Pertama Digital Berhad, a local investment holding company in the govtech and fintech spaces, has brought Indonesian firm Crowdo Holdings Pte Ltd into a consortium that intends to apply for a digital bank license from Bank Negara Malaysia (BNM).

As previously reported, BNM is accepting applications for a digital banking license, with a deadline set to 30 June this year. The central bank said the granting of up to five licenses would be announced by the first quarter of 2022. A lot of big names are reportedly interested in obtaining one – including Grab, Razer and AirAsia.

According to Pertama Digital, Crowdo is a SME-focused neobank (or digital bank) that possesses an AI-powered credit scoring engine specialised for emerging markets within ASEAN. It was apparently in the first batch of fintech companies fully licensed by Indonesia’s Financial Services Authority to provide digital lending services to SMEs.

“Crowdo brings years of priceless insights and validated turnkey solutions from delivering productive financing to MSMEs that are overwhelmingly operated by Indonesians with no credit history. This partnership will allow our Malaysian digital bank to immediately serve thousands of businesses in a viable manner from Day One,” said Pertama Digital Director of Strategy Saify Akhtar.

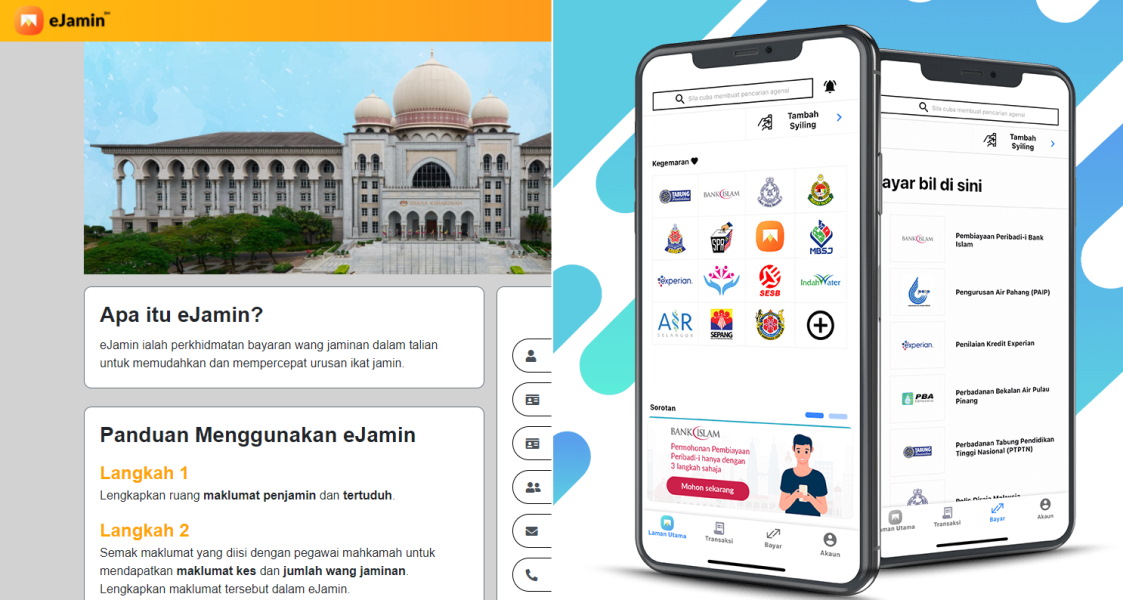

As for Pertama Digital’s background, its subsidiary DAPAT Vista specialises in the digitalisation of government services. It operates the government SMS gateway, mySMS, and owns the MyPay and eJamin apps. eJamin is notably described by the company as the world’s first smartphone court bail payment solution and is currently being used by courts across Malaysia.

(Source: Pertama Digital [1] [2]. Images: Pertama Digital, ezs @ Flickr, used under Creative Commons licence.)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.