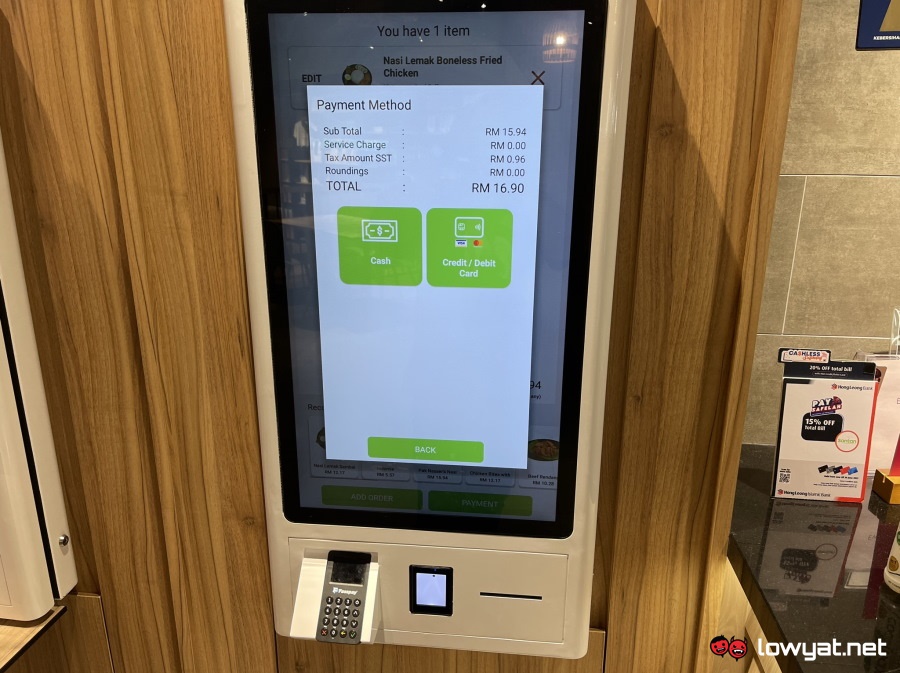

According to its FAQ document, Pocket currently can be used for products and services on the Super App itself and AirAsia website as well as selected Santan branches. Since there is a Santan branch near our HQ, I decided to try out Pocket to pay for my lunch.

While the self-service order kiosk at Santan Mid Valley Megamall does not support direct Pocket payment or any given e-wallet for the time being, I still can use Pocket for payment there as indicated by the QR code placard at the nearby cash payment counter. I was told that I just need to choose cash as the payment option at the order kiosk in which I then received a receipt that I have to hand over to the staff at the cash payment counter to complete my payment.

At the counter, I was then asked to scan the QR code inside Pocket’s placard and I duly did so by using the Pay option contained within Pocket’s quick tab on the Super App’s home screen. The app’s QR scanner then came alive and within a few seconds, another screen appeared which showed the balance in my Pocket’s wallet as well as the intended recipient of the payment.

So, I entered the price of my meal as noted by the receipt from the order kiosk, pressed the “Pay” button, entered my PIN code to authorise the transaction, and I was done. I then showed the payment successful screen to the staff at the counter who then entered the transaction details into the POS register and issued me the final receipt.

As noted earlier, my experience using Pocket to pay for my meal at Santan Mid Valley Megamall should sound nothing out of ordinary to those who have already been acquainted with e-wallets. Being an AirAsia service, Pocket transactions are also eligible for AirAsia Points according to its website but at the time this article was published, I still somehow have not received any for my transaction at Santan.

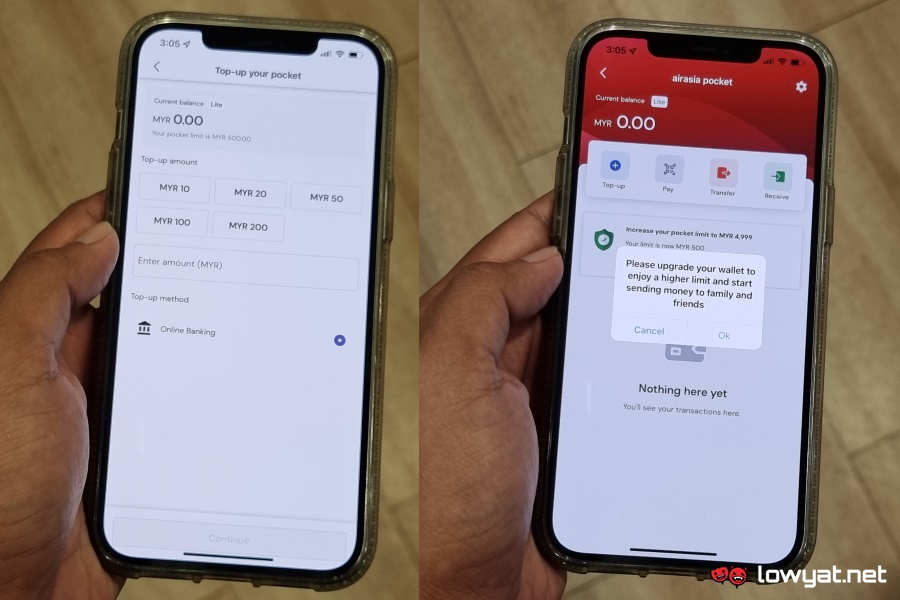

In terms of usage, Pocket seems ready for the prime time although do note that there are a couple of things that the e-wallet service still lacks. For example, you can only top-up Pocket’s wallet by using FPX online banking as there is no option to directly link your credit or debit card directly to it for now.

Pocket also has a wallet size of up to RM4,999 although the Lite account holder is limited to just RM500 and is not able to transfer or receive funds from another Pocket user. In order to unlock the bigger wallet size and peer-to-peer transaction, users have to upgrade their Pocket account to the Pro tier by submitting a photo of their MyKad or passport via the app’s e-KYC process.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.