Maybank has recently rolled out a new option for its customers that allows them to withdraw money from ATMs without their bank cards. Instead, the new option which is also called Contactless Withdrawal by the bank relies on its MAE app.

First reported by Rnggt, this is not the first time that Maybank has allowed cardless ATM withdrawal though. For years, customers have already been able to do so although the previous method utilises SMS to deliver the needed information which includes transaction ID and withdrawal code.

Before you can start withdrawing money using this method, you have to enable it for your MAE app first. So, the journey begins here:

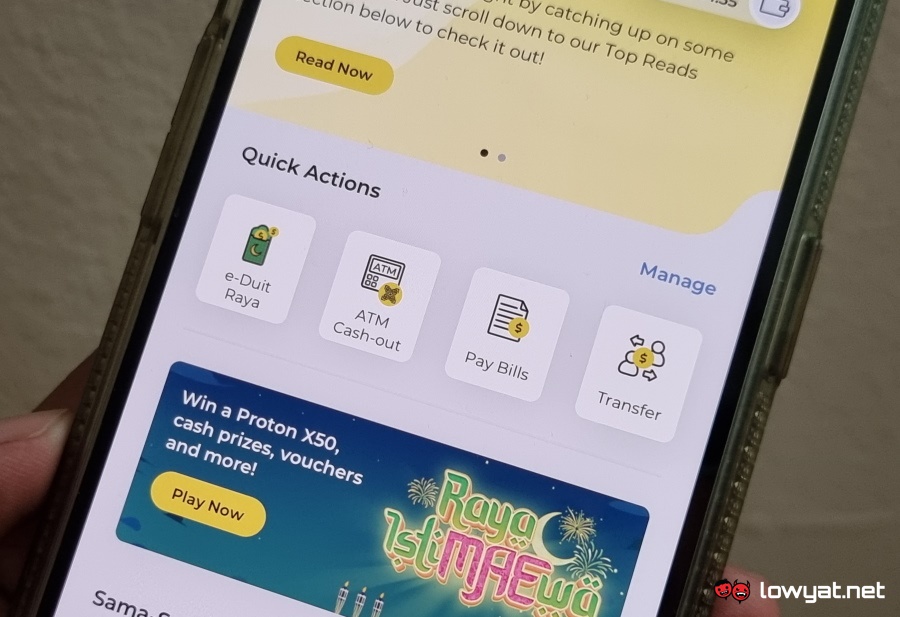

Step 1: At the MAE home screen, look for the area that contains Quick Action widgets, and tap on Manage.

Step 2: In the “Customise Top Actions” section, choose the action that you feel that you don’t use often, and take it out by tapping on the “-“ icon. This will subsequently unlock other services listed in the “Available Services” area as you can only have four Top Action widgets at a time.

Step 3: Scroll down until you see the “ATM Cash-out” option and press the “+” icon.

Step 4: Once the ATM Cash-out option is already listed in the Customise Top Actions section, press the “^” icon to bring the action to the first, second, or third slot in the list. If you leave it on the fourth slot, then you will not be able to see it on the MAE’s home screen as the e-Duit Raya widget is currently occupying the first slot of the Quick Actions list despite whatever you saw in the previous Manage section.

Step 5: Tap on “Save Changes”.

Step 6: You should be able to see the “ATM Cash-out” widget on the MAE home screen. Tap it and enter your MAE/Maybank2U password.

Step 7: On the ATM Cash-out activation screen, tap on the T&C statement to agree to it, and tap Confirm.

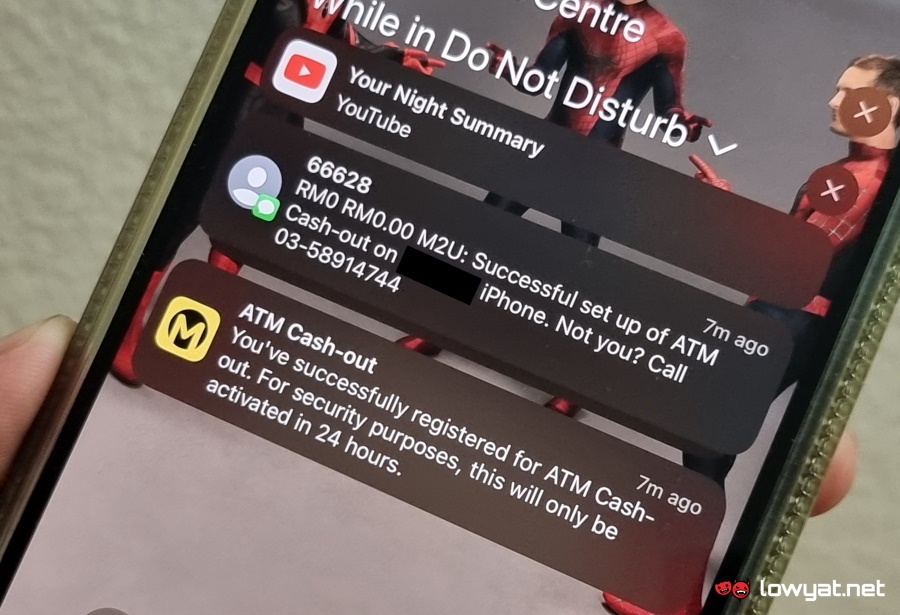

Step 8: Check the masked mobile phone number on the One Time Password (OTP) screen to ensure that it is yours and then tap on the Confirm button to receive the OTP SMS.

Step 9: Enter the OTP code and tap on the checkmark button to confirm.

Step 10: The screen should now display the ATM Cash-out set up successful screen. You will also receive a phone notification and SMS as well.

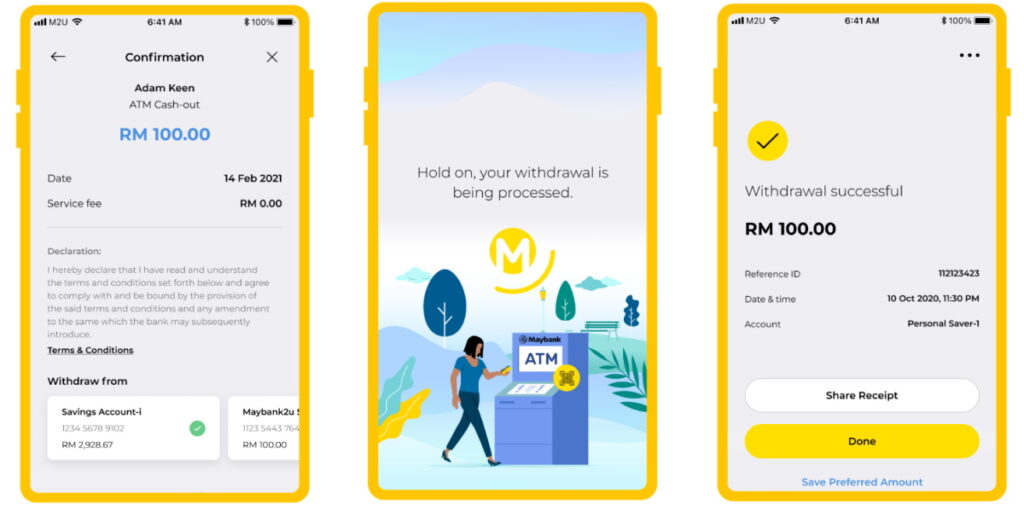

As one can only start utilising the MAE-based cardless ATM withdrawal function a full 24 hours after activation, we have yet to experience the service ourselves as we had only activated the feature at 11:20 PM last night. Nevertheless, here are the steps to perform the withdrawal, based on the instructions listed by Maybank’s website:

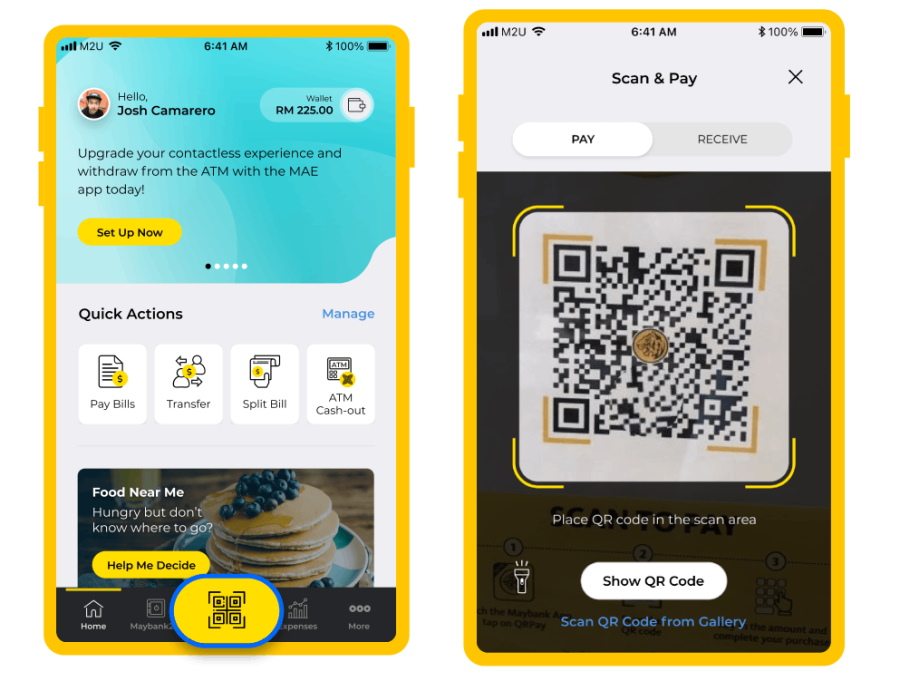

Step 2: Scan the QR code that is shown on the ATM’s screen.

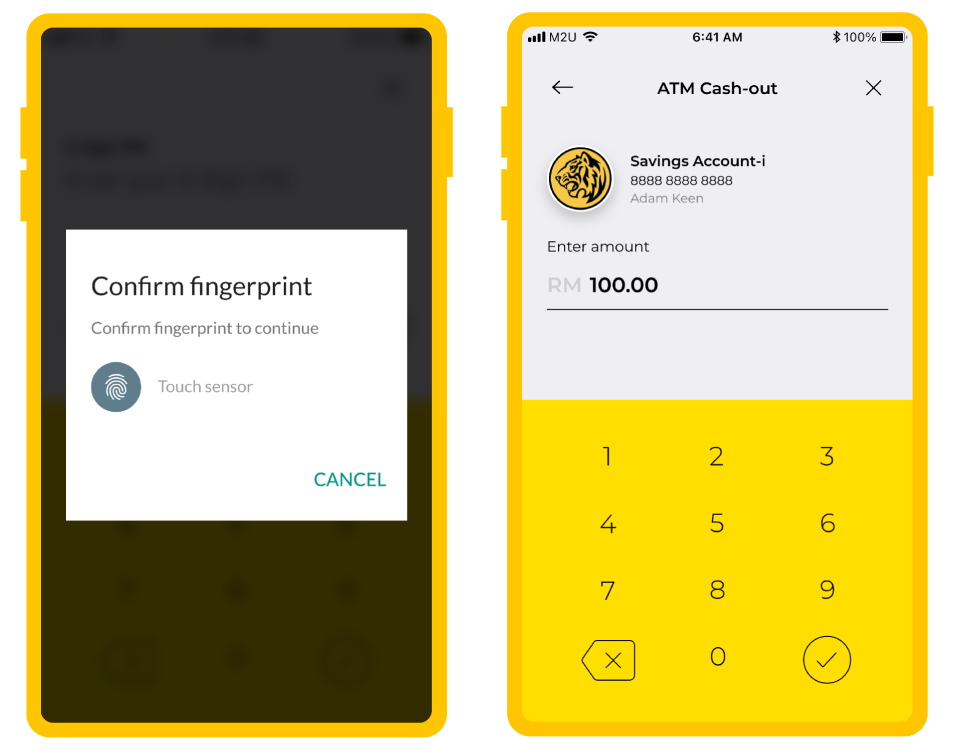

Step 4: Enter the amount that you would like to withdraw and tap on the checkmark button. If the withdrawal amount is RM1,000 and above, you also have to enter the Secure2u code after this.

Step 6: The processing screen would then appear and if your request is successful, the ATM would also begin to disperse your cash.

You can easily identify ATMs that support the new MAE-based cardless withdrawal feature by looking at their screen which displays the QR code that users have to scan in order to perform the transaction. This particular ATM which is located at the Maybank branch in Mid Valley Megamall Kuala Lumpur even has a small poster that highlights the new feature.

Unlike the previous SMS-based cardless cash withdrawal option which has a daily limit of RM300, there is no such hard limit for the MAE-based users as it depends directly on the customer’s existing daily withdrawal limit. This withdrawal option does not carry additional charges as well.

Meanwhile, Maybank has also said this feature will be made available at all of its ATMs in the near future. If you want to check it out now though, you have to visit one of the 998 ATMs that currently support the feature which the bank has listed on its website .

![[Image: Maybank / YouTube.]](https://www.lowyat.net/wp-content/uploads/2022/05/maybank-mae-cardless-withdrawal-01-750x532.jpg)