Whether it is to split a bill between friends for a meal or to simply send money to your family, you would almost always have to refer to your list of third-party bank account numbers. Thankfully, this is no longer the case thanks to the DuitNow service, available on Maybank2u and the Maybank App.

DuitNow is a safe and reliable way to send and receive money instantly by just using a DuitNow ID. If you are a registered DuitNow user, you can easily tie your Maybank account details to your mobile phone number, IC number, or other validated IDs such as business registration number and passport number.

So rather than keying in your recipient’s account number manually, which could be subject to error and is time consuming, this service allows you to immediately transfer funds to them by keying in their phone numbers or by simply looking up their contact details straight from your smartphones. The same also applies if the recipient uses their IC number or other validated IDs instead. Of course, only registered and verified DuitNow IDs will appear in the list, thus ensuring trust and security when conducting a transaction via the service.

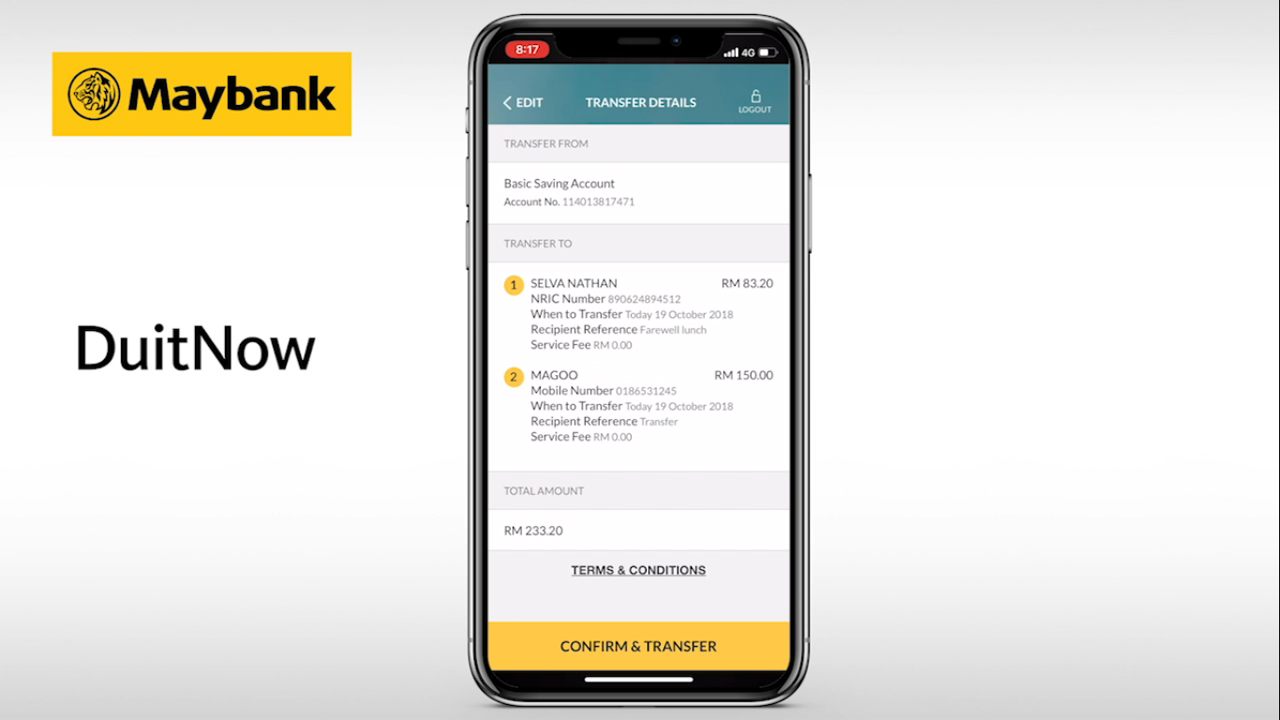

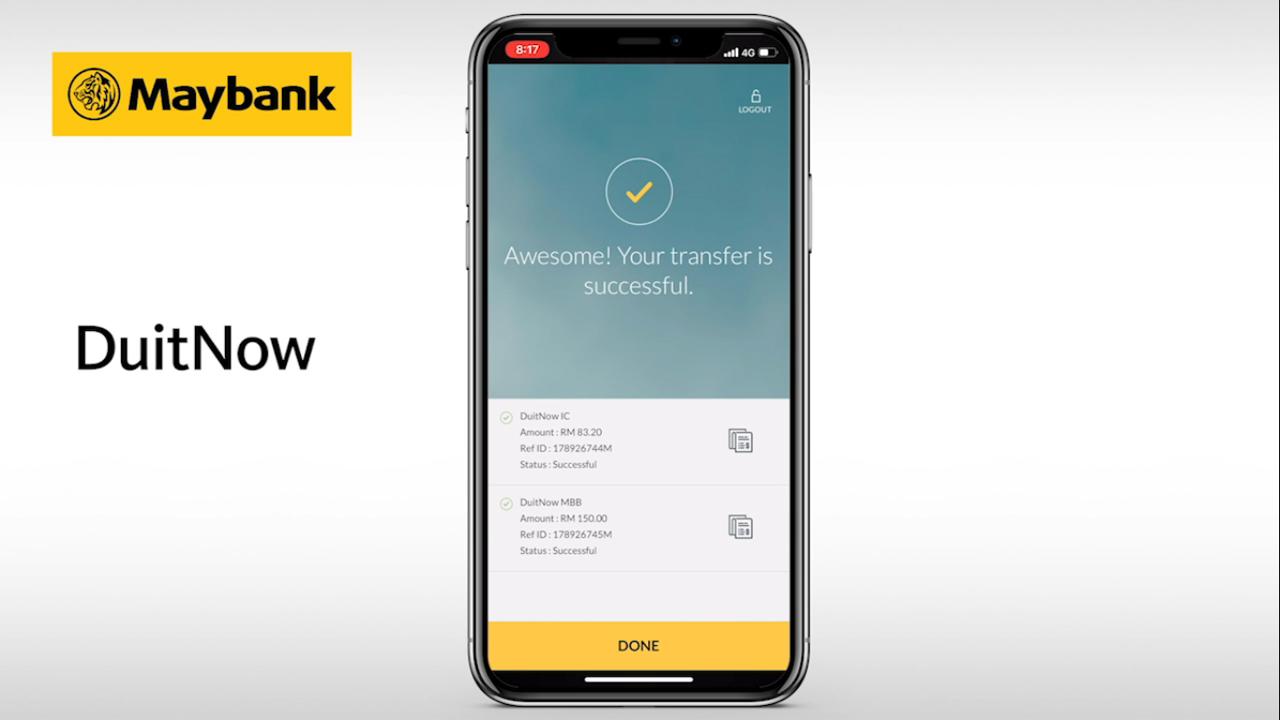

DuitNow also has a feature that allows you to complete multiple transactions to different recipients in one go. You are then provided with the individual receipts of each transfer, so you have the ability to share them directly with your recipients.

To get started with Maybank DuitNow is really easy. Simply register a DuitNow ID via Maybank2u by selecting your Mobile Number, NRIC, Army or Police Number, Passport Number, or Business Registration Number. You can then pair your ID to your savings account, or to any preferred account number if you have multiple accounts with Maybank.

Once registered, you’re good to go! Start transferring money instantly, efficiently and securely with DuitNow via M2U today.

For further information on new DuitNow services, head on over to Maybank2u to find out more.

This article is brought to you by Maybank2u.

Follow us on Instagram, Facebook, Twitter or Telegram for more updates and breaking news.