CIMB Bank aims to provide convenience to customers via its CIMB Clicks website and mobile app. This enables customers to access a variety of banking services anytime and anywhere, especially in the comfort of their own homes. This is especially relevant now with the ongoing pandemic, where Malaysians are unable to leave their homes unless necessary.

Understanding this, CIMB has updated both its website and app to further enhance the customers’ remote banking experience, by introducing a cleaner and friendlier interface. This is on top of the newly added features such as security improvements and cashless payments, which adds to the platform’s overall convenience and safety for its customers.

From secure transactions to recordkeeping, the following are the new additions that every CIMB Clicks user should definitely check out:

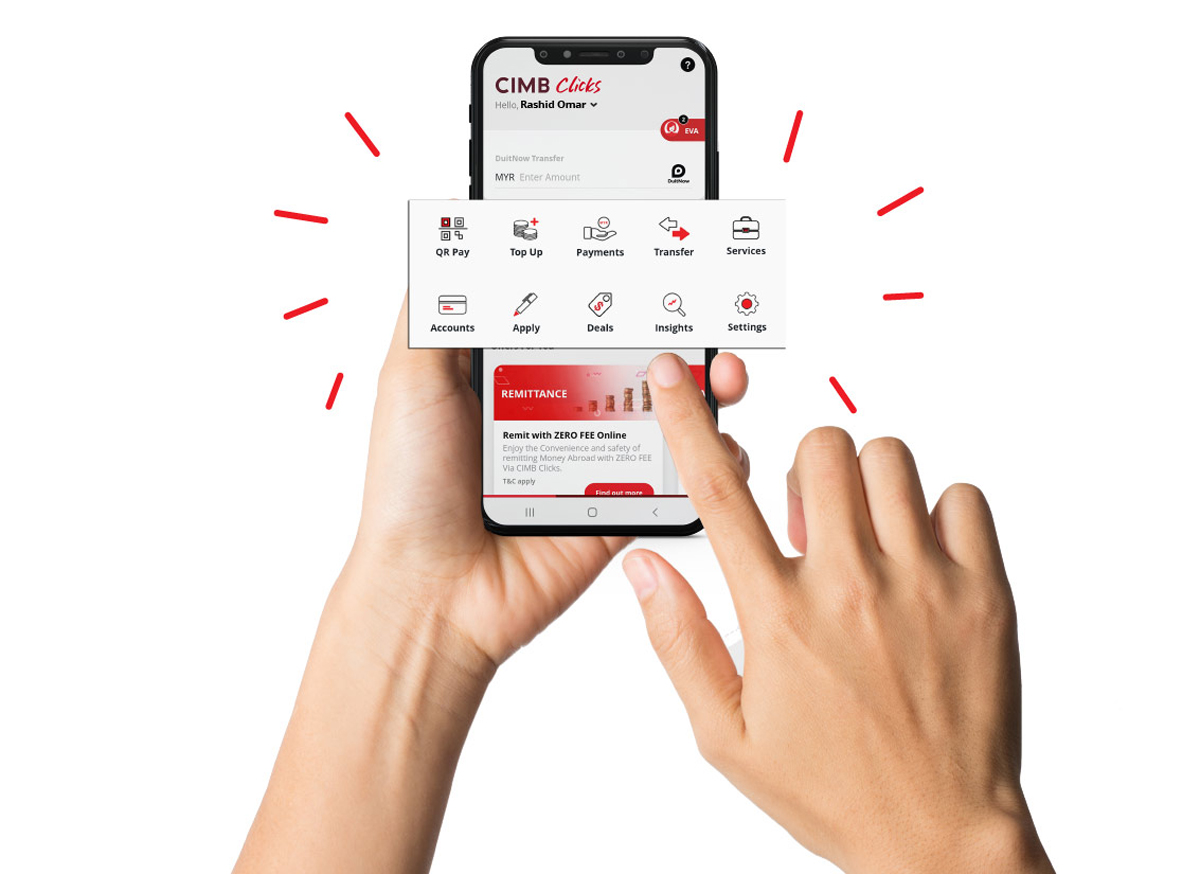

CIMB Clicks Mobile App

A Refreshed & Friendlier Interface.

The CIMB Clicks mobile app now features a new interface that offers more functionality. This enables easier navigation, with a swipeable homescreen which allows for more functions to be available quickly to the user. You can now adjust your CIMB Clicks transaction limits, make Foreign Transfer easily in just a tap and get rewarded through fun challenges. Furthermore, each screen also displays all of your money management needs, providing you with better control of your finances.

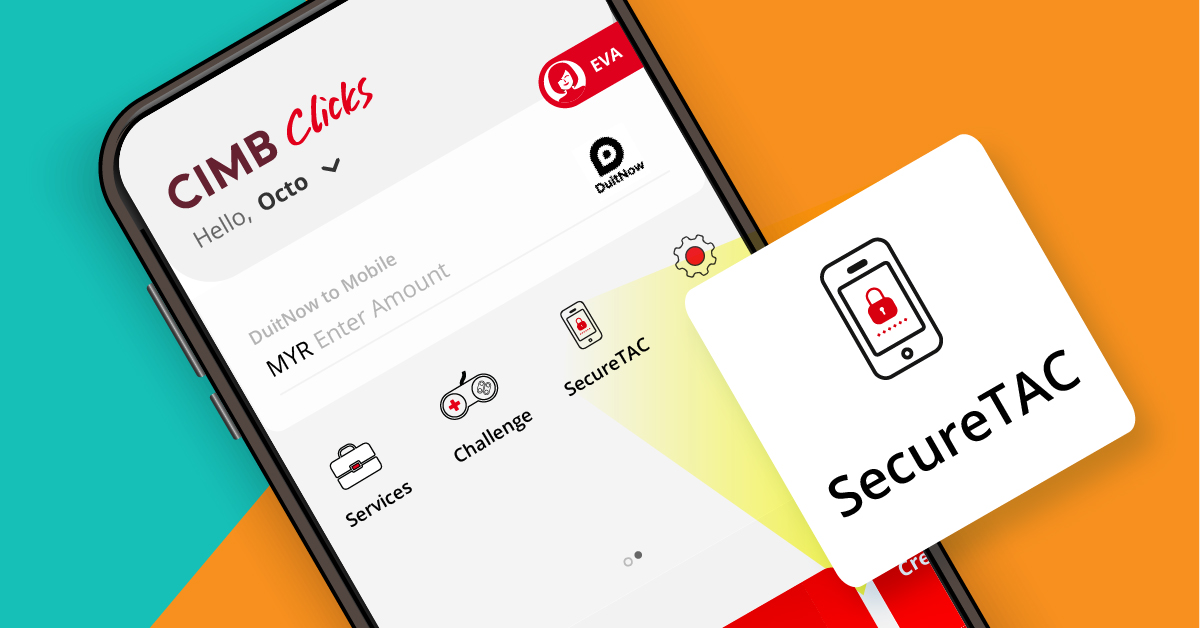

Faster & Secure Transactions Approval.

Thanks to the introduction of SecureTAC (Transaction Authorisation Code) to CIMB Clicks app, customers will no longer have to undergo cumbersome steps in order to complete their transactions. Unlike SMS TAC, all payment authorisations will be undertaken on the app itself with just one single tap via this new feature. Users can approve web transactions by simply clicking on the SecureTAC push notification, or by navigating to the SecureTAC button in CIMB Clicks. What’s even better is that this easy approval also works when you’re abroad.

Of course, this process isn’t accessible to anyone who currently has your phone in hand. As a default security measure, users are first required to verify their identity on CIMB Clicks by submitting their credentials or biometrics before enabling the SecureTAC function.

Scan To Pay & Transfer!

Yes you can Scan to Pay a merchant displaying a DuitNow QR standee from CIMB Clicks App. Plus, you can also transfer money using DuitNow QR! Spare yourself the extra trouble of keying in or sharing lengthy account numbers with CIMB Clicks’ integration of DuitNow QR. The process is remarkably simple, as all you are required to do is scan a DuitNow QR code from your recipient, and then approve the exact amount for transfer. You can also receive money easily by showing your DuitNow QR. Speedy yet safe, this cashless feature is accessible anytime and anywhere.

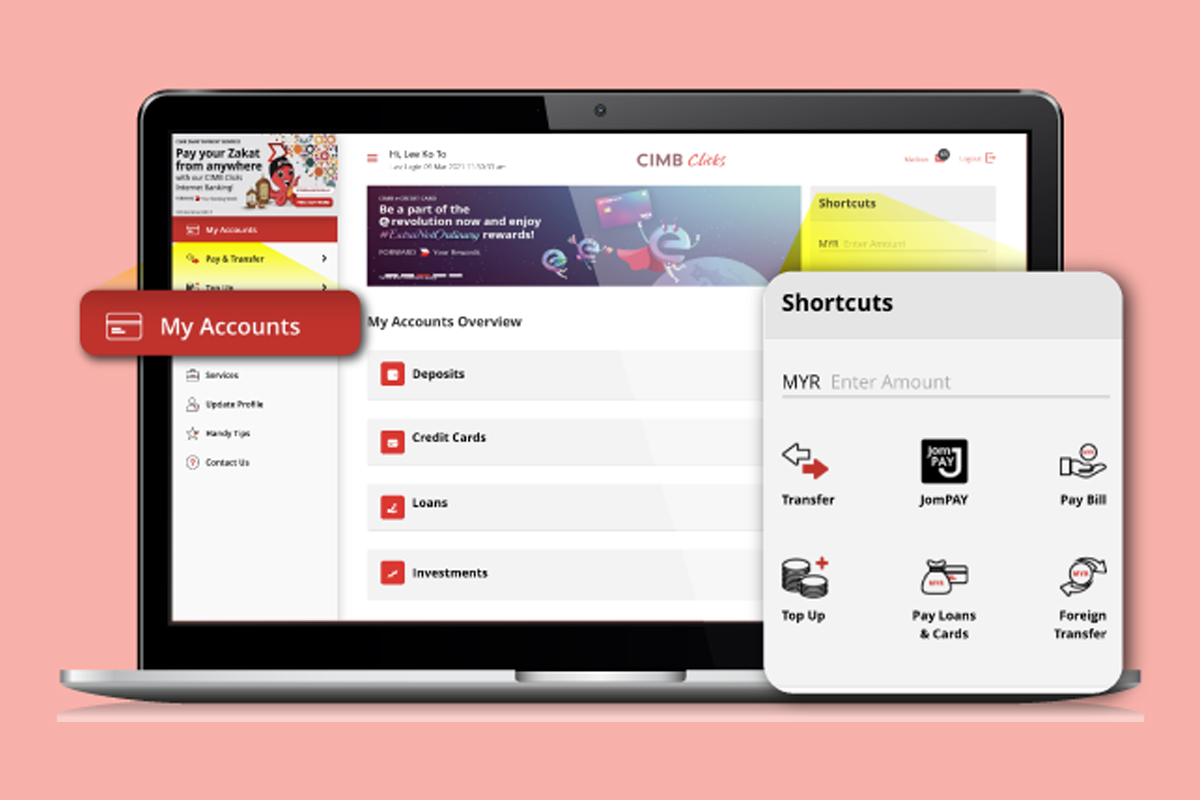

CIMB Clicks Website

Instantaneous Shortcut Navigation.

The app isn’t the only platform that was updated for the user convenience. The CIMB Clicks website, has also been revamped to include a new Shortcuts section. So rather than navigating back to your account’s main page or painstakingly searching for a desired banking feature, just click on the new section to swiftly gain access to most used functions in CIMB Clicks.

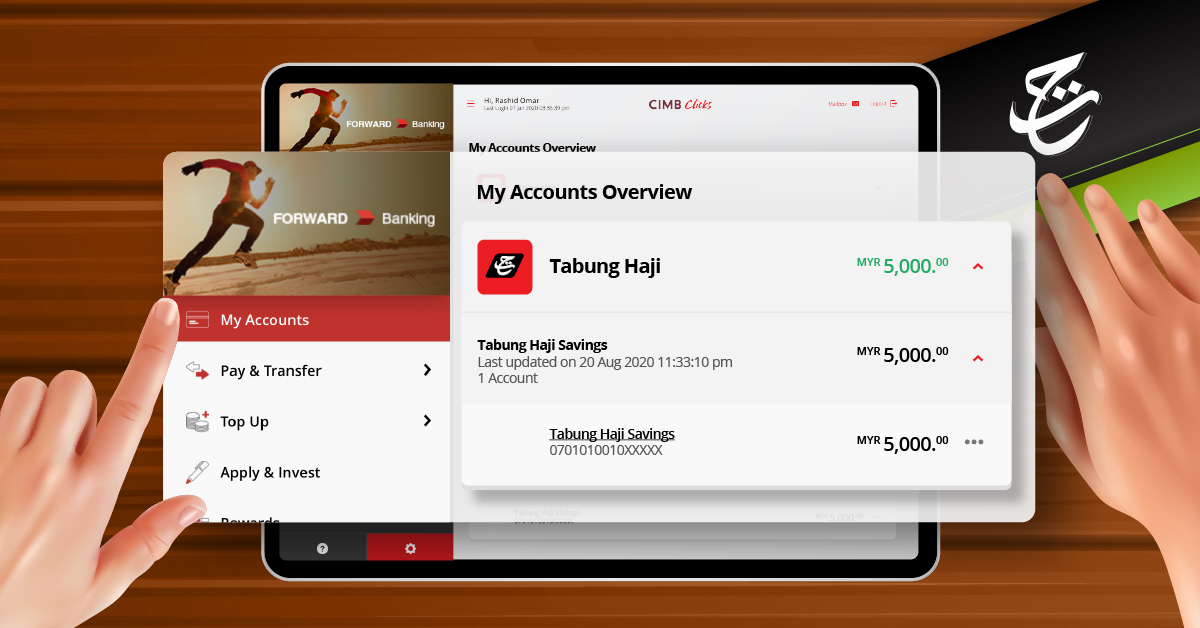

Tabung Haji

Life’s just easier with everything in one place. You can now link your Tabung Haji account to CIMB Clicks and easily manage it from one-place! With this one-time linkage, you can save yourself the hassle of managing several accounts from different places and enjoy these quick services via CIMB Clicks!

For further reading regarding CIMB Click’s features related to Tabung Haji, please visit the following URL: https://www.cimbclicks.com.my/tabung-haji.html

Explore The Newly Enhanced CIMB Clicks!

All these features and more are waiting for you in the newly revamped CIMB Clicks! Be sure to explore these new, convenient and secure functions now by checking out the website via www.cimbclicks.com.my, or by accessing the mobile app that is available on both Android and iOS smart devices.

Also, don’t forget to follow CIMB Bank’s social media channels on Facebook, Instagram, Twitter, and YouTube to keep up with the latest news and announcements!

This article is brought to you by CIMB.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.