To make retail purchases more seamless, Mastercard is turning to biometric payments to make the checkout queue move faster. The company launched a new program called Biometric Checkout, which let users make payments using facial recognition or by waving the palm of their hand without having to swipe their cards.

Mastercard already launched a card with built-in fingerprint authentication back in 2017 and they are already working on another card with Samsung. However, the payment processor’s new solution doesn’t involve updating the cards but instead uses biometric technology through the payment terminals.

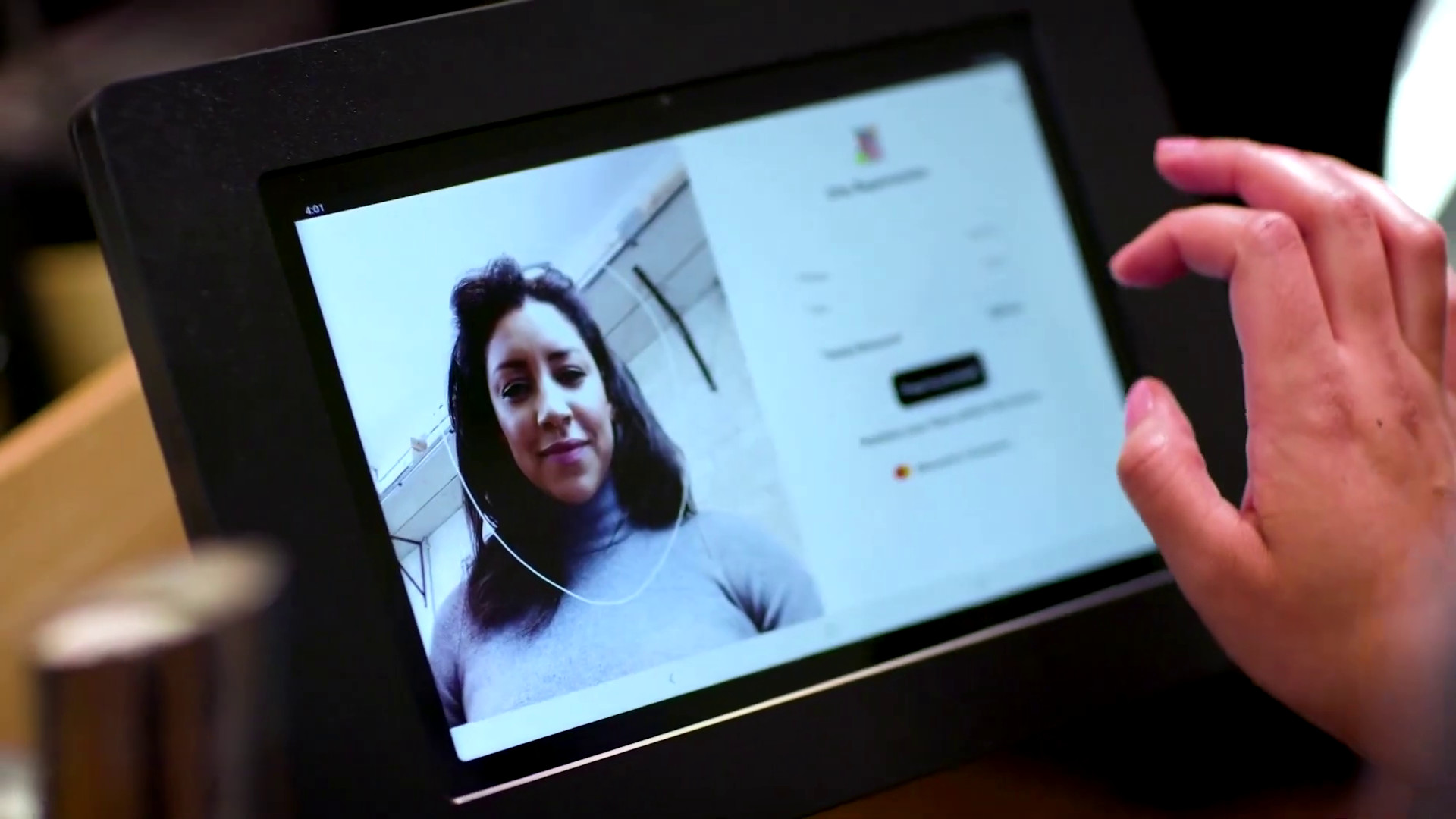

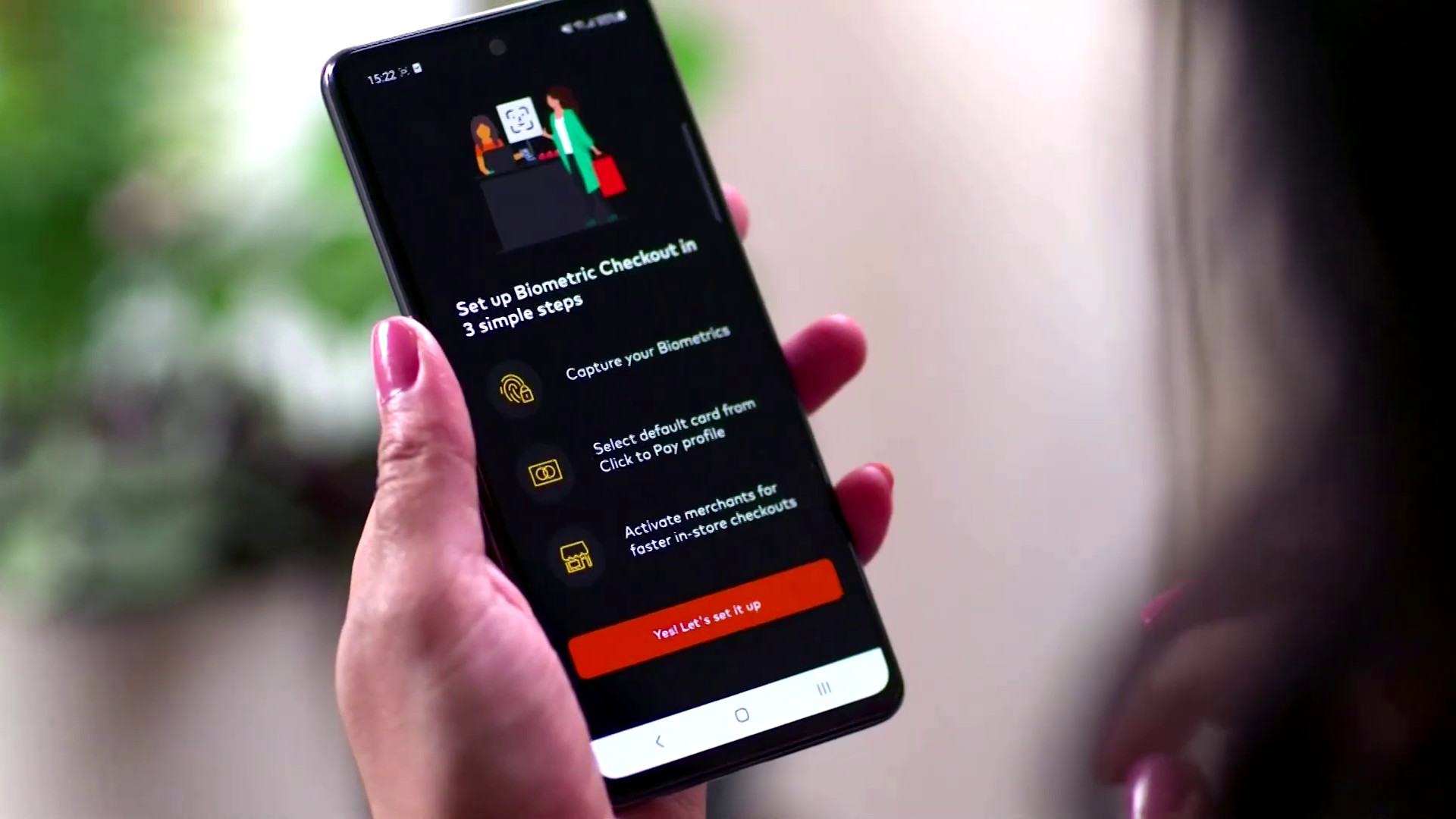

To use the biometric service, customers must enroll their biometrics through an identity provider app; Mastercard said you can simply smile or wave your hand over a reader to pay once enrolled. It claims that merchants benefit from using the new checkout feature with faster checkouts, fewer chargebacks through higher approval rates, and better fraud control with end-to-end security.

For now, Biometric Checkout is only rolling out in five St Marche supermarkets in São Paulo, Brazil, but the company plans to launch pilot programs in the Middle East and Asia soon with a global rollout later in the year. The program is partnering with NEC, Payface, Aurus, PaybyFace, PopID, and Fujitsu Limited.

As to whether customers would actually want to upload their faces for payments, Mastercard cited a study by Idemia [PDF] that showed that 74% of consumers globally have a positive attitude towards biometric technology, with 84% having used biometric authentication. Ajay Bhalla, Mastercard’s president of cyber and intelligence, also opined that biometric tools would be essential for the payments infrastructure in the metaverse.

With the COVID-19 pandemic creating demand for more contactless solutions, contactless card transactions are expected to grow to US$6.7 trillion (~RM29 trillion) by 2026. Of that pie, the market for contactless biometrics technology is projected to reach US$18.6 billion (~RM82 billion).

(Source: Mastercard, CNBC)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.