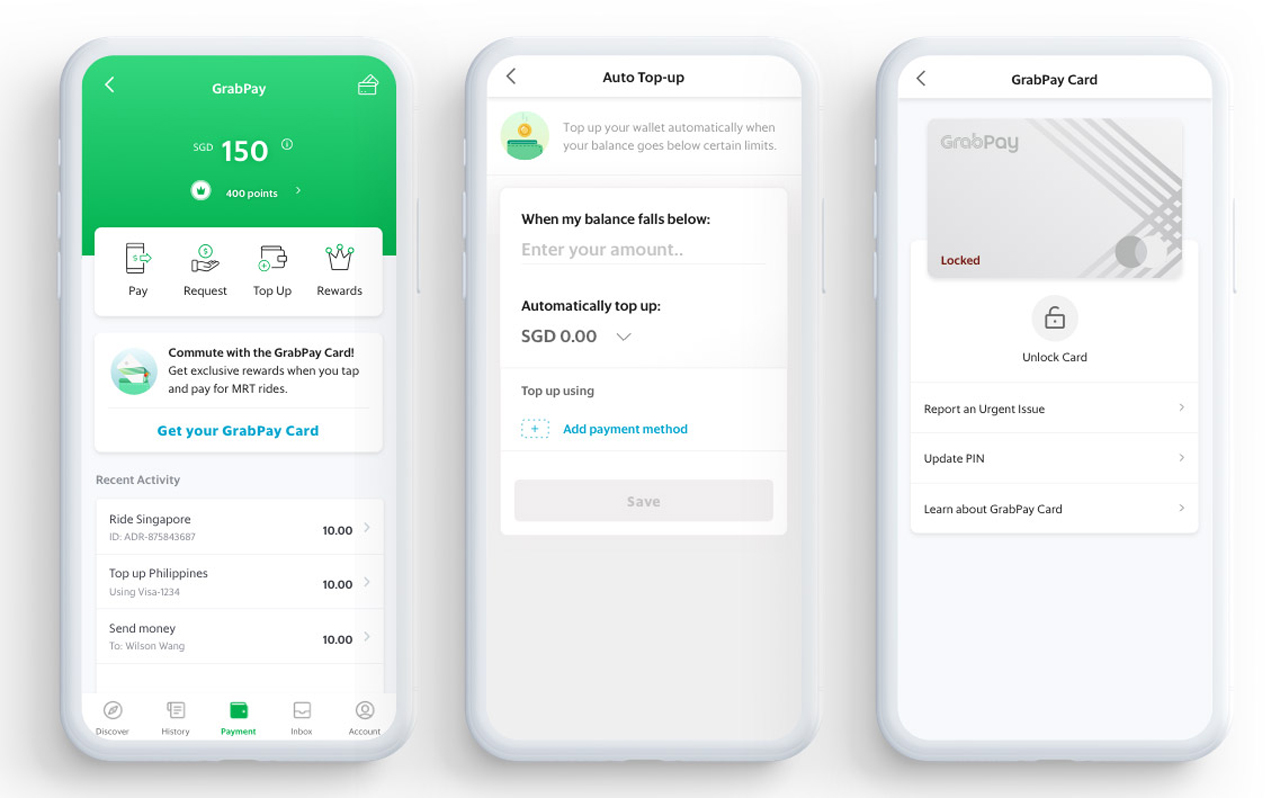

Aside from its acclaimed ride-sharing and food delivery service, Grab is now venturing further into digital payments on top of its existing GrabPay e-wallet solution. In a partnership with Mastercard, the company revealed on 5 December that it is launching GrabPay Card, Asia’s first ever numberless payment card system.

According to Huey Tyng Ooi, Managing Director of GrabPay, the card is a continued evolution of the GrabPay service, where it allows the company to move towards an open payments ecosystem through this collaboration with Mastercard. She also commented that the card is an important step for GrabPay in becoming a truly Asean wallet.

The numberless card approach is to prevent the user’s identity and financial theft – similar to Apple’s credit card solution which was launched in August. Payments via GrabPay Card is accepted at over 53 million merchants within Mastercard’s worldwide network, and allows users to earn and redeem reward points.

Two versions of the card exists: a physical version, as well as a digital version. The digital GrabPay Card is currently available only in Singapore for now, and users could also opt for the physical card, which will be rolled out in batches, upon receiving the digital version.

The GrabPay Card is set to be launched in the Philippines during the first quarter of 2020. According to Tech in Asia, the card will also be introduced to other countries in Southeast Asia in the first half of that year. Until an official announcement by Grab Malaysia is made, it’s uncertain if the GrabPay Card service will debut in our country.

(Source: Tech in Asia // Images: Grab)

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.