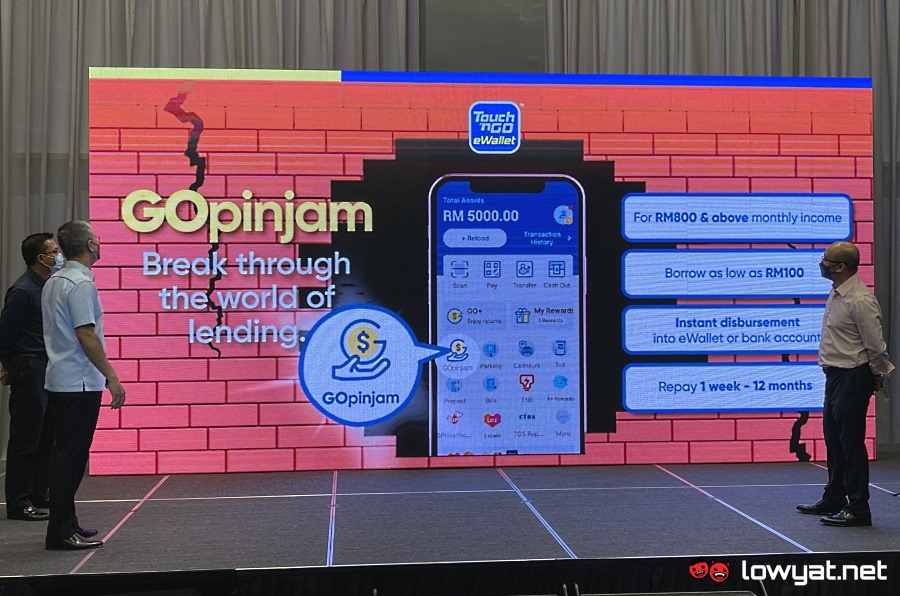

Touch ‘n Go (TNG) today unveils yet another new digital financial offering in the form of GOpinjam. As you can tell from its name, it is a micro-lending scheme that is being delivered directly via the TNG eWallet app.

With the CIMB Bank e-Zi Personal Loan as its foundation, GOpinjam provides personal loans from as low as RM100 to as high as RM10,000. With an interest rate of between 8% to 36% depending on the loan amount and repayment duration, customers can set the repayment tenure to be between one week to one year.

They can choose to receive the loan amount either through TNG eWallet itself or CIMB/CIMB Islamic Bank account. According to its FAQ document, customers can actually submit multiple GOpinjam applications as long as the total loan amount does not exceed RM10,000 at one time.

They can choose to receive the loan amount either through TNG eWallet itself or CIMB/CIMB Islamic Bank account. According to its FAQ document, customers can actually submit multiple GOpinjam applications as long as the total loan amount does not exceed RM10,000 at one time.

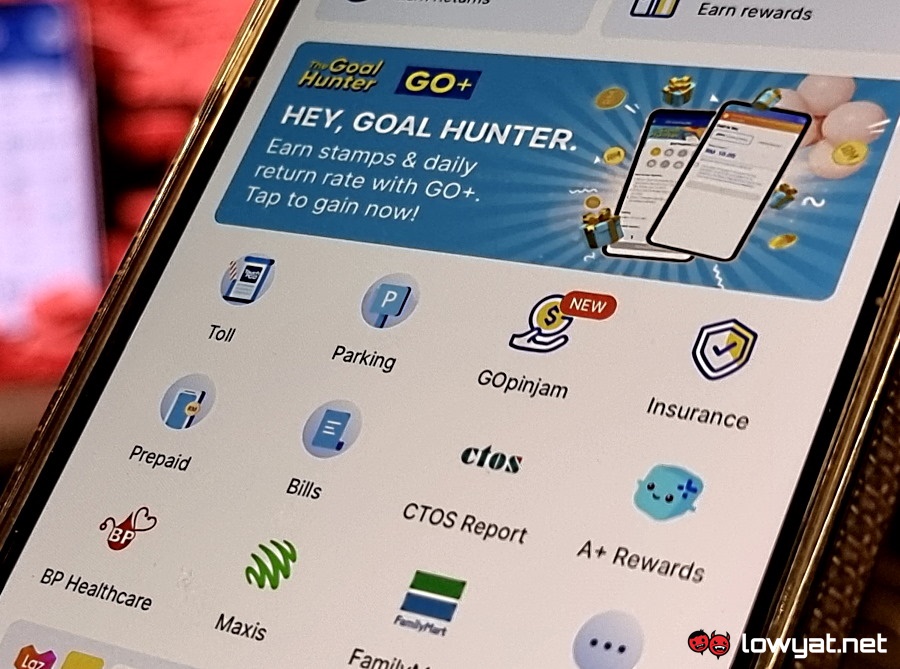

Based on our quick experience with the service inside the app, the process to apply for GOpinjam is quite straightforward. All one needs to do is go to the GOpinjam section of the TNG eWallet app, input their monthly salary, and the app will then calculate the recommended amount of loan in relation to the salary alongside the maximum amount that the user can apply from GOpinjam.

Once the user has chosen their loan amount and repayment duration, they will be required to complete the app’s eKYC verification process. In addition to that, they also need to submit income documents which can be either the latest monthly payslip from a company registered in Malaysia, an EPF statement that showed at least 3 months of contribution, or a B/BE Form e-filing acknowledgement receipt.

First-time GOpinjam customers are able to know the result of their application by the following business day while the approval process for returning users can take place as fast as 5 minutes. At the moment, GOpinjam is available for Malaysians aged 21 to 63 with a minimum income of RM800 per month.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.