Grab has officially announced its plan to become a publicly-traded company in the United States through cooperation with Altimeter Growth. The company’s intention to go public has been rumoured for quite some time but interesting enough, Grab’s eventual listing on NASDAQ will not be done through the traditional initial public offering (IPO) route.

Instead, it will take place through a special purpose acquisition company (SPAC). In fact, the new Grab deal is said to be the world’s largest SPAC merger to date since it will have an equity value of around USD 39.6 billion (RM 163.7 billion) once completed later this year.

Grab who begun its journey as MyTeksi in Malaysia before making Singapore its current headquarters, will receive around USD 4.5 billion in cash. A huge chunk of it was funded through private investment in public equity (PIPE) offering which involved participation from multiple parties including Permodalan Nasional Berhad.

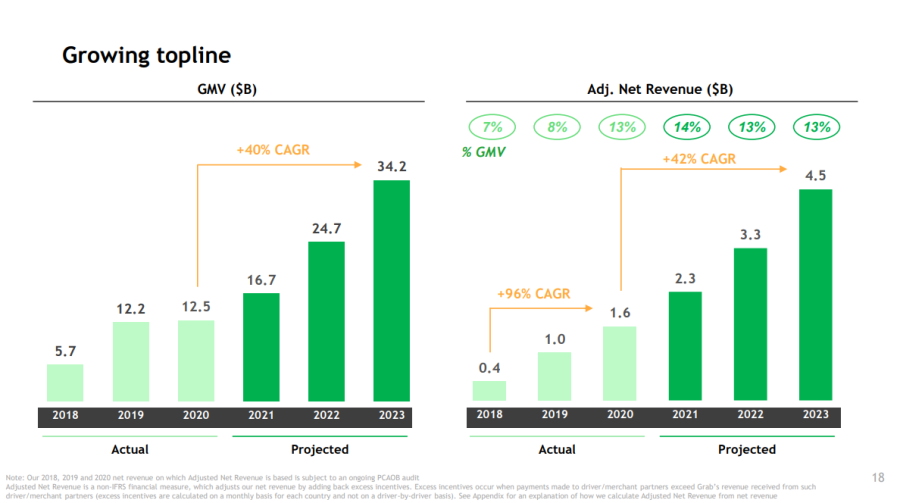

In today’s announcement, Grab pointed out that the strong financial performance that it managed to achieve during 2020 is one of the reasons behind its decision to go public. Despite the pandemic, the company managed to complete 1.9 billion transactions that are equivalent to Gross Merchandises Value (GMV) of USD 12.5 billion which are much higher than the pre-pandemic levels.

Grab expects that the value will only increase further at up to USD 34.2 billion in the next two years which not surprisingly made the company very attractive to investors. Meanwhile, it is not known for now what will be in store to consumers in regards to this deal but one thing for sure: Grab will soon have more resources to defend itself against other competitors.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.