Maybank has issued an announcement to inform users of a significant change to its online and mobile banking service, Maybank2u. Starting today onwards, any changes done to the platform’s settings are now required to be validated via the Secure2u authorisation process before they are fully reflected.

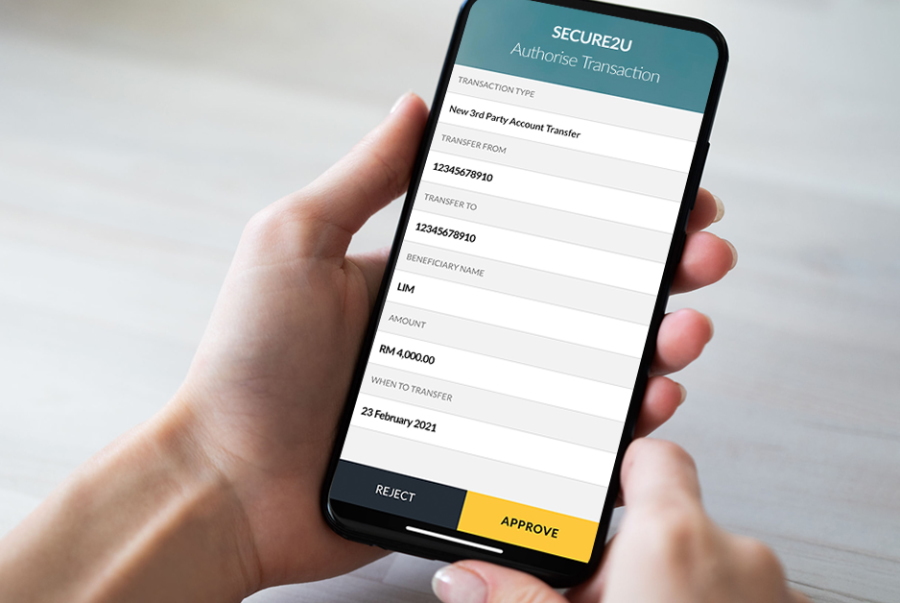

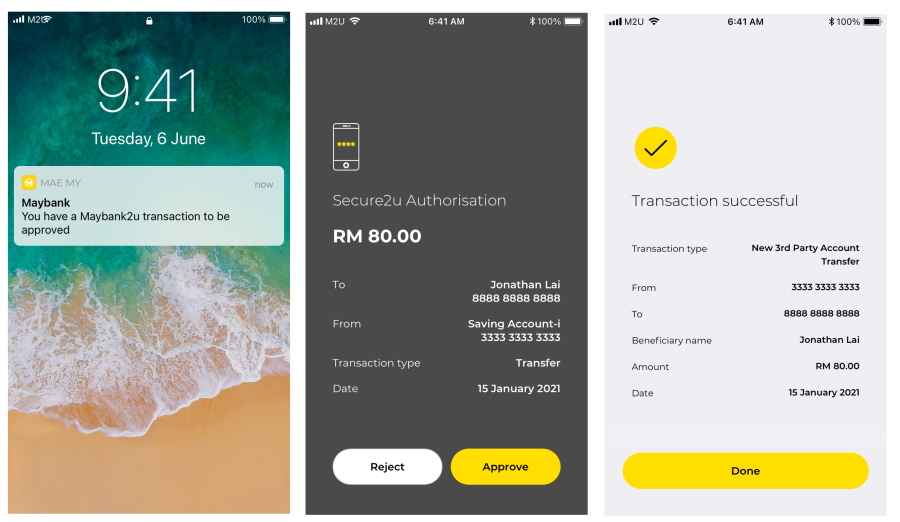

For those unfamiliar, Secure2u is an validation method that uses either the one-tap approval Secure Verification or the six-digit Secure TAC approach (which is introduced as an alternative to the discontinued SMS TAC method). Prior to this, it is regularly used to approve transactions on Maybank2u and the bank’s MAE app, including first/third-party bank transfers, one-off payments, and more.

According to the bank, the added security measure is introduced as a “safer and convenient way to approve updates or changes made” to its Maybank2u online banking platform and mobile app. Features that now require Secure2u validation includes cardless withdrawal, Foreign Telegraphic Transfer (FTT), Interbank Fund Transfer (IBFT), Interbank GIRO (IBG), and so on. Additionally, Maybank says users are also required to validate certain actions such as setting a favourite for third-party transactions and registering for the DuitNow service.

Maybank2u users who’ve not activated Secure2u validation are advised to do so via its app or through the bank’s MAE app on mobile devices. For the former, tap on the “three lines” button on the upper left corner of the screen, tap on “Secure2u”, and then follow the on-screen instructions to complete the registration. To activate it on the MAE app, simply tap on the “More” button on the bottom right corner, select “Secure2u”, tap “Activate Now”, and then follow the on-screen instructions to proceed.

(Source: Maybank [official website])

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.