Maybank has recently announced that it will discontinue the usage of SMS-based Transaction Authentication Number (TAC) for bill payments and Interbank GIRO (IBG) transactions for its online banking platform, Maybank2U. The new policy will be in place starting from 15 March 2021.

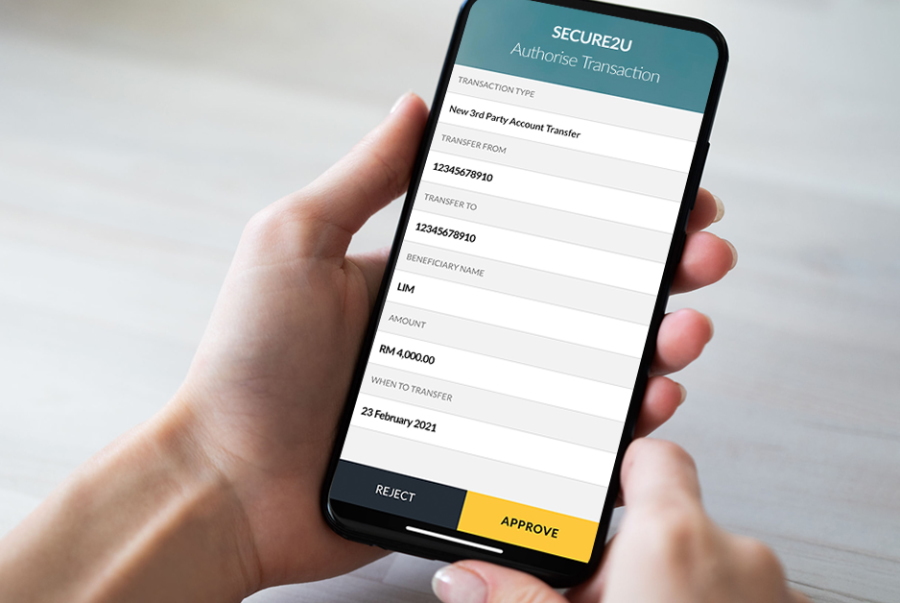

Customers will then have to utilise the bank’s Secure2u feature to authorise these transactions. For those who aren’t familiar with it, Secure2u essentially tied your Maybank2u user ID to one particular phone or tablet for security purposes.

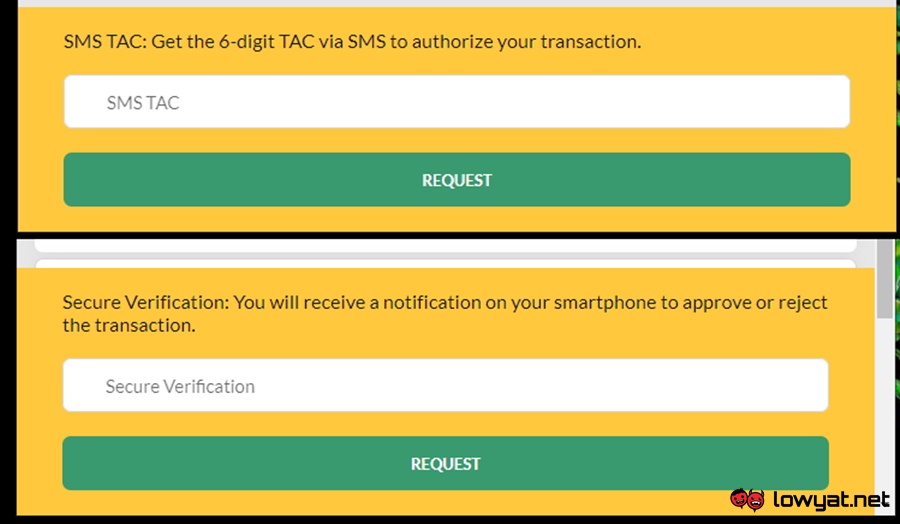

Secure2u has two main functionalities with one of them being the Secure TAC generator which provides the 6-digit Secure TAC directly on customers’ device that they can use for selected transactions. The other function under Secure2u is called Secure Verification which would ask for customers’ authorisation via a notification that would appear on their device after the transaction is initiated.

Secure2u is not something that customers would receive by default as they have to opt-in for it through the Maybank2u MY app or website. Also, do take note that the Secure2u can only be obtained through Maybank2u MY app as it is not available on the newer MAE by Maybank2u app.

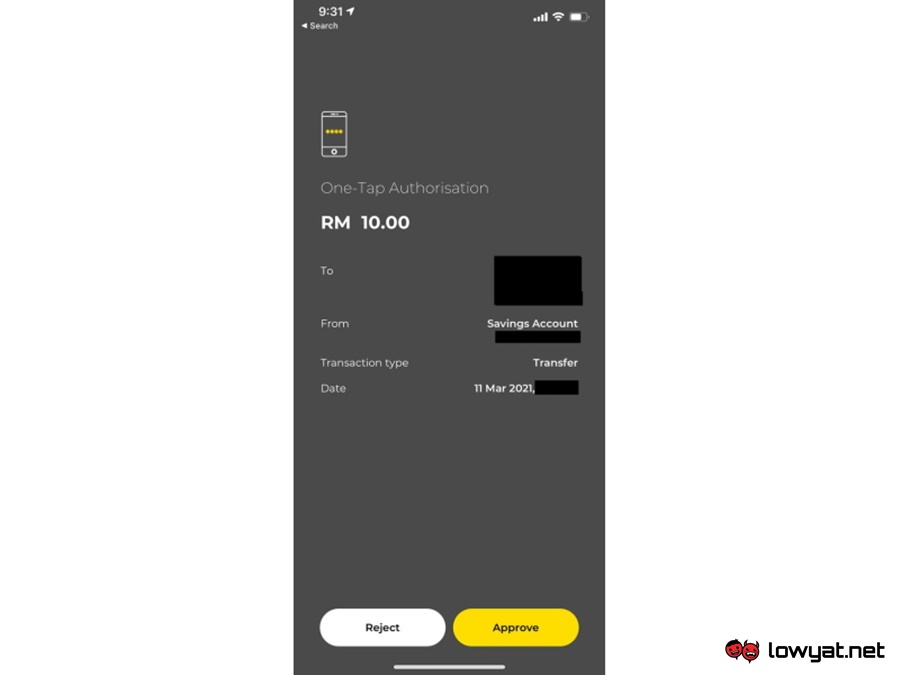

The MAE app has another approach called One-Tap Authorisation although it is generally similar in nature as per Secure2u’s Secure Verification. Right now, transactions that are initiated via the Maybank2u website and Maybank2u MY app will have to use Secure2u while naturally, One-Tap Authorisation will cover transactions that are commenced through the MAE app.

This is not the first time that Maybank has made Secure2u mandatory for its customers. In fact, it was only a few days ago on 8 March that the bank had implemented the policy where all Maybank2u transactions of RM 3,000 and above can only be authorised using Secure2u.

Not only that, Maybank has also stated that the Secure2u is now the only method that can be used to authorise all transactions through Maybank2u MY app. The SMS TAC option will only be provided if you initiate transactions of under RM 3,000 through the Maybank2u website but then again, that option will not be made available once you enable Secure2u for your account.

For the longest time, Maybank has claimed that Secure2u is much safer than the SMS TAC. This is indeed a sound argument considering that there are indeed tools that can be used to intercept SMS TACs in addition to the existence of SMS TAC scams.

However, the condition of the Internet connection on your device could affect the ability to receive Secure Verification promptly which could be quite critical for some customers out there. Nevertheless, it seems that Maybank is currently on a mission to get everyone on board the Secure2u method whether you like it or not.

(Source: Maybank [1][2 – pdf][3 – pdf].)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.