The rumours have been going on for quite some time but earlier this week, BigPay has officially confirmed that it has applied for the digital banking licence to Bank Negara Malaysia (BNM). As you may know, the fintech company is one of the main portfolio companies under the AirAsia Digital umbrella.

Interesting enough, the submission does not involve BigPay’s name alone though. The company has managed to rope in Malaysia Industrial Development Fund to support its application, as well as Ikhlas Capital which is a Singapore-based regional private equity fund manager that is being chaired by Nazir Razak, the younger brother of ex-PM Najib Razak who has spent 29 years in various positions at CIMB.

In addition to that, an unnamed “foreign conglomerate with fintech expertise” is also part of the consortium that BigPay has managed to assemble to support its digital banking ambition which the company has since referred to as the BigPay Bank.

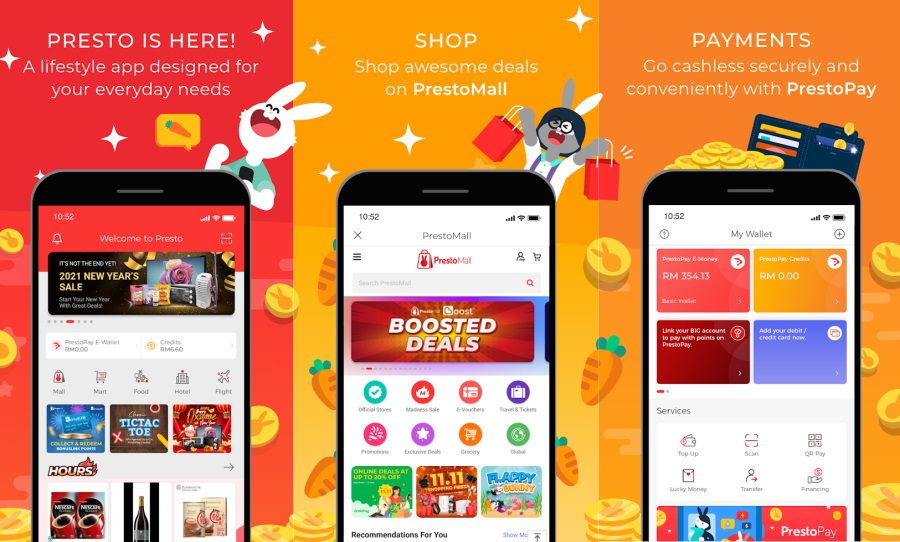

Another company that has disclosed its licence application is PUC who runs the digital ecosystem Presto. If the name didn’t ring a bell, the company acquired 11street back in 2018 and renamed it into PrestoMall a year later.

Just like other parties that are vying for the digital bank licence from BNM, PUC is not going solo in its attempt. The company has said that it has collaborated with two state governments and a conglomerate although their names were not revealed in the announcement.

Star Media Group (SMG) who is the parent company of the long-running local English newspaper, The Star is vying for the digital bank licence too. Through a collaboration with property developer Paramount Corporation as well as RCE Capital, Prosper Palm Oil Mill, and an unnamed technology partner.

It is indeed an interesting decision by SMG following the upcoming closure of its streaming service Dimsum this September. On another hand, Paramount itself has dabbed its feet in the financial sector for quite some time through Fundaztic, a peer-to-peer financing platform that is celebrating its fourth anniversary this year.

Not to forget, Grab and Singtel who have successfully obtained a digital bank license from the Monetary Authority of Singapore last year is now hoping to repeat the same feat in Malaysia. Through a brief notice to the Singapore Exchange, Singtel has announced that its digital bank joint venture with Grab has applied for BNM’s digital bank licence.

Like other applicants, the JV’s bid for the licence is also being supported by a consortium of investors and similarly, their names were not revealed by Singtel. Previously, several companies including Axiata-RHB and Pertama Digital had also submitted their digital bank license application to BNM.

The fundamental purpose of a digital bank is to provide financial services to the unserved and underserved market through the usage of technology. Among the type of customers that digital banks may serve includes micro businesses, start-ups, self-employed individuals, and those in the lower-income groups.

Given the big names that have applied for the licence, this can be seen as a general acknowledgement of the digital bank’s vast potential. However, it is going to be a while before we can know who will become the first group of digital bank operators in Malaysia though, as BNM will only announce its decision sometime within the first quarter of 2022.

(Source: AirAsia Group, Bursa Malaysia – [1][2], Singtel – [pdf]. Images: Bank Negara Malaysia, Big Pay, Presto / Google Play, The Star.)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.