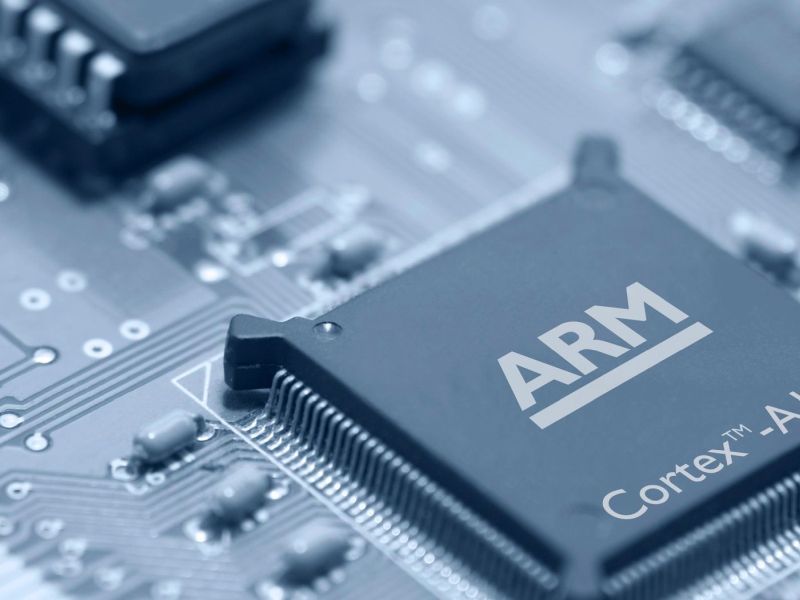

Softbank, the Japanese multinational conglomerate, recently confirmed its intention to sell its ownership of the UK-based semiconductor maker, ARM. While rumours and gossip have had their eyes pegged on NVIDIA, though, the GPU brand is just one of many potential suitors vying for the bid.

According to a report by The Telegraph, Softbank does have options and, should neither of them be deemed suitable, the conglomerate may simply hold on to its shares of ARM and take the company public again. On the other hand, the bank could also simply decide to sell a stake or a handful of stakes in ARM. Instead of just letting it go wholesale to a single buyer.

At the time of writing, Softbank did not specify or list down the name of other potential buyers, only that it was still in the process of negotiations with them.

Softbank first acquired ARM back in 2016 for GBP24 billion (~RM131 billion). However, a string of losses combined with a recent US$12 billion (~RM50.4 billion) profit have seemingly forced the Japanese conglomerate to rethink its ownership of ARM. Especially considering the sudden interest in it from other parties.

Of course, for companies like NVIDIA, acquiring a company like ARM also comes with its own set of problems; as it stands, the microprocessor company is responsible for supplying the vast, if not overwhelming majority of other tech brand with its chips. That list includes AMD, Apple, Huawei, Samsung, and Qualcomm, to name a few.

(Source: The Telegraph via Hot Hardware)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.