The buy now, pay later (BNPL) concept is nothing new. The idea behind this is simple enough: the consumer is allowed to own a new product, so long as they honour to pay for it accordingly by instalment. And thanks to the rise of online shopping, this approach has become a common option offered to consumers before they proceed with their purchases.

Indeed, BNPL provides shoppers a convenient way to purchase certain products by enabling them to split up the cost into interest-free payments for greater affordability.This is regularly offered by the automotive market, and more recently to consumer technology such as computers and smartphones.

But are all BNPL services the same?

The short answer is no.

The idea of immediately owning, say, an iPhone at a small fraction of its total price is indeed attractive, but more often than not, there’s always a catch. Certain BNPL services come with monthly interest, especially when the instalment plan is offered over a long duration. Furthermore, these are usually tied to contracts with strict conditions such as charging a penalty fee to the consumer, should they miss payments or cancel their purchase.

While this may sound harsh and intimidating, they are not malicious nor are they scams. Instead, sellers and services include these as necessary measures to encourage consumers to honour their end of the bargain, and to serve as a penalty if not. Failure to comply with these conditions could land consumers into debt – a scenario to be avoided.

Another major thing to take note is the fine print that is always included with any BNPL promotions, which details the terms and conditions for taking up the offer. That being said, it is illegal for sellers or services to hide these facts from the consumer, so do take note of that. Always avoid the “too good to be true” offers, no matter how enticing their promotions are presented to you.

Meanwhile, there are other BNPL services that are more relaxed and flexible. You need not worry about interest, upfront costs, hidden charges, or fees (provided that you pay on time). Moreover, ownership of a credit card is not mandatory, thus making this approach accessible to a wider range of consumers and available to a variety of products such as furniture, electronics, and even apparel. Duration of instalment payments are also more flexible and shorter, which allows buyers to easily plan their purchases according to their budget.

PayLater by Grab

One such example of this is PayLater by Grab, which offers consumers a better way to manage their cash flow. At the same time, it also enables merchants to provide more flexible postpaid and instalment options to their customers.

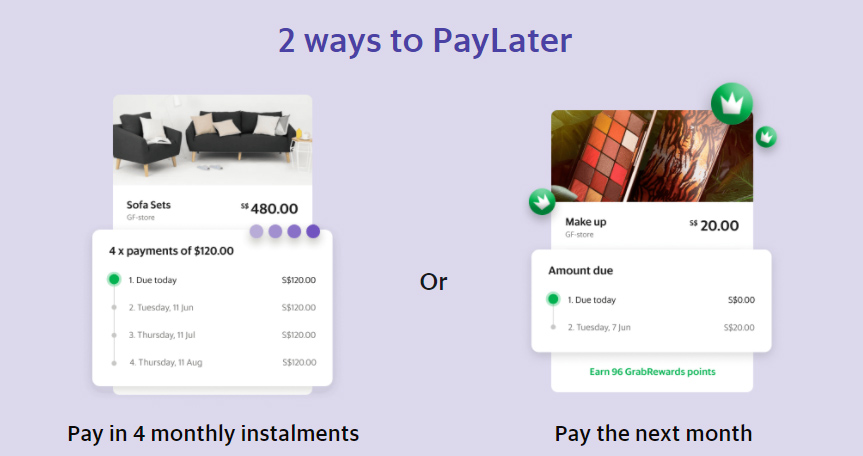

Regarding the latter, buyers can either pay for an item in four interest-free instalments, or the full amount the next month. PayLater has no upfront costs, no extra fees when you pay on time, and more importantly, no catch.

So how does it work?

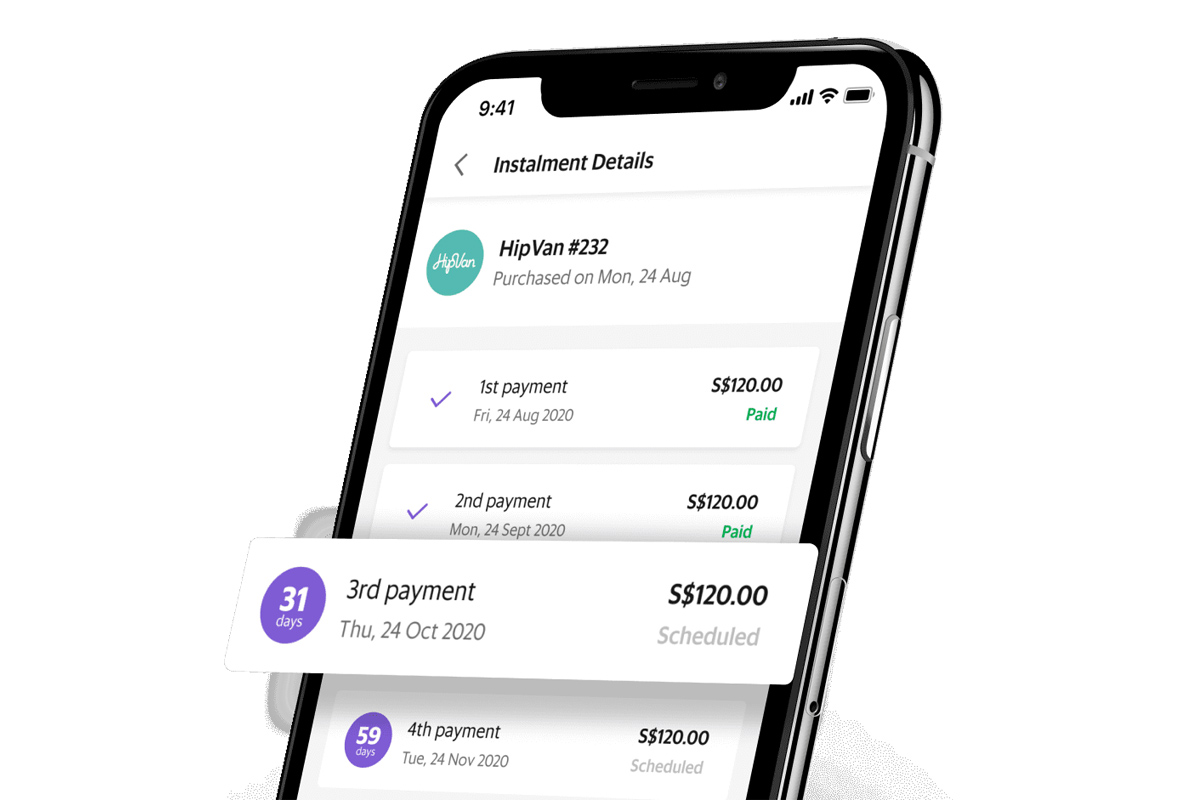

During the purchase confirmation of an item from an online store that offers the service as a payment option, just select PayLater upon checkout and Grab will pay the merchant in full upfront, while the buyer pays the company only ¼ of the item’s price during the point of purchase. The remaining price of the item will be automatically deducted from the buyer’s GrabPay e-wallet in instalments over three months. As mentioned earlier, the alternative option is to fully pay for the product the next month, where Grab will only charge the buyer then.

Your peace of mind, prioritised.

PayLater is safe and secure. Sensitive information such as credit or debit card details are not required, as only your mobile number is needed during checkout. Furthermore, Grab issues a One-Time Password (OTP) to your mobile for every transaction made via the service, thus ensuring that no other individual may abuse your credentials without your knowledge. On that note, Grab will also notify you every step of the way – from payment reminders, successful payments, and even refund completion.

For further reading regarding Grab’s policy on customer safety and privacy, please visit this link.

Are you eligible for PayLater?

As part of Grab’s responsible spending practices, users must fulfill the following criterias in order to be eligible for its PayLater service:

- 21 years of age or older.

- Platinum, Gold, or Silver GrabRewards subscriber.

- Active record of using Grab’s cashless payment service.

If you wish to learn more about the PayLater service, be sure to visit Grab’s official website via this link. Also, don’t forget to follow it on its social media channels on Facebook, Instagram, and Twitter in order to keep up with the latest news and promotions.

This article is brought to you by Grab Malaysia.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.