Grab Financial Group (GFG), the Fintech arm of the e-hailing and delivery giant, announced that it raised more than US$300 million (~RM 1.21 billion) from investors, including Hanwha Asset Management Co. Ltd., a top South Korean asset management company. The development bolsters Grab’s determined and very public push into financial services across Southeast Asia as the next plank of its growth.

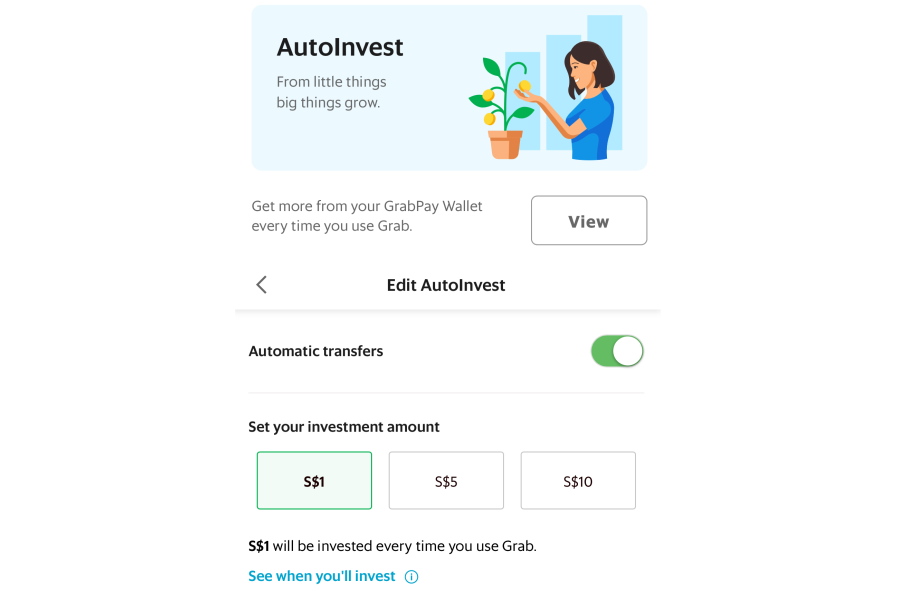

In addition to that, GFG has also said that its total revenues grew by over 40% in 2020 compared to the year before. It attributed this to strong consumer adoption of AutoInvest, its first retail wealth management product which is currently available in Singapore.

The company stated that the monthly users for AutoInvest nearly doubled in December 2020. Additionally, its insurance distribution quadrupled monthly active users in just three months to over 4.5 million.

GFG Senior Managing Director Reuben Lai said, “We are delighted to draw upon the expertise of top investors who know financial services and Fintech well so that we can continue to build and open up access to affordable and transparent financial services for millions of underserved people and small businesses, and make inroads into financial inclusion in the region.”

Relatedly, Grab’s consortium with telco conglomerate SingTel was one of two entities awarded full digital bank licenses in Singapore last December. The consortium intends to formally launch its digital bank in early 2022.

Grab is also eager to set up a digital bank in Malaysia. Last week, Bank Negara Malaysia (BNM) officially opened the application period for digital banks, and so we’ll have to see if that happens.

(Source: Grab)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.