Secure2u is a stronger authorisation method by Maybank to approve online transactions through the M2U app and MAE app. As part of Maybank’s continuous effort to make online banking safer and more seamless for its customers, Secure2u will be the preferred method to approve transactions moving forward.

Starting from 9 November, all transactions of RM1000 and above will be exclusively approved using Secure2u. Similarly, all prepaid reload transactions, regardless of the amount, will also require approval by Secure2u starting from 16 November.

What this means is that instead of getting SMS Transaction Authorisation Codes (TAC), Secure2u will be used to approve transactions.

Why use Secure2u?

Secure2u requires users to link their smartphone to their M2U account, which means that any and all transactions can only be approved from the registered phone and nowhere else. This is safer for users as it reduces the risks of SMS fraud.

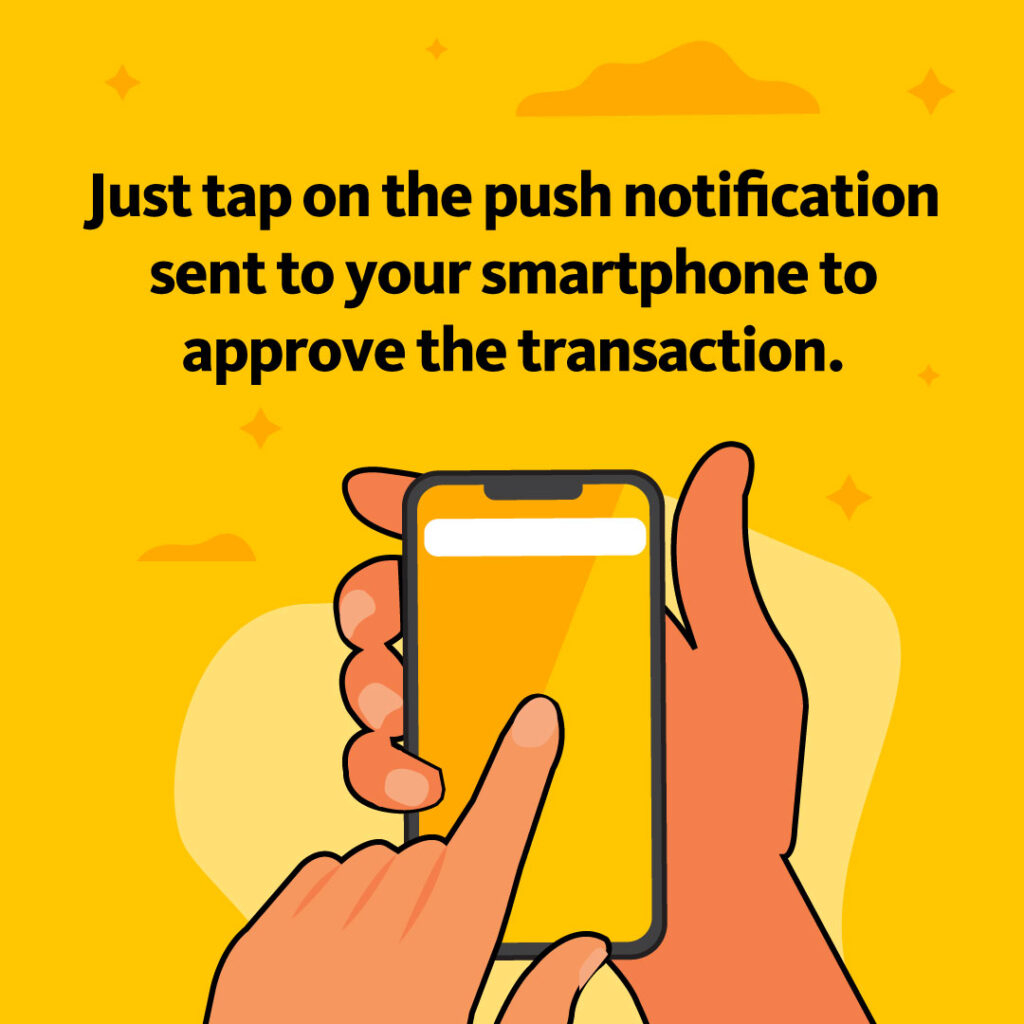

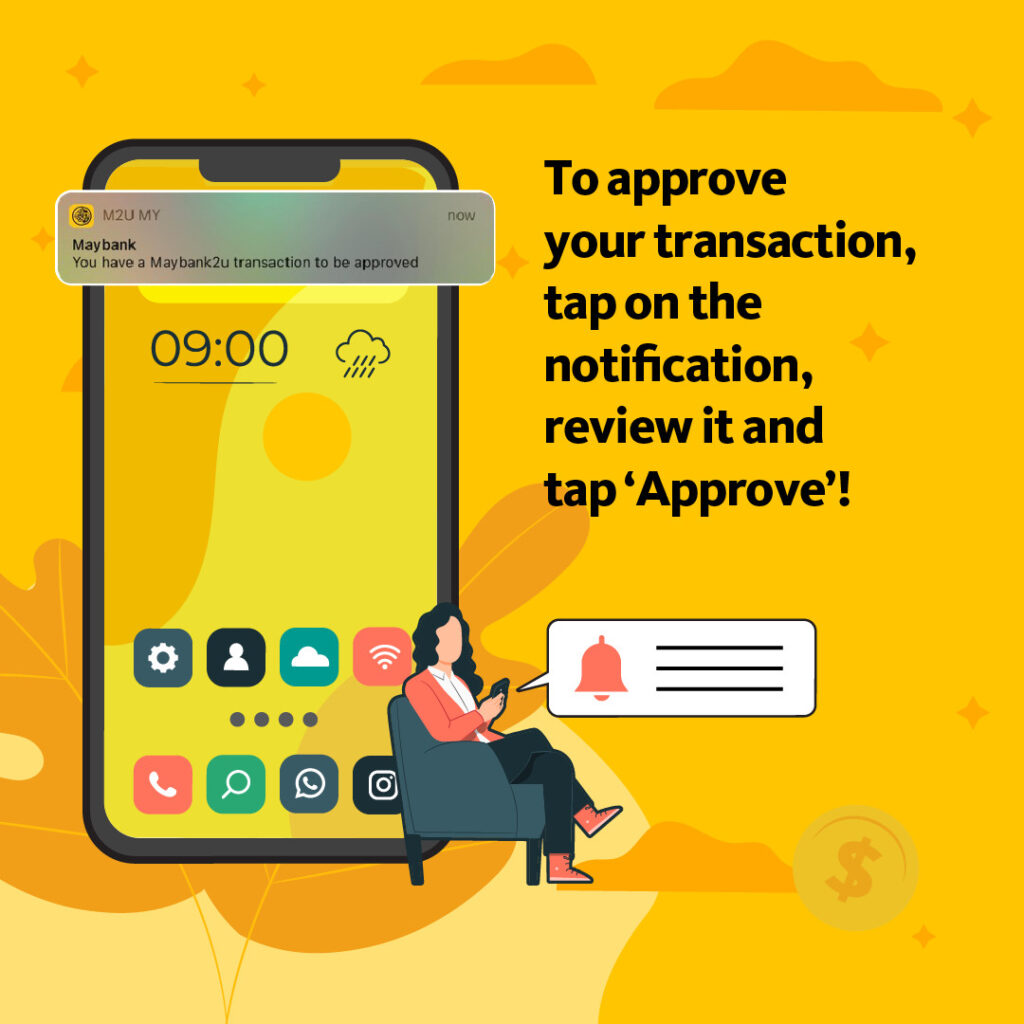

The feature is also much less tedious than using SMS TACs, as that method requires you to manually input multiple digits whereas with Secure2u, users just need to tap “Approve” on the push notification sent to you and as easy as that, your transaction is approved.

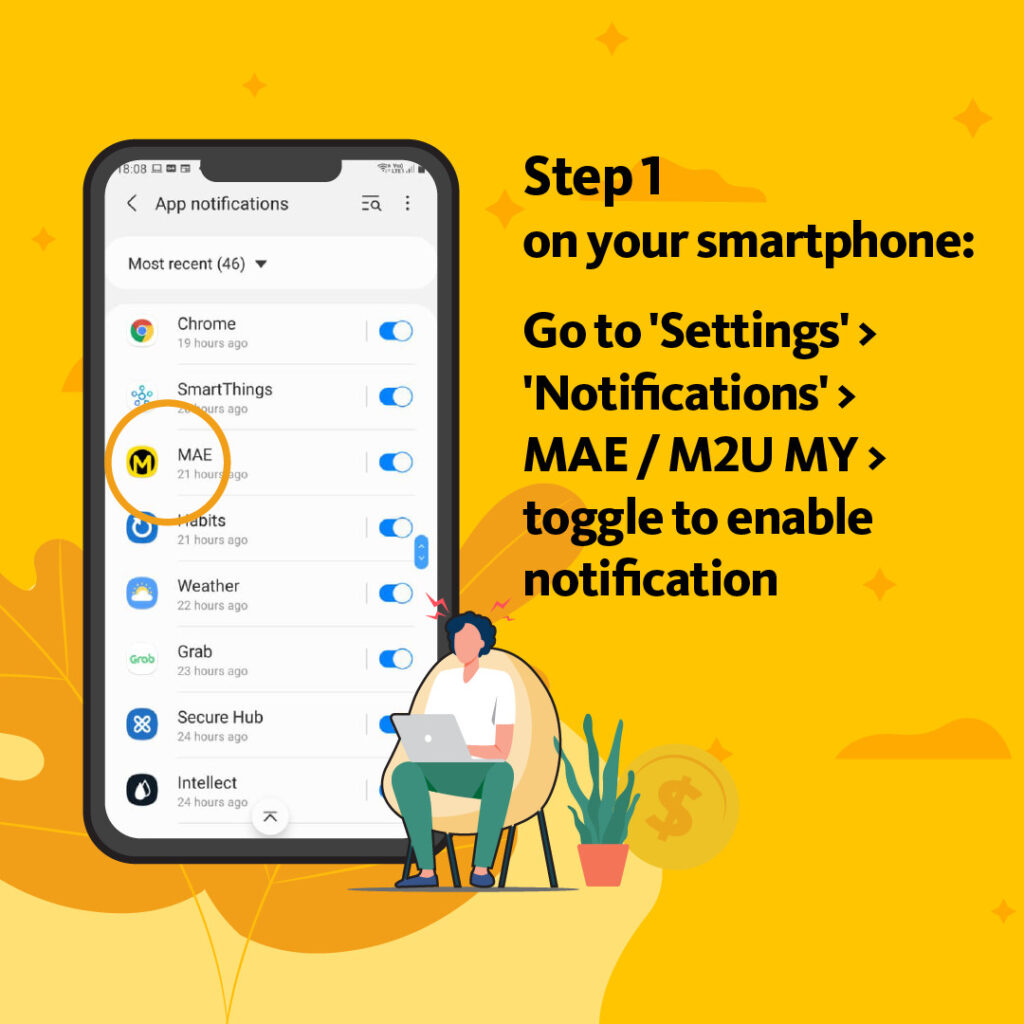

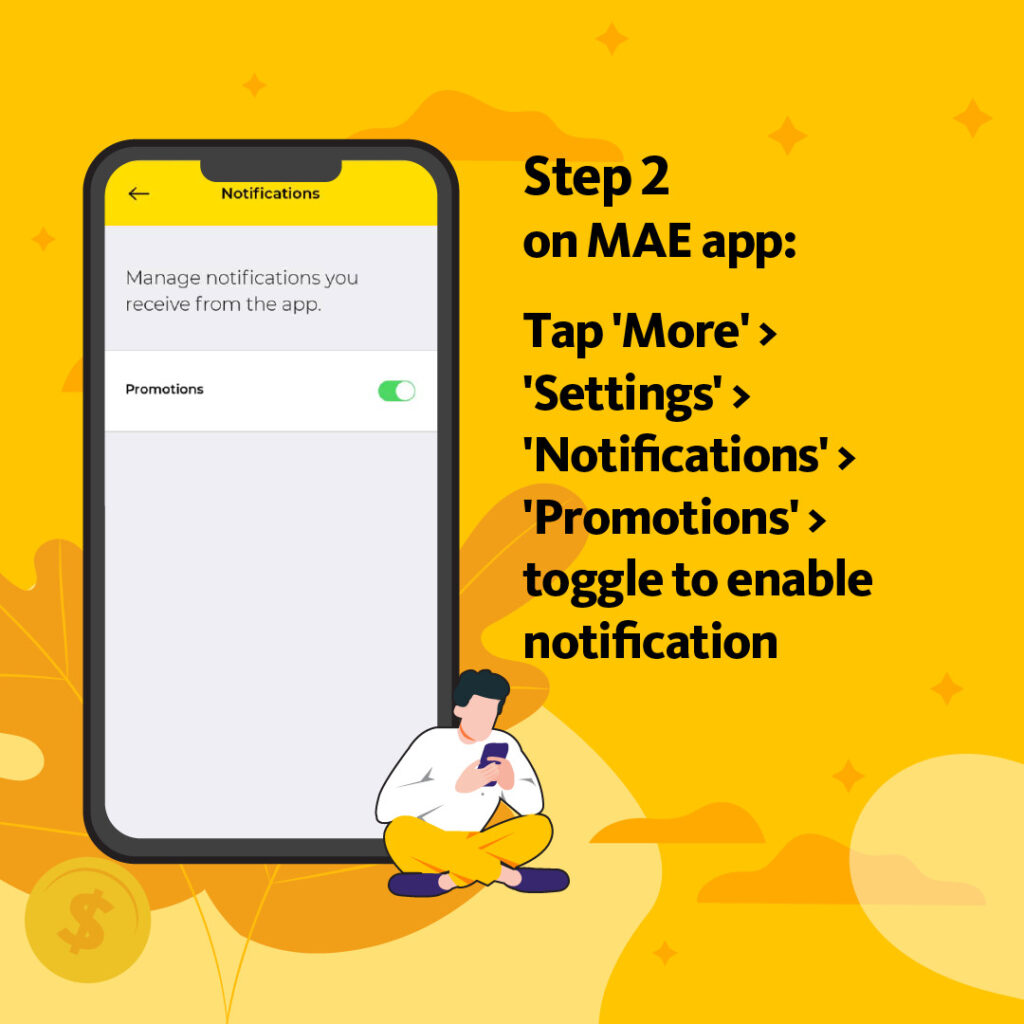

Making sure to receive notifications

To receive Secure2u notifications, ensure that your phone allows push notifications for the MAE or M2U app. You can do this by going into your phone’s settings, find the notifications setting, and toggle on the switch for MAE or M2U. You can then proceed to enable notifications on the respective app to make sure that you receive the Secure2u notifications.

Avoid getting logged out during transactions

If you’re making a transaction on the Maybank2u website through Secure2u, you may find yourself suddenly logged out of the website when you open the M2U or MAE app on your phone. This is due to Maybank’s security measures that only allow users to log into one device at a time.

To prevent this from happening, make sure to only approve the transaction through the push notification prompt instead of launching the app. When you’re approving a transaction via Secure2u, you will receive a push notification and all you need to do is tap on “Approve” without having to go into the app itself.

If you lose your Secure2u-registered device

If your registered smartphone gets lost or stolen, you’re advised to quickly deregister your device from Secure2u to avoid another person having access to approve transactions on your behalf. Maybank also encourages users to be proactive by setting up a password on your device’s lock screen for added security.

Maybank provides various avenues for you to deregister your device at your convenience. One method is to login to the Maybank2u website and go to Settings > Security > Secure2u > toggle to disable Secure2u. You can also call the Customer Care hotline at 1-300-88-6688 (local) or 603-78443696 (overseas) to deregister Secure2u.

If you suspect that someone else has gained access to your phone, you should immediately contact the Fraud Hotline at 03-58914744 to terminate your online banking.

Using Secure2u to approve transactions

Approving transactions through Secure2u is quick and simple. After you have the feature enabled on M2U or MAE, make your transaction as usual on your chosen app and tap on “Approve” after checking the details, without having to go through SMS TACs.

When you’re making a transaction on the Maybank2u website, click the “Request” button next to “Secure Verification”. Then, tap on the push notification sent to your phone and you will be able to approve it.

You can learn more about how to enable Secure2u, as well as the transactions that require using the feature, at Maybank’s website.

If you need more help, you can seek assistance through the Live Chat on the Maybank2u website, available from 8 AM to 12 AM everyday. Alternatively, you can also get in touch with Maybank through the Customer Care hotline at 1-300-88-6688 (local) or 603-78443696 (overseas).

Don’t forget to also follow Maybank’s Facebook, Instagram, and Twitter to keep up with all the latest news and announcements.

This article is brought to you by Maybank.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.